NatWest Life Insurance Review From £5.46 Per Month

Welcome to our newly updated 2026 Natwest life insurance reviews page

National Provincial Bank was established in 1833, and Westminster Bank in 1836.

The new bank expanded its services, offering credit cards, entering the securities market, and providing international banking services to large companies. By the 1980s, the bank was called NatWest and offered home loans.

In 2000, NatWest was acquired by the Royal Bank of Scotland Group in the most significant takeover in British banking history. The company now offers a range of services, including banking, credit cards, loans, mortgages, investments, insurance, and more.

Reasons To Get A Free, No-Obligation Quote

- Bespoke life insurance, critical illness and income protection cover and mortgage protection to suit your needs

- Choose the cover that’s right for you

- Compare the UK’s top insurers

- Protect your loved ones

- Plan for funeral and cremation costs

- Resolve inheritance tax liabilities

- Life insurance over sixty NatWest plans at excellent rates

How Does NatWest Compare To The Leading UK Life Insurance Companies?

Overview Of NatWest Life Insurance

| Feature | Description |

|---|---|

| Provider | AIG Life Limited |

| Policy Options | Term Life Insurance, Critical 3 with Life Assurance, Guaranteed Sixty-Plus Life Insurance |

| Application Age Range | 17 – 86 (varies by policy type) |

| Term Length | 3 – 70 years (varies by policy type) |

| Defaqto Rating | 5 stars for Term and Critical 3, 4 stars for Guaranteed Sixty-Plus |

| Financial Conduct Authority | Regulated by the FCA |

| Additional Benefits | Free access to the Smart Health app and 24/7 virtual GP, Free terminal illness cover |

Policy Options and Features

| Policy Type | Key Features |

|---|---|

| Term Life Insurance | Pays out a cash lump sum if the insured passes away during the term. Available as a joint policy. Includes free terminal illness cover. |

| Critical 3 with Life Assurance | Covers cancer, heart attack, and stroke. Pays out upon diagnosis or death during the term. |

| Guaranteed Sixty-Plus | Designed for ages 60-80 with guaranteed acceptance. No medical questions are required. |

Coverage and Eligibility

| Coverage Option | Description |

|---|---|

| Level Term | The sum assured remains the same throughout the policy term. |

| Decreasing Term | The sum assured decreases over time, typically aligned with a mortgage balance. |

| Increasing Term | The sum assured increases over time to keep pace with inflation. |

Claims and Customer Support

| Aspect | Detail |

|---|---|

| Substantial claims statistics | 98% of claims were paid, totalling £119 million. |

| Customer Support | Dedicated support for policy amendments and claims processing. |

Additional Benefits and Services

| Benefit | Description |

|---|---|

| Smart Health Access | Free access for all customers to a 24/7 virtual GP and health experts. |

| Home Purchase Benefit | Up to 90 days of free cover during the home-buying process. |

| Mortgage Guarantee | Covers outstanding mortgage debt if the sum assured does not fully cover it upon claim. |

| Separation Benefit | Allows splitting a joint policy into two separate policies without new medical information. |

NatWest Life Insurance Reviews

AIG Life Limited provides NatWest life insurance. The term life policy pays a guaranteed lump sum if the insured dies during the selected term.

UK residents aged 18 to 64 may qualify for a plan with a term of 2 to 40 years, not to exceed the 70th birthday.

Policy Options

Coverage options include level term and decreasing term. Level term provides uniform coverage for the duration of the plan term.

A decreasing term features a coverage amount that decreases over the plan term, designed to correspond to the decreasing balance of a loan or mortgage.

A joint life policy is available to insure spouses or partners. However, this policy pays a benefit only on the first death.

After this, the plan ends, and the surviving individual is not covered. People choose a joint policy because it is less expensive than purchasing two individual policies.

However, a single payout may not be sufficient to support a loved one’s survivors. Therefore, consumers should carefully consider the best policy for their situation.

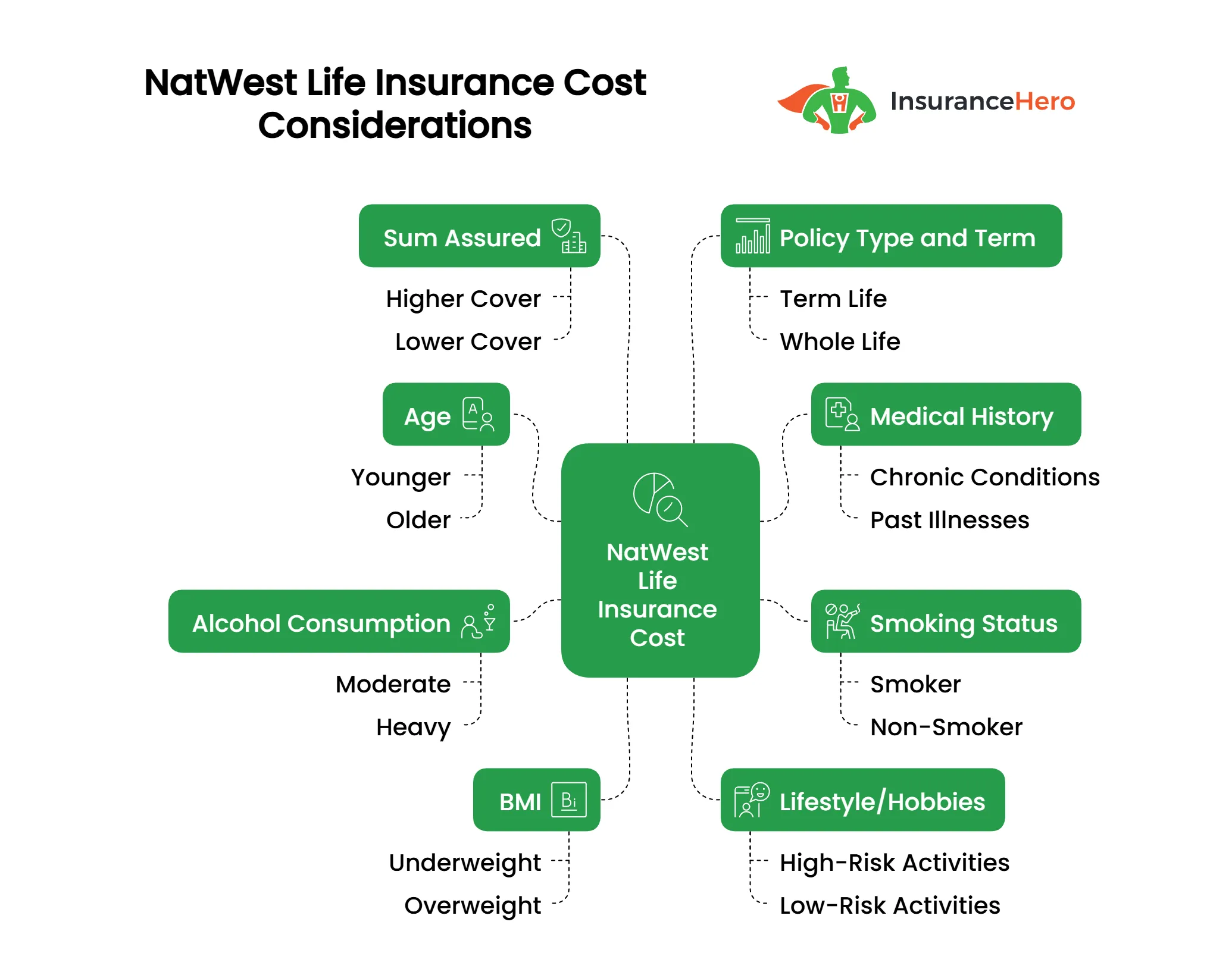

Consumers aged 18 to 64 may add critical illness coverage to their life policy for an additional charge. This guarantees a cash payout if the insured is diagnosed with a specified illness during the policy term.

The policy covers 25 major conditions or illnesses, including types of stroke, heart attack, and certain cancers, three conditions that account for more than 80 per cent of all claims.

Even if the individual can eventually return to work, this benefit makes it easier to bridge the income gap. Many families cannot live off one income; having this extra cash available can make a big difference.

The table below shows monthly quotes from Lloyd’s Life Insurance for level- and decreasing-term life insurance plans.

These numbers are based on a non-smoker in fair health needing £200,000 of coverage over a 20-year term.

| Persons Age | Decreasing Term Cover | Level Term Cover |

|---|---|---|

| 25 | £5.46 | £6.03 |

| 30 | £6.04 | £7.42 |

| 35 | £6.41 | £9.46 |

| 40 | £9.51 | £13.31 |

| 45 | £12.23 | £18.35 |

| 50 | £19.16 | £26.95 |

| 55 | £22.73 | £25.13 |

Critical Illness & Over 50’s Whole Of Life

Consumers may select a critical illness policy term between two and 40 years if this does not extend beyond their 70th birthday.

Premiums are regularly reviewed and may be increased. The benefit may be used for any purpose, such as making adjustments to the home to accommodate the medical condition or providing a more comfortable lifestyle.

Over 50s whole-of-life insurance is designed for UK residents aged 50 to 75 who wish to provide a benefit to help pay bills, funeral expenses, or educational costs for their grandchildren.

Acceptance is guaranteed without answering medical questions or submitting to a medical examination. Premiums start at £10 per month, and payouts and premiums are guaranteed to remain the same for the policy’s lifetime duration.

If the insured dies within the first two years of taking an over-50s policy, the only benefit will be a refund of premiums paid.

The only exception is if the death results from an accident, the guaranteed cash sum will be paid. With an over-50s plan, total premiums paid may exceed the payout upon death, depending on the insured’s lifespan.

Life insurance is an excellent way to protect loved ones against the financial hardship they will experience upon your death.

Understanding how this coverage works is essential to getting the most value from the premiums paid.

NatWest life insurance policies have no cash surrender value, and coverage ends if the insured stops paying premiums, with no refund issued. Inflation can decrease the cash benefit amount, so a regular coverage review is recommended.

Your home and household financial status may be jeopardised if you suffer a serious illness or die unexpectedly.

Even if you already have life insurance, you may need to supplement it. Many people have a policy that covers their mortgage, but this may not be enough.

Family members will still need money to maintain the home and pay regular expenses like food, clothing, and utilities. A life insurance policy will provide them with cash when they need it most.

We hope you have found our NatWest life insurance review helpful. There are many reasons to get life insurance.

Still, some of the most common benefits include providing peace of mind in the event of your passing, ensuring that your loved ones are financially taken care of, and covering end-of-life costs.

Whatever your reason for wanting life insurance, it’s important to ensure you have the right policy for your needs. Working with an experienced agent can help you find the best life insurance cover at the best price.

When we search for a life insurance policy for you, we review the term and over-50s policies provided by AIG through NatWest.

As experts in this industry, we can quickly determine whether this provider offers anything that will meet your needs.

If the price is competitive, we will provide a quote and the necessary information you need to make a purchasing decision.

NatWest Over 60 Life Insurance

NatWest offers AIG-backed Guaranteed Sixty-Plus Life Insurance for UK residents aged 60 to 80.

This policy ensures guaranteed acceptance, making it a straightforward option for those seeking coverage without needing medical evaluations. It is particularly suited for covering funeral expenses or providing a modest financial gift to loved ones.

Designed to alleviate financial stress, this insurance provides reassurance that your family won’t face the burden of funeral costs.

Important Features Of NatWest Guaranteed Sixty-Plus Life Insurance:

- Helps cover funeral expenses or leave a small financial legacy.

- No medical assessments or health-related questions (guaranteed acceptance).

- Affordable premiums start at £5 per month.

- Triple payout for accidental death within the first two years.

- Full coverage kicks in after two years.

- Includes access to Smart Health, a 24/7 virtual GP service.

Important Note: Premiums are payable until the age of 90, after which the coverage continues for the remainder of your life without additional payments.

Further Information:

Natwest Head Office

135 Bishopsgate

London

EC2M 3UR

https://personal.natwest.com/personal/insurance/life-insurance.html

Company number: 00929027

Contact Number: 0844 826 8022

Further useful resources:

- https://www.defaqto.com/star-ratings/life-and-protection

- https://themoneycharity.org.uk/advice-information/insurance/

AA Life Insurance UK Cover Review

Various life insurance products are available, including level term, decreasing term, and 50-plus. AA life insu…

AEGON Life Insurance Reviews – Compare Quotes

If you want to provide financially for surviving loved ones upon death, AEGON life coverage may be the solution. …

AIG Life Insurance UK Reviews

AIG (American International Group) is synonymous with the insurance industry. AIG is a multinational insurer fo…

ASDA Life Insurance Cover Reviews

ASDA Financial Services offers travel, home, motorist, pet, life insurance, personal loans, trade, gift, and credit card…

Aviva Life Insurance Review – Cover From £5 Per Month

Aviva is the largest UK insurance services provider and the fifth largest insurance group, with more than 45 million cus…

Axa Life Insurance Cover Review

The AXA Group has been in the insurance business since the 18th century. Acquisitions, mergers, and name changes for lea…

Barclays Life Insurance Review

Barclays PLC is a major financial services company backed by more than 300 years of history. Welcome to our new…

British Seniors Over 50 Life Insurance Reviews

Find out about British Seniors Over 50 Life Insurance Reviews, Customer Experience, and Policies Available. Abou…

Direct Line Life Insurance For Over 50’s Review

Direct Line is a household name for insurance products. At the outset, their core offering was vehicle insurance with a …

Ageas Protect Life Insurance Review

Fortis Life is now Ageas Protect, the financial protection arm of Ageas within the UK. The company offers produ…

Friends Life Life Insurance Reviews

Since 1810, Friends Life has been providing financial services. Founded in Yorkshire as Friends Provident in 1832, the c…

LV Life Insurance Reviews

In 2007, Liverpool Victoria rebranded their company name to use LV=. The LV= brand is a visual play on the word…

Nationwide Life Insurance Reviews And Cover

Nationwide Building Society offers insurance, banking, investment, loan, credit card, and mortgage services to residents…

One Family Over 50s Life Insurance Reviews

One Family over 50s life insurance offers UK residents aged 50 to 80 a straightforward way to take out life insurance co…

Post Office Life Insurance Review

Welcome to our Post Office life insurance review. In the United States, the Post Office is where residents mail letters …

Prudential Life Insurance UK Reviews

The international financial services group Prudential plc serves over 25 million customers and manages approximately £3…

Royal London Life Insurance Reviews

Royal London is the largest mutual life and pensions company in the UK. It comprises several specialist businesses desig…

Scottish Provident Life Insurance Review

Scottish Mutual Assurance Limited provides healthcare and protection products under the brand name Scottish Provident. …

Scottish Widows Life Insurance Reviews

Scottish Widows is a nationally recognised financial services provider that has served families with financial protectio…

Shepherds Friendly Over 50s Life Insurance Review

The Shepherds Friendly Society is one of the longest-running insurers in the world. In 1826, they began by establishi…

Smart Life Insurance Reviews, What Buyers Should Know

Welcome to our newly updated Smart Life Insurance reviews guide. Smart Life Insurance offers people a range of flexible,…

The Exeter Life Insurance Reviews

Do you have pre-existing medical conditions? Do you want to put in place a robust life insurance policy that will provid…

Virgin Money Life Insurance Review

Virgin Life Insurance is one of the over 400 companies in Virgin Group Limited, the British-branded venture capital cong…

Vitality Life Insurance Review – Should You Buy?

Vitality Life takes a more active role than most insurance providers do by helping people to live active and healthy lif…

Zurich Life Insurance Reviews

Zurich Financial Services Group, commonly referred to as Zurich, was founded in 1872. Headquartered in Zurich, …

Saga Life Insurance Over 50 Reviews

Welcome to our Saga Life Insurance Over 50 Reviews. Many people over 50 are concerned about choosing the right life insu…

HSBC Life Insurance Review

Life insurance is an important financial product that can help provide financial security to your loved ones in the even…

Lloyds Bank Life Insurance Review

“Lloyds Bank is likely at the forefront of your search if you’re in the market for life insurance. But how does this maj…