Asthma Life Insurance Coverage Guide

Have you been suffering from Asthma and considering life insurance coverage? Maybe you’ve been turned down before and are worried you’ve run out of options?

Can you get life insurance if you have asthma?

The good news is that Insurance Hero can help you find an asthma life insurance policy that covers a pre-existing condition, such as asthma, at a standard rate or with a small loading.

With our help, your asthma need not affect the cost of your life insurance.

Asthma doesn’t usually raise life insurance costs in the following circumstances:

- If your condition is mild and symptom-free most of the time.

- You haven’t needed regular hospital care due to regular attacks.

- Your condition responds well to treatments such as Accuhalers, Clickhalers, Novolizers, and Turbohalers.

More serious symptoms, however, can influence an application. Insurers might look beyond asthma itself and ask about your overall health and lifestyle. These include your age, weight, and smoking habits.

Ultimately, approval and pricing are based on a comprehensive view of your risk, not just a single condition.

Have Asthma And Need Cover? Compare The Leading Life Insurance Companies Today

A Recent Asthmatic’s Life Insurance Policy (With Costs)

| Applicant Information | Asthma Life Insurance Policy Details |

|---|---|

| Date of Birth & Smoking Status | Born in 1994, and doesn’t smoke |

| Height & Bodyweight | 5 ft 9 tall and weighs 11 stone 8 pounds |

| Asthma Background | Diagnosed with asthma during their early teens |

| Medical History | Experienced a moderate episode in 2024 requiring two days in hospital with nebuliser treatment |

| Insurance Coverage | £246,000 mortgage protection cover |

| Policy Duration | 30-year term |

| Premium Structure | Fixed monthly payments |

| Monthly Premium | £10.59 per month |

An Explanation of Asthma

A simple definition of asthma is the inflammation of the bronchi, commonly known as the airways.

These tiny tubes carry oxygen in and out of the lungs, and when someone has asthma, they become inflamed after exposure to an irritant, causing chest tightness and difficulty breathing.

An asthma attack is classified by the onset of these symptoms, which can vary in severity. Depending on the severity, these symptoms may require the individual to go to a hospital for treatment.

Although the exact cause of asthma is unknown, several theories exist regarding how asthma develops in individuals.

Some of these theories link asthma to a family history of the condition and an association with other conditions, such as certain allergies and eczema.

Environmental factors, along with some of the theories mentioned earlier, are also considered when determining how asthma develops.

How is Asthma Treated?

There is currently no cure for asthma, but several treatments are available that are effective in managing the condition and preventing asthma attacks, as well as helping to control and alleviate symptoms.

These treatments include specific medications, identifying individual triggers or irritants, and some lifestyle changes.

Some treatments currently available in the United Kingdom include oral steroids, preventers, and reliever inhalers.

How Can Asthma Affect Your Life Insurance Application?

Having a pre-existing condition, such as asthma, can slightly increase life insurance premiums, as insurers consider pre-existing conditions when determining coverage and costs.

Insurers will closely examine the individual’s medical history when applying for life insurance.

For pre-existing conditions such as asthma, the increased cost of coverage is usually determined by the severity of the condition and the recency of symptoms.

Since asthma is a common condition diagnosed early, symptoms are usually well-managed when an individual applies for life insurance.

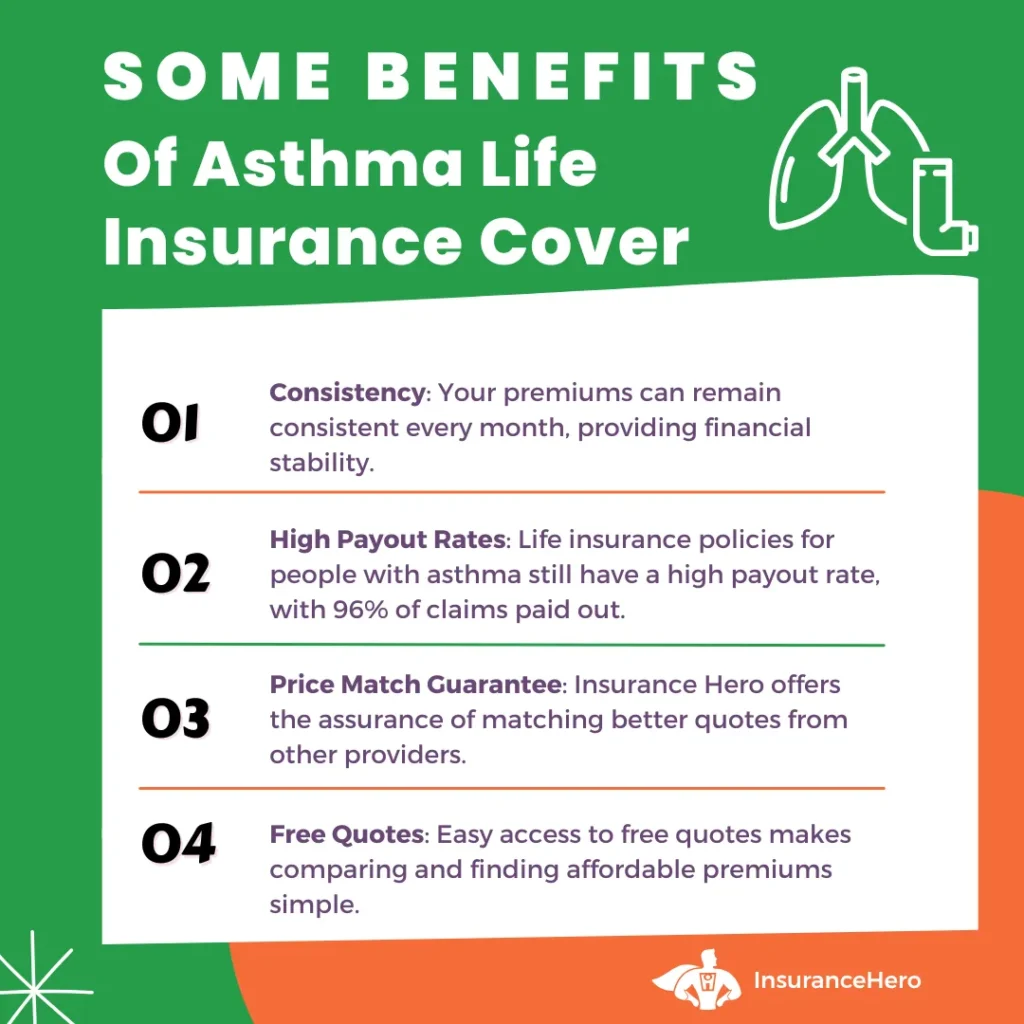

Because of this, many insurers will issue these individuals “standard term” insurance.

In cases where symptoms are more severe and have resulted in hospital attention or prescription needs in the previous two years, insurers may offer individuals “rater premiums.”

This means the policy costs more to account for the additional risk posed by the condition.

Another route that some insurance companies will take is to ask the applicant for more detailed information and a history of their condition to make a more informed decision.

It is important to remember that not all life insurance providers are created equally.

Because of this, each insurer may have a different policy regarding covering individuals with asthma and how they rate premium payments based on lifestyle factors and medical conditions.

The professional insurance consultants at Insurance Hero can help individuals who have conditions such as asthma find an affordable life insurance policy with pre-existing conditions that meets all their needs.

Types of Life Insurance Policies available

| Policy Type | Description |

|---|---|

| Term Life Insurance | A common type of policy for family protection |

| Mortgage Life Insurance | Decreasing term for mortgage protection |

| Critical Illness Cover | For serious medical conditions |

| Income Protection | For loss of income due to illness |

| Whole of Life Insurance | For your entire life, often for tax planning |

| Family Income Benefit | Regular income payout instead of a lump sum |

General Considerations To Be Aware Of

| Consideration | Detail |

|---|---|

| Application Process | Similar to non-asthmatics |

| Severity of Asthma | Affects the ease of getting insurance |

| Regular Policy Review | Recommended |

| Comparison Across Providers | Advised |

Is asthma a pre existing medical condition?

Asthma is considered a pre-existing medical condition in the UK life insurance market. Insurers evaluate its severity and management level to determine policy terms and premiums.

Controlled asthma may have minimal impact, but severe cases can sometimes affect coverage and costs. It is wise to disclose all health details for an accurate policy assessment.

💡Need Help Understanding Your Coverage Options?

Based on the complexity of your condition, talking with a specialist from the Insurance Hero team can help you:

- Identify insurers most likely to accept your application

- Understand what information underwriters require

- Receive accurate premium estimates based on the severity of your asthma

Please choose from one of the two options below:

How does smoking affect asthma life insurance coverage?

Smoking with asthma usually leads to higher life insurance premiums in the UK because underwriters view the combination as a higher respiratory and cardiovascular risk.

Most insurers class you as a smoker if you have used any tobacco or nicotine product, including vapes or nicotine replacement, in the last 12 months.

Athmatic smokers often face percentage loadings on top of standard smoker rates, especially if usage is heavier.

Stopping all nicotine for at least 12 months can allow reapplication or repricing as a non‑smoker with many providers, potentially reducing premiums if asthma remains stable.

Is asthma a critical illness?

Asthma is typically not classified as a critical illness, and critical illness coverage focuses on more severe conditions like cancer or heart disease.

Because it’s generally viewed as a low-risk, non-serious condition by many insurers, it usually isn’t included on the list of illnesses covered by most critical illness policies.

However, severe asthma cases might influence life insurance premiums and terms.

Current Statistics

According to Asthma + Lung UK’s 2024 Annual Report:

| Statistic | Figure | Source |

|---|---|---|

| Total number of people diagnosed | 5.4 million | Asthma + Lung UK (2024) |

| Children affected | 1.1 million | NHS Digital, Hospital Episode Statistics (2023/24) |

| Adults affected | 4.3 million | GP Patient Survey (2024) |

| The number of severe asthma cases | 250,000 estimated | British Thoracic Society (2024) |

| % of the population with the condition | 8.3% | ONS Population Estimates + Asthma + Lung UK |

| Annual Deaths | ~3 per day (1,000+ annually) | Asthma + Lung UK Mortality Review |

Sources:

- Asthma + Lung UK. (2024). “Annual Asthma Survey Report 2024.”

View Report - NHS Digital. (2024). “Hospital Episode Statistics 2023/24.”

- British Thoracic Society. (2024). “Severe Asthma Guidelines.”

- Office for National Statistics. (2024). “Population Estimates.”

Data Currency: All statistics verified as of January 2026

Next Update: Due June 2026 (following Asthma + Lung UK annual report)

Income Protection Insurance and Asthma

Income protection insurance provides financial support if you cannot work due to illness or injury.

If you have asthma, you may be concerned about how it will affect your income protection insurance application.

However, many insurance providers offer income protection insurance to people with asthma, and the severity of your symptoms will play a significant role in determining your premiums.

If you have mild asthma, you may be able to secure income protection insurance at standard rates.

However, if your asthma is more severe or you’ve experienced frequent asthma attacks, you may face higher premiums or special terms.

It’s important to disclose your asthma symptoms and medical history when applying for income protection insurance to ensure you receive accurate quotes and coverage.

Some insurance providers may offer income protection insurance with exclusions for asthma-related claims.

In this case, you may want to consider alternative providers that offer more comprehensive coverage. You should review your policy terms and conditions to understand what is covered and what is not.

Finding Affordable Life Insurance with Asthma

Finding affordable life insurance with asthma requires careful consideration and research.

Here are some tips to help you find the best life insurance policy for your needs:

- Compare quotes: Shop around and compare quotes from different insurance providers to find the best rates.

- Disclose your medical history: Be honest about your asthma symptoms and medical history to ensure you receive accurate quotes and coverage.

- Choose the right policy: When selecting a life insurance policy, consider your financial situation, dependents, and lifestyle.

- Consider a specialist broker: A specialist broker like Insurance Hero can help you find the best life insurance policy for your needs and budget.

- Review policy terms and conditions: Understand what is covered and what is not, including exclusions or limitations.

Medical Exams and Asthma

If you’re applying for life insurance with asthma, you may be required to undergo a medical exam. The purpose of the medical exam is to assess your overall health and determine the level of risk you pose to the insurance provider.

During the medical exam, you’ll be asked about your asthma symptoms, asthma medication, medical history, smoking status and treatment plan. You may also be required to provide medical records or undergo additional testing, such as a lung function test.

You may not be required to undergo a medical exam if you have mild asthma. However, if your asthma is more severe or you’ve experienced frequent asthma attacks, a medical exam may be necessary to assess your risk level.

You should be truthful about your asthma symptoms and medical history during the medical exam to ensure you receive accurate quotes and coverage.

Failure to disclose your medical history can result in your policy being invalidated or claims being denied.

In some cases, insurance providers may offer non-medical life insurance policies, which do not require a medical exam.

However, these policies may have higher premiums or limited coverage. It’s crucial to review policy terms and conditions carefully before deciding.

⚕️ MEDICAL INFORMATION NOTICE

The medical condition information Insurance Hero provides on this page is for general educational purposes only and should not be considered medical advice.

For specific medical and asthma-related questions:

- Consult your GP or specialist

- Contact NHS 111 for health concerns

- Visit www.nhs.uk for trusted medical information

References & Sources

Medical Information Sources:

- NHS. (2025). “Asthma: Overview.” NHS.UK.

https://www.nhs.uk/conditions/asthma/

Last reviewed: October 2025

- National Institute for Health and Care Excellence. (2024).

“Asthma: diagnosis, monitoring and chronic asthma management (NG80).”

https://www.nice.org.uk/guidance/ng80

Published: November 2024

- British Thoracic Society. (2024). “British Guideline on the Management

of Asthma.” BTS/SIGN Guidelines.

https://www.brit-thoracic.org.uk/quality-improvement/guidelines/asthma/

Updated: September 2024

Statistical Data Sources:

- NHS Digital. (2024). “Hospital Episode Statistics: Admitted Patient Care.”

https://digital.nhs.uk/data-and-information/publications/statistical/hospital-admitted-patient-care-activity/2024-25

Published: September 2024

Last Updated

All sources verified and accessed: January 6th, 2026

Next scheduled review: May 28, 2026

Citation Standards

This page follows standard academic citation practices. Authoritative sources support all factual

claims. Where sources conflict, multiple perspectives are presented. For the most current information, please consult the sources linked above.

Other conditions related pages and how they affect coverage:

Life Insurance No Medical Exam Or Questions Required

Are you looking for a life insurance no medical exam policy? Did you know that, in many cases, insurers do not require a…

Is Life Insurance With A Heart Condition Possible?

Can I Get Life Insurance If I Have A Heart Condition Or A Stent? Providers typically ask detailed questions abo…

HIV Life Insurance, Can I Get Cover In 2026?

Many people think life insurance is unavailable to those suffering from HIV. The good news is that getting life insuranc…

Life Insurance For Disabled Adults And People In The UK

Insurance Hero has tried hard to find the best life cover for those with a disability in the UK. From that list…

Cancer Life Insurance And Critical Illness Quotes

When a medical tragedy strikes, knowing there is financial support for you and your family can bring a lot of relief to …

Anxiety Life Insurance Cover In 2026

In the UK, one in four people will experience some mental health issue each year, with the most common conditions encoun…

Diabetes Life Insurance Cover

Some people assume it is hard to secure life insurance with some pre-existing condition. This includes diabetes life ins…

Life Insurance With High Cholesterol

High cholesterol and high blood pressure affect almost 30 per cent of the population. If left untreated, these condition…

Life Insurance With High Blood Pressure

Can someone with high blood pressure get life insurance? The simple answer is yes. We work with UK insurers that offe…

Epilepsy Life Insurance Specialist Cover Options

Pre-existing illnesses are more common now than a few decades ago. Insurance Hero is an insurance company speci…

Trusted High BMI Life Insurance For Overweight People In 2026

The average individual has a Body Mass Index (BMI) of 23. BMI is the measure of the ratio between height and weight. …

Do Any UK Companies Offer Female Cancer Life Insurance?

Cancer is a worldwide medical issue. More than 335,500 people in the UK will be diagnosed with cancer in 2025, according…

Trusted Life Insurance For Recovering Alcoholics In 2026

Life insurance is an essential product that helps individuals support their families, even when they are no longer aroun…

Life Insurance For Smokers – Lower Rates Are Possible

Estimates in the UK still indicate over 9 million people smoke despite smoking restrictions in indoor public places. Smo…

Impaired Risk Life Insurance Cover

It is well-known that health status affects the premiums offered by most life insurance carriers. If insurance …

Bipolar Disorder Life Insurance Coverage

According to Bipolar UK, an organisation that provides support for people affected by bipolar disorder, 1.3 million peop…

Life Insurance With Lupus What Are Your Options?

Are you living with lupus and worrying about how it affects your chances of getting life insurance? You’re not …

Life Insurance With Crohn’s Disease 2026

Crohn’s disease is one of the main inflammatory bowel diseases that affects 1 in every 650 people in the UK. …

A Guide To OCD Life Insurance

Navigating the world of OCD life insurance (Obsessive-Compulsive Disorder ) might seem challenging, but don’t worry – …

MS Life Insurance Multiple Sclerosis Life Cover

Insurance Hero offers MS Life Insurance plans that suit your lifestyle without restrictions. Individuals diagnos…

Is It Possible To Get Life Insurance After A Stroke?

Few things bring the fragility of life and the inevitability of mortality into focus quite like a major health event. …

Low BMI Life Insurance Cover For Underweight People

You can often secure life insurance coverage even if you are underweight or have a low BMI. Many insurance companies …

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.