Business Loan Protection Insurance 2026 Guide

Do you own a business? Are you worried about the continuity of the business, particularly the ability to repay any company overdraft or commercial loan if something happens to you or a key team member?

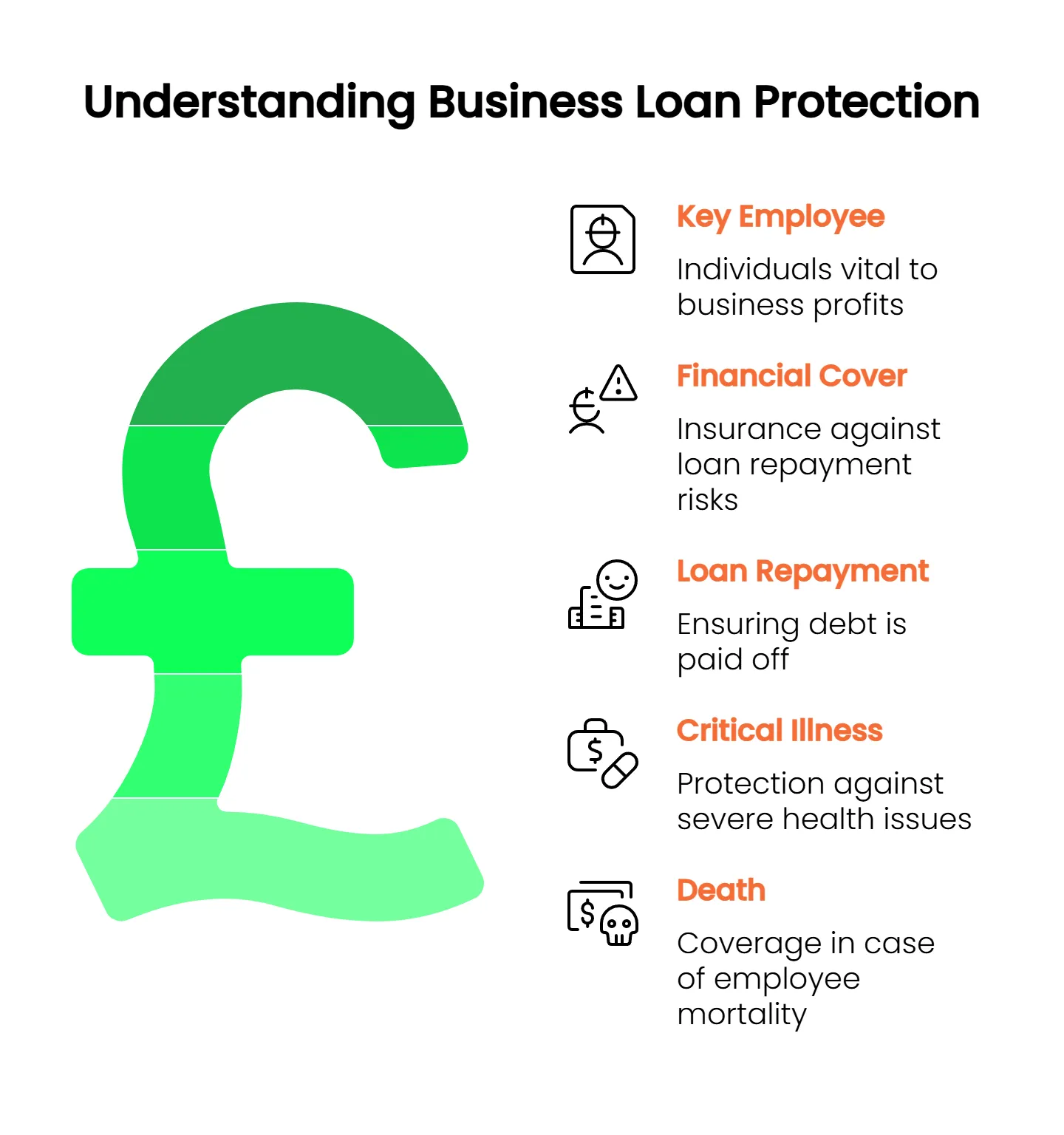

Did you know that business loan protection insurance is designed to repay any outstanding business debts or loans should you or an important employee die or not work due to a critical illness diagnosis?

This guide will explain how it works and why it should be considered for businesses and startups.

Compare The Top 10 UK Insurers. Protect Your Business For Less – Compare & Save

These summary tables provide a concise overview of Business Loan Protection Insurance tailored to the UK market

Coverage Options

| Type | Description |

|---|---|

| Level Cover | The insurance coverage amount remains unchanged throughout the policy term and is suitable for interest-only loans. |

| Decreasing Cover | The cover amount decreases over time and aligns with the outstanding loan balance, and is recommended for capital and interest loans. |

Policy Considerations

| Consideration | Description |

|---|---|

| Tax Treatment | Premiums are not typically tax-deductible as a business expense, but the payout is usually tax-free. |

| Trust Ownership | Policies can be written in trust to ensure the payout is used to repay the loan directly, avoiding probate delays. |

Additional Benefits and Features

| Feature | Description |

|---|---|

| Critical Illness Cover | An optional addition to cover the diagnosis of specified serious illnesses. |

| Flexible Premiums | Options to choose between guaranteed or reviewable premiums. |

Market Considerations

| Subject | Detail |

|---|---|

| Underwriting Process | It may vary by insurer, with some offering ‘fast track’ processes for smaller loan amounts. |

| Insurance Providers | A range of insurers offer tailored products for different business sizes and sectors. |

What Is Business Loan Protection Insurance?

When a business owner or company director dies or becomes disabled to the point that continuing to work is no longer an option, corporate lenders may exercise their right to recall any outstanding debt related to the owner’s finances.

Such a scenario may put the business’s very future, including its staff, at risk.

Like a life insurance policy, in return for paying a regular monthly premium correlated to the size of the outstanding debt, business loan protection is a product that pays out the value of the debts, allowing the business to repay any corporate loans, mortgages, or overdrafts.

The life cover can also repay any loans made to the company by business owners or directors, as well as by external creditors.

As some business loans may also involve personal liability, it is a vital form of insurance to protect individual shareholders from any losses.

Does Our Company Need Corporate Loan Insurance?

Protecting a business from outstanding financial obligations is not a legal requirement. However, many corporate lenders will insist that they can repay loans in the event of an incident by having loan insurance in place.

If a director or shareholder is personally responsible for repaying a business loan, their death or incapacitation can result in the creditor immediately calling in the full amount owed.

A business without protection may risk being declared an unviable or insolvent entity if a director or shareholder dies and the loan cannot be repaid.

Get Over £200k Of Loan Insurance Cover From £7.60 Per Month- Secure A Free Quote Below

How Much Cover Does Your Business Need?

The level of coverage required should correlate to the outstanding loan balance, known as the sum assured.

The lump sum to be paid to creditors in the event the owner or business partner dies will be reflected in the monthly or annual premium paid throughout the fixed-term policy.

How Much Will A Business Loan Protection Policy Cost?

The cost of taking out corporate loan protection depends on several factors taken into consideration by the insurer, including the following:

- What is the health of the person to be insured? Do they have any underlying medical conditions?

- Do they have a healthy lifestyle, exercise, and do not drink excessively or smoke?

- How old are they at the policy outset?

- Is the job they do considered risky, or is it low risk?

For Example:

The cost for a 36-year-old business owner applying for a £140,000 business loan over a fixed term period of 10 years with decreasing cover is around £7 a month. For a 50-year-old, implementing the same policy will cost around £25 a month.

Insurance Hero is an independent broker who can provide a competitive quote closely aligned with your and your business’s needs. Contact our sales team today on 0203 129 88 66 for a fast and free quote.

Is business loan protection tax-deductible?

HMRC does not consider any payout from a business loan policy as benefiting a business, as any payout money goes directly to creditors.

Instead, HMRC considers any premiums paid into a policy to be part of the finance raised. This means that premiums are not considered tax-deductible business expenses.

Only the payout money is usually tax-free, as the ultimate beneficiary of any payment is the creditors and not the business itself.

How about writing the Policy into the trust?

If a payout from a business loan policy is requested, the payout must go directly to creditors to settle any outstanding obligations.

If a policy is written into a trust, this adds a layer of complexity as a trust is a separate legal entity from the underlying business. Writing a policy into trust would only create unnecessary complexity when it aims to pay lenders and settle any debt.

Further Benefits Of Insurance for Loan Cover

As well as a financial payout when you most need it, a comprehensive business loan cover should also include the following key features:

- Sessions with a physiotherapist or an acupuncture professional

- Stress-related advice and counselling through a dedicated helpline

- Full 24/7 access to a GP by phone or video consultation

- An ability to increase or decrease the level of cover

- Switching the frequency of premiums between monthly and annual payments

- Reducing or extending the cover period

- Removing the insured person from a policy

Increasing or Decreasing Cover

Depending on the circumstances surrounding any business protection, increasing or decreasing the level of cover can be a helpful option.

Increasing cover

Under this cover, premiums and the sum assured will increase in line with the UK Government’s Consumer Price Index (CPI).

It is a benchmark that indicates the change in the cost of living and premiums under a policy; as cover increases, premiums will rise accordingly.

Decreasing cover

The premiums and the sum assured will decrease over the policy’s fixed term. Decreasing cover is often associated with a commercial mortgage, where the size of the borrowing decreases over the life of the loan, so the level of cover must also decrease.

Level Cover

The level of insurance cover remains unchanged throughout the fixed-term policy.

What about Critical Illness?

Most providers offer the option to include critical illness coverage as part of their overall business loan insurance products.

It may be an available option or be added at no extra cost. Some insurers also refer to critical illness coverage as disability insurance, so being aware of the differing terminology is helpful.

Critical illness is essential, as death is not always the outcome that will stop business owners from being able to run a business.

Critical illness covers the diagnosis of a disease where the insured will not be able to work, with a payment forthcoming should the person survive 14 days from diagnosis.

Critical illness can include qualifying diseases, including, but not limited to, the following:

- Kidney failure

- Liver failure

- Structural heart surgery

- Multiple sclerosis

- Loss of a hand or a foot

- Motor neurone disease

- A stroke

- Parkinson’s disease

- Heart attack

- Coma

- Certain types of cancer

- Motor neurone disease

- Heart valve replacement or repair

- Coronary artery by-pass grafts

- Benign spinal cord tumour

- Progressive supranuclear palsy

- Traumatic brain injury

How Do I Find the Best Rates and Deals?

It is essential to shop around when considering insurance coverage. Rather than going directly to an insurer, an independent broker such as Insurance Hero, which is not tied to a particular insurer, will do the heavy lifting, searching the market and multiple insurers to get the best advice and quotes.

Insurance Hero has experience providing business protection insurance to businesses of different sizes. As an independent broker, we are not tied to any insurance provider.

We have relationships with all the top insurers, including Zurich, Aviva, Aegon, LV, and L&G, to ensure we can offer competitive quotes tailored to your business’s needs.

For a fast, free quote, contact our friendly, professional team of advisers at Insurance Hero on 0203 129 88 66 today. We want to help you protect your company and your staff by providing peace of mind in the event of your absence.

Other Types of Related Insurance

Business loan protection insurance is a critical cover to protect the interests of your business, but did you know that different types of related insurance cover can protect your company:

Keyman insurance

Keyman insurance provides cover if a key staff member dies or becomes critically ill and is no longer able to work.

Keyman insurance is available to businesses of all sizes, from sole traders to medium- and large-sized limited companies.

It helps maintain the business’s viability should something happen to the critical person, whether the founder or an essential sales manager.

A lump sum payout would be due in return for monthly premiums. This payout may be used to maintain the supply chain if costs increase, providing a financial buffer against a fall in profit or the cost of recruiting and training a replacement employee.

Shareholder protection insurance

Shareholder protection insurance provides other shareholders of a company with a lump sum cash payment to buy the shares of a deceased shareholder.

It is an essential form of insurance if existing shareholders need to maintain control so the organisation can trade profitably without outside interference.

Relevant Life insurance

Any payout from a Relevant life insurance policy differs, as it is for the benefit of the insured staff member, not the business itself.

In the event of the insured’s death, the insured’s dependents will receive financial compensation. Relevant life insurance is considered tax-efficient, as UK corporate relief applies to the premiums paid and the payout.

FAQS Section:

What happens if I die before the policy is set up?

Most insurers will automatically include an accidental death benefit should you die after an application submission, but before the policy is in place.

Insurers usually pay out for up to 90 days after receiving a business loan protection application.

A similar type of cover, immediate cover, allows protection before a policy is fully set up and is typically for up to 60 days.

Can I change my policy once it is in place?

Insurers will typically include the ability to change your policy, known as a guaranteed insurability option, as part of the cover.

This means that insurance coverage can increase if an existing business loan is extended without requiring further medical evidence.

What is legal and general business loan protection?

Legal & General business loan protection offers both level and decreasing cover options, so the amount insured can match the business’s outstanding debt or decrease alongside loan repayments for accuracy.

Businesses can also add critical illness cover for broader protection, and the plan provides an immediate accidental death benefit while the application is processed.