10 High Net Worth Life Insurance Strategies

Life insurance is an essential financial tool that provides financial security for your loved ones and helps preserve your wealth.

For high-net-worth individuals (HNWIs) in the UK, life insurance can serve multiple purposes, such as estate planning, business protection, and tax mitigation.

Do high net-worth individuals need life insurance?

High-net-worth life insurance and other insurance types can benefit individuals with significant assets.

Life insurance offers a one-time cash payment to your family in the event of your demise.

For affluent individuals, safeguarding their wealth for their family’s benefit can be crucial. Life insurance ensures that your loved ones can maintain their current standard of living with minimal financial disruptions.

Various insurance products designed for affluent individuals, known as ‘high net worth insurance,’ can help protect other facets of your life.

Insurance Hero can help you obtain a life insurance policy with coverage of up to £2,000,000.

Additionally, we can assist you in acquiring multiple policies that offer various payouts to address different aspects of your life.

This guide will explore ten life insurance strategies explicitly tailored for high-net-worth individuals in the UK to help you make informed decisions and protect your wealth.

Secure Up To £2M In High Net Worth Life Insurance Cover

⏱ Enquiry Form Takes About 60 Seconds

Understand the Types of Life Insurance in the UK

Term Life Insurance

Term life insurance covers a specific period, usually between 10 and 30 years. If you pass away within the policy term, the insurer will pay out a death benefit to your beneficiaries.

Term life insurance is typically the most affordable type of life insurance and can be appropriate for high net-worth individuals in the UK who:

- Need coverage for a specific period, such as until their children finish university or their mortgage is paid off.

- Want to supplement an existing whole-of-life insurance policy.

- Seek a cost-effective solution for a temporary need.

Whole of Life Insurance

Whole of life insurance, as the name suggests, provides coverage for your entire life as long as premiums are paid. This type of policy often accumulates a cash value over time, which can be accessed via loans or withdrawals.

Whole of life insurance can be suitable for high net worth individuals in the UK who:

- Require long-term financial protection for their beneficiaries.

- Want to use the policy’s cash value for estate planning or investment purposes.

- Seek a policy that can provide both death and living benefits.

Endowment Life Insurance

Endowment life insurance is a savings-oriented policy that combines life insurance with a savings component.

At the end of the policy term, the policyholder receives a lump sum payment, known as the maturity benefit. If the policyholder passes away before the end of the term, the death benefit is paid to the beneficiaries.

Endowment life insurance can be appropriate for high-net-worth individuals in the UK who:

- Want a disciplined savings approach for specific financial goals, such as funding a child’s education or a retirement plan.

- Seek a policy that provides both life insurance protection and a savings component.

Critical illness cover

Supplementing your life insurance policy with critical illness coverage for an extra charge.

This addition enables you to file a premature claim on your life insurance policy if you are diagnosed with a life-altering (though not fatal) condition specified in your policy.

The resulting payout can cover healthcare expenses, implement required modifications to your residence, or compensate caretakers.

Terminal illness cover

Terminal illness cover is included at no additional expense with all term policies obtained through Insurance Hero.

This coverage offers the possibility of an early payout if you are diagnosed with a life-threatening condition and are expected to pass away within a year.

The funds can be utilised to manage private medical costs, organise your finances, or even allocate them towards quality time with family members.

Income Protection

Income protection insurance disburses a portion of your typical income in monthly, tax-free payments if you become too sick or injured to work.

High-net-worth clients might encounter certain complexities with income protection:

- First, individuals with substantial wealth often have multiple income streams and may be subject to different taxes, making it difficult to accurately calculate income protection.

- Second, many standard income protection policies have a maximum monthly benefit that may not be sufficient for a high-net-worth individual.

Nonetheless, some insurers, such as Zurich, cover up to 80% of your yearly net income, with a cap of £20,000 per month.

Coverage and Benefits of High Net Worth Life Insurance

| Coverage Aspect | Description | Benefits |

|---|---|---|

| Death Benefit | A lump sum will be paid to the beneficiaries upon the insured’s death. | Provides financial security for the family, helps maintain the estate, and covers any debts or taxes. |

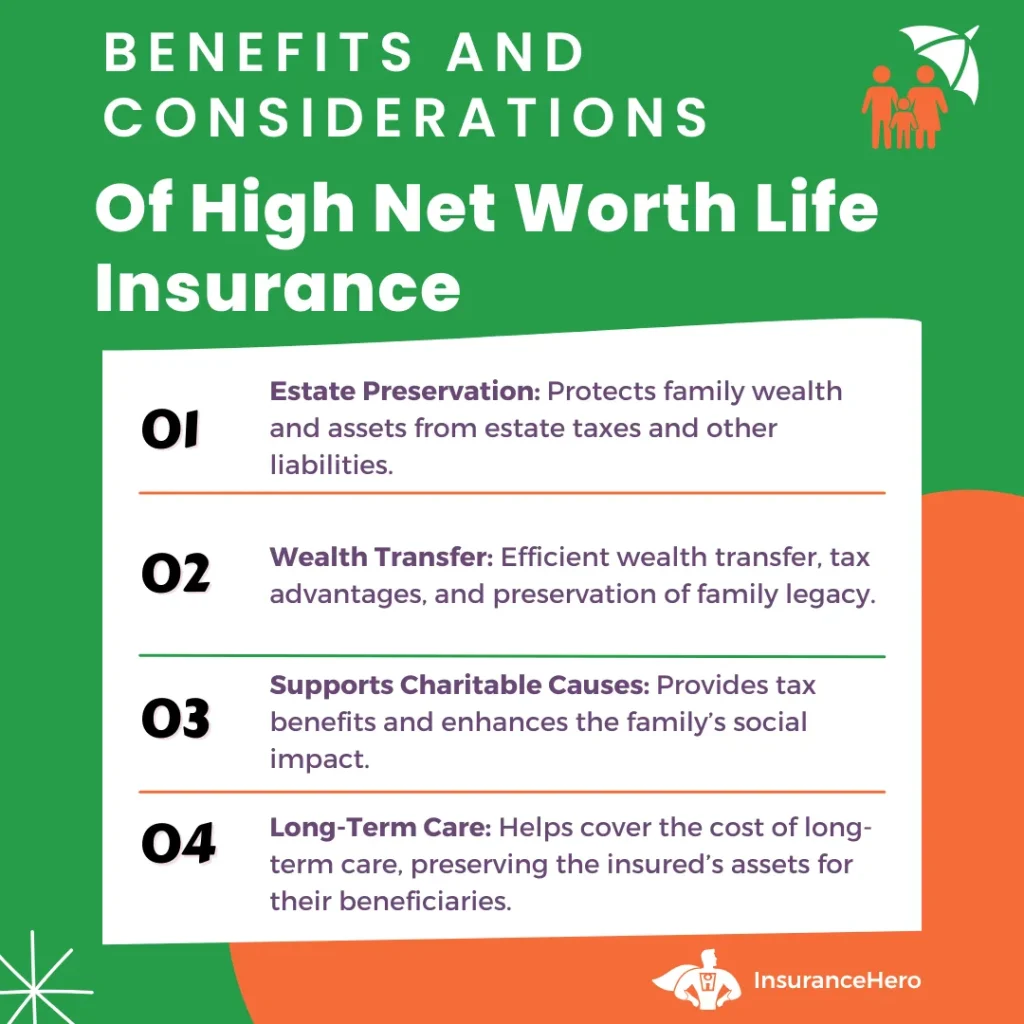

| Estate Preservation | Coverage that ensures the estate remains intact after the insured’s death. | Protects family wealth and assets from estate taxes and other liabilities. |

| Wealth Transfer | Facilitates the transfer of wealth to future generations. | Efficient wealth transfer, tax advantages, and preservation of family legacy. |

| Business Succession | Covers the costs associated with business succession planning. | Ensures a smooth transition of business ownership, protects the business’s value, and provides financial support for partners or key employees. |

| Charitable Giving | Allows policyholders to leave a legacy through charitable donations. | Supports charitable causes, provides tax benefits, and enhances the family’s social impact. |

| Long-Term Care | A lump-sum payment will be made to the beneficiaries upon the insured’s death. | Helps cover the cost of long-term care, preserving the insured’s assets for their beneficiaries. |

Evaluate Your Insurance Needs

Before choosing a life insurance policy, it’s crucial to assess your financial needs and goals.

Consider the following factors:

- Debts and liabilities: Ensure your policy covers outstanding debts, such as mortgages, loans, and credit card balances.

- Income replacement: Determine the amount needed to replace your income and maintain your family’s lifestyle.

- Future expenses: Estimate costs for your children’s education and your spouse’s retirement.

- Estate planning: If you have a sizeable estate, consider the potential impact of inheritance tax and explore strategies to minimise it.

Maximise Inheritance Tax Planning Benefits

Life insurance can significantly influence inheritance tax planning for high net worth individuals. In the UK, inheritance tax is levied on estates worth more than £325,000 at a rate of 40%.

Life insurance can help mitigate this tax burden in the following ways:

- Liquidity: A life insurance policy can provide beneficiaries with immediate funds to pay inheritance tax without having to liquidate assets.

- Trusts: By placing your life insurance policy in a trust, you can ensure that the policy proceeds are not included in your estate, thus reducing the inheritance tax liability.

Leverage Business Protection Insurance

If you own a business, protecting it with life insurance is essential.

Several types of business protection insurance can be relevant for high-net-worth individuals in the UK:

- Key Person Insurance: This type of policy covers the loss of a key employee due to death or illness. The business is the beneficiary, and the policy payout can help cover financial losses from the key person’s absence.

- Shareholder Protection Insurance: Shareholder protection insurance provides funds for the remaining shareholders to buy out the shares of a deceased shareholder, ensuring that control of the company remains within the group.

- Loan Protection Insurance: This policy covers the repayment of outstanding business loans in the event of the death of a business owner or key employee.

Common Riders for High Net Worth Individuals’ Life Insurance Policies

| Rider | Description | Benefits |

|---|---|---|

| Waiver of Premium | Waives premiums if the insured becomes disabled. | Ensures coverage continues without financial burden during disability. |

| Guaranteed Insurability | Allows the insured to increase coverage without additional underwriting. | Enables policyholders to adapt to changing financial needs. |

| Accelerated Death Benefit | Provides a portion of the death benefit if the insured is diagnosed with a terminal illness. | Offers financial relief during a difficult time. |

| Long-Term Care Rider | Provides coverage for long-term care expenses. | Helps cover the cost of long-term care, preserving the insured’s assets. |

| Return of Premium | Returns a portion or all of the premiums paid if the insured outlives the term policy. | Offers a refund of premiums for term life policies, providing additional financial flexibility. |

Implement Gift Inter Vivos Policies

A Gift, Inter Vivos policy is a decreasing term life insurance policy designed to cover the potential inheritance tax liability resulting from a substantial gift made during your lifetime.

In the UK, gifts made within seven years of your death may be subject to inheritance tax.

With a Gift Inter Vivos policy:

- The policy term matches the seven-year taper relief period for gifts.

- The death benefit decreases over time to align with the tapering inheritance tax liability on the gift.

This policy can provide peace of mind for high-net-worth individuals who make sizeable lifetime gifts and want to ensure their beneficiaries are not burdened with inheritance tax.

Invest in Relevant Life Policies

A Relevant Life policy is a tax-efficient term life insurance policy for UK-based employees and company directors.

The policy provides a death-in-service benefit for the employee, with the following advantages:

- Premiums are paid by the employer and are usually tax-deductible as a business expense.

- The policy does not count towards the employee’s lifetime allowance for pension purposes.

- The policy can be written into trust, ensuring the proceeds are not subject to inheritance tax.

A Relevant Life policy can be an attractive option for high-net-worth individuals who own a business and want to provide a tax-efficient benefit for themselves and their employees.

Diversify with Joint Life Policies

A joint life policy covers two individuals, typically a married couple, under a single policy.

This type of policy can be structured in two ways:

- Joint Life First Death: The policy pays out upon the first death of either insured, and the surviving partner loses coverage.

- Joint Life Second Death: The policy pays out upon the second death of the insured individuals, making it suitable for inheritance tax planning.

Joint life policies can offer cost savings compared to purchasing separate policies. They can be an attractive option for couples who want to streamline their life insurance coverage.

Utilise Trusts to Protect Life Insurance Proceeds

Placing your life insurance policy in a trust can offer several advantages for high-earning individuals in the UK:

- Inheritance tax benefits: By placing the policy in a trust, the proceeds are not considered part of your estate and, thus, not subject to inheritance tax.

- Control: A trust lets you specify how and when the policy proceeds are distributed to your beneficiaries.

Probate avoidance: Trust assets bypass the probate process, enabling quicker, more efficient distribution of policy proceeds.

There are different types of trusts available, each with its unique features and benefits:

- Discretionary Trust: The trustees can decide how and when the beneficiaries receive the policy proceeds.

- Bare Trust: The beneficiaries have an absolute right to the policy proceeds, and the trustees have no discretion.

- Split Trust: Combines discretionary and bare trust elements, allowing flexibility in distributing the policy proceeds.

It’s essential to consult with a legal or financial advisor to determine the most suitable trust structure for your specific needs and circumstances.

Consider Over 50s Life Insurance Plans

Over 50s life insurance plans are designed for individuals aged 50 and above, offering guaranteed acceptance without medical underwriting. These plans typically offer a fixed death benefit and have relatively low premiums.

Over 50s life insurance plans can be beneficial for high net worth individuals in the UK who:

- Have pre-existing medical conditions that may make obtaining traditional life insurance difficult or expensive.

- Want to cover funeral expenses or leave a small legacy for their beneficiaries.

- Seek a simple and hassle-free application process.

Remember that the death benefit for Over 50s plans may be limited compared to traditional life insurance policies, so it’s essential to evaluate whether this type of plan aligns with your overall financial goals.

Factors Affecting Life Insurance Premiums for High Net Worth Individuals

| Factor | Description | Impact on Premiums |

|---|---|---|

| Age | The age of the individual at the time of policy issuance. | Older individuals typically pay higher premiums. |

| Health | The overall health and medical history of the individual. | Poor health or pre-existing conditions can lead to higher premiums. |

| Gender | The gender of the individual. | The individual’s overall health and medical history. |

| Occupation | The nature of the individual’s occupation. | High-risk occupations can result in higher premiums. |

| Lifestyle | The individual’s lifestyle choices, such as tobacco use, alcohol consumption, and exercise habits. | Unhealthy lifestyle choices can lead to higher premiums. |

| Coverage Amount | The size of the death benefit being purchased. | Higher coverage amounts result in higher premiums. |

Review and Adjust Your Coverage Regularly

Life insurance is not a one-time decision, and it’s crucial to review and adjust your coverage regularly to ensure it continues to meet your evolving needs.

Consider the following factors when reviewing your policy:

- Changes in personal circumstances: Major life events, such as marriage, divorce, the birth of a child, or the purchase of a new home, may necessitate adjustments to your life insurance coverage.

- Changes in financial goals: As your financial goals evolve, so should your life insurance coverage to ensure it remains aligned with your objectives.

- Changes in legislation: Stay informed about UK tax laws and insurance regulations that may affect your policy and adjust your coverage accordingly.

High Net Worth Life Insurance Conclusion

Life insurance is a critical component of a comprehensive financial plan for wealthy individuals in the UK.

Understanding the different types of life insurance available and implementing tailored strategies ensures that your wealth is preserved and protected for future generations.

Don’t hesitate to consult us to help you navigate the complexities of life insurance and select the most suitable options for your unique circumstances.

FAQs

What is the difference between term and whole of life insurance in the UK?

Term life insurance provides coverage for a specific period, while whole of life insurance provides coverage for your entire life as long as premiums are paid. Whole-of-life insurance also accumulates cash value over time.

How can life insurance help with income tax planning for UK high-net-worth individuals?

Life insurance can provide liquidity to pay inheritance tax without liquidating assets, and by placing the policy in a trust, the proceeds can be excluded from your estate, reducing the inheritance tax liability.

What is a Gift Inter Vivos policy, and why should I consider one?

A Gift Inter Vivos policy is a decreasing term life insurance policy designed to cover the potential inheritance tax liability resulting from a substantial gift made during your lifetime.

It can provide peace of mind for those who make sizeable lifetime gifts and want to ensure their beneficiaries are not burdened with inheritance tax.

What are the tax advantages of life insurance for high-net-worth individuals in the UK?

Life insurance can offer several tax advantages, such as providing funds to cover inheritance tax liabilities, offering tax-efficient benefits through Relevant Life policies, and excluding policy proceeds from your estate when placed in a trust.

What is business protection insurance, and how can life insurance be used in such strategies?

Business protection insurance includes various life insurance policies that protect a business’s financial stability, such as Key Person Insurance, Shareholder Protection Insurance, and Loan Protection Insurance.

These policies help cover financial losses due to the death or illness of a key employee or business owner.

How can Relevant Life policies benefit high-net-worth individuals in the UK?

Relevant Life policies provide tax-efficient term life insurance for UK-based employees and company directors, with premiums paid by the employer and usually tax-deductible as a business expense.

The policy does not count towards the employee’s lifetime allowance for pension purposes and can be written into trust, ensuring the proceeds are not subject to inheritance tax.

Is an over-50s life insurance plan a good option for high-net-worth individuals in the UK?

Over-50s life insurance plans can be beneficial for high-net-worth individuals with pre-existing medical conditions who want to cover funeral expenses or leave a small legacy for their beneficiaries.

However, the death benefit for Over 50s plans may be limited compared to traditional life insurance policies, so it’s essential to evaluate whether this type of plan aligns with your overall financial goals.

What is a joint life policy, and how can it benefit high-net-worth individuals in the UK?

A joint life policy covers two individuals, typically a married couple, under a single policy. It can offer cost savings compared to purchasing separate policies and can be an attractive option for high-net-worth couples in the UK who want to streamline their life insurance coverage.

How often should I review and adjust my life insurance coverage?

It’s essential to review your life insurance coverage regularly, at least once every few years or when there is a significant change in your personal circumstances, financial goals, or relevant legislation.

Are there any specific UK insurance companies catering to high earners?

AIG is renowned in the UK life insurance sector and offers a policy specifically crafted for high-net-worth individuals.

For those looking for comprehensive coverage, AIG’s life insurance plan is ideally suited to the needs of affluent individuals. Knowing you’re protected offers many benefits and peace of mind.

AIG understands that individuals with high net worth require a policy that meets their unique needs when it comes to life insurance. That’s why they’ve developed a plan tailored to the specific needs of this demographic.

From flexible payment options to tailored coverage, AIG’s life insurance for high-net-worth individuals provides a comprehensive solution for those seeking peace of mind and financial security. A life insurance policy that meets their unique needs

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.