Self-Employed Income Protection Insurance

Working as self-employed can be immensely rewarding if a business becomes successful and, with no employer or boss to report to, offers complete freedom.

If you cannot work, however, will you still be able to pay the bills and support yourself and your loved ones?

Self-employed income protection insurance provides a replacement salary until you can return to the workplace. An insurer offers this financial protection in return for receiving regular monthly premiums throughout the policy.

The Main Benefits Of Self Employed Income Protection Insurance:

Insurance Hero can help you find the most comprehensive and cost-effective income protection policies available.

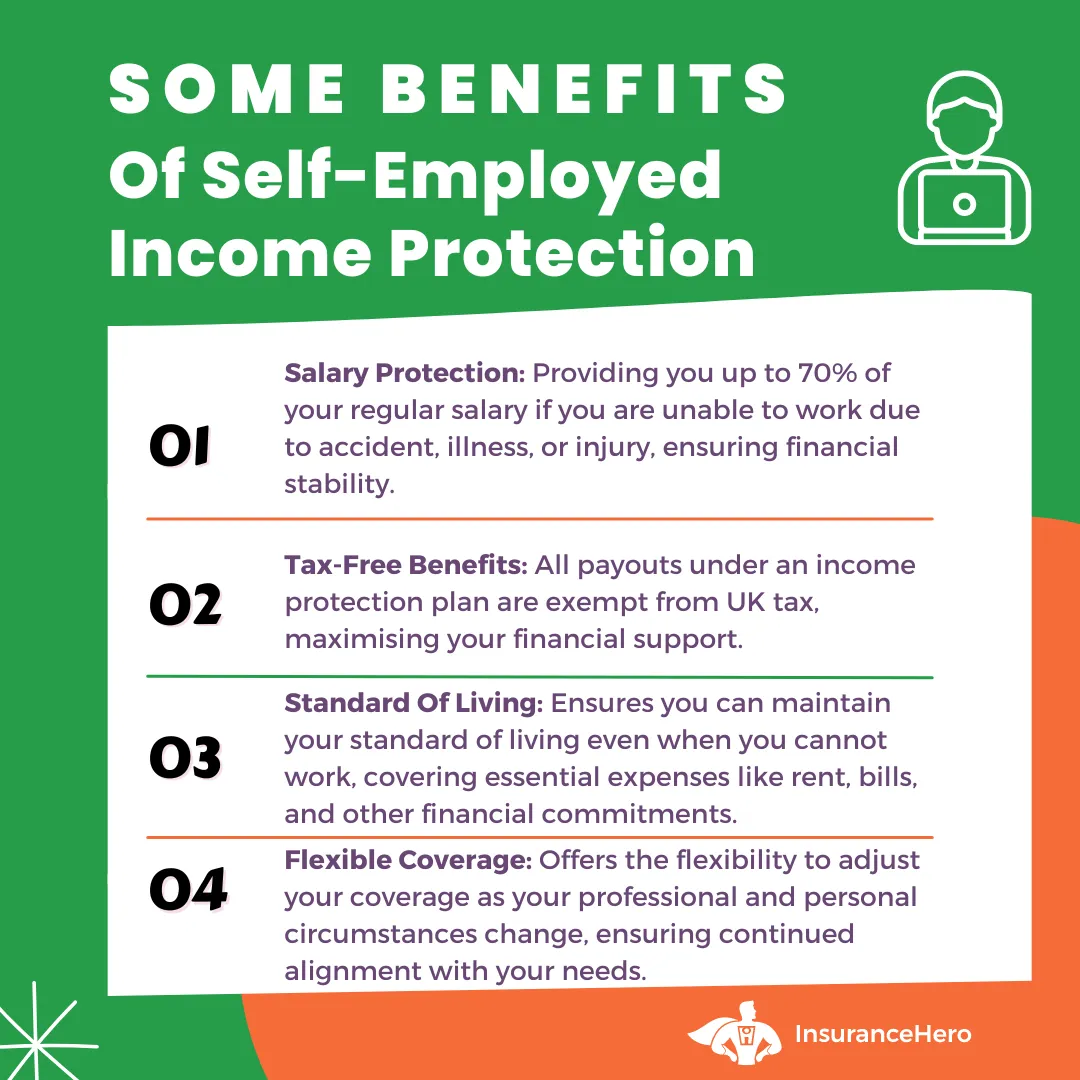

- Any payout received from an income protection policy is free of UK tax.

- An insurer will provide a replacement salary for up to 70% of pre-claim earnings.

- The wage from a plan will allow you to maintain your current lifestyle until you can return to the workplace.

- Income insurance plans are flexible and can be continually adjusted to align closely with your professional and personal circumstances.

- A policy can protect you financially until retirement if you can no longer return to the workplace.

- Prevents depletion of savings by providing a steady income during health-related work interruptions.

Maintain Your Current Lifestyle, Should You Fall Ill Or Suffer From An Injury – Quick Quote Form

Reasons to Consider Income Protection

Working as a self-employed person, whether through your own limited company or as a sole trader, means you are unlikely to have any financial fallback, such as a sickness policy offered by many businesses to their staff.

A well-run business may maintain an employee’s salary for up to 12 months if they are unable to work.

As a self-employed person, with no source of income when off work due to an accident or illness, you would be reliant on the government sickness benefit, which provides cover of around £100 a week for up to 28 weeks.

Unfortunately, this is nowhere near enough to live on week by week.

An income insurance plan will cover that shortfall in earnings until you can return to work.

What Affects the Cost of Income Protection?

Self-employed income protection insurance is calculated by underwriters using algorithmic models to determine the premium.

For an income insurance policy, the following factors will affect the cost of coverage:

- The length of the deferral period before a replacement salary is forthcoming.

- The length of the self-employed income protection insurance, and, if long-term cover, the retirement age

- Does the applicant have a history of adverse medical conditions? If yes, they may be required to pay more.

- How old is the applicant at the time of making an application for income protection?

- What level of cover requirements do you have as a percentage of your current salary?

- What is the applicant’s lifestyle? Is smoking, drinking alcohol, and no exercise playing a part? It affects your health and, as a result, the insurance cost.

- Is the job that the applicant undertakes considered a high-risk occupation? Remember that the nature of your profession can affect the insurance pricing.

- What is the likelihood that the applicant will be unable to work due to the type of job?

The Importance of Using an Independent Broker

There are strong reasons for employing the services of an independent insurance broker as opposed to taking insurance out directly with an insurer:

An independent broker is not affiliated with any particular insurer and can obtain quotes from multiple sources. This means they are not only providing you with the most competitive price but also offering a choice of policies that closely align with your specific needs.

A broker has extensive relationships with insurers and greater negotiating power due to the volume of policies they generate, resulting in lower premium quotes than an individual would receive directly.

Insurers tend to be generalists, offering a wide range of different insurance plans.

An independent broker is more likely to be an expert in a specific type of insurance, such as self-employed income protection insurance, allowing them to understand it deeply and help you make the right insurance decision aligned with your needs.

Insurance Hero is an Independent broker specialising in income protection, critical illness, and life insurance. Contact one of the expert team today on 0203 129 88 66 for a competitive, no-obligation quote.

Standard and Optional Features of An Income Protection Policy

An income insurance policy offers a range of standard and optional features. Not all insurers offer all of the optional elements of a plan, and so by highlighting them to you, if you think they apply to your circumstances, you can ask your broker or insurer whether they can be included.

Cease age

In insurance jargon, cease age means how old you will be when your policy ends. It is often set up to coincide with your retirement from the workplace. The later you retire, the more expensive the cover becomes.

Level of cover

The self-employed work as sole traders or as limited company directors.

Standard plans apply to sole traders and range from 60% to 70% of gross pre-claim salary, depending on the insurance coverage.

For those operating through a limited company, up to 80% coverage can be achieved through director income protection insurance, which we will explain in the next section.

Length of claims

The length of claims is the length of time that a replacement salary will be provided between when you make a claim under your plan and when you can return to the workplace. Short-term cover offers the option of between one and five years of salary protection.

The longer the payout period, the more expensive the premium. Long-term coverage is the most expensive option, as a replacement salary provides coverage until you can return to work or, if you cannot, until your retirement date.

The deferral-period

The period between your claim and the receipt of your replacement salary is known as the deferral period. The duration can be selected at the start of the insurance and is based on your professional and personal circumstances.

For self-employed people, if they cannot work, it is unlikely that a salary will be forthcoming from the business, so the deferred period could be triggered from the month after they cannot work, so there is no gap in salary.

Additional Features:

Childcare benefit

Childcare benefit pays out a fixed amount per child if you are unable to work. The top-up is designed to cover the cost of additional childcare, such as a childminder.

Policy pausing

Being self-employed, there may be times when you are not working. Income protection for self-employed people only pays out when you are working, and it makes sense to pause paying into a plan during periods of unemployment or inactivity.

Involuntary dismissal

Standard income protection does not cover job loss through involuntary dismissal. In some cases, insurers will allow this clause to be added to a plan. This option will make an insurance plan more expensive.

Death benefit

An additional feature is a death benefit. If you die while receiving income protection benefits, your dependents will receive a lump payout.

Indexation and premium options

A reputable insurance provider will provide several flexible cover options to tailor a policy to your circumstances. Indexation is the adjustment of the cost of cover over the life of an insurance policy:

Level cover means the replacement salary will stay the same whenever you claim throughout a fixed-term policy, meaning premiums will also remain the same.

Decreasing life coverage results in a steady reduction in any replacement salary over the fixed-term insurance, and depending on when you claim, the income benefit will be less.

Increasing life cover reflects the rise in the cost of coverage and the subsequent rise in salary to keep up with inflation in the UK, as measured by the retail price index (CPI).

Reviewable premiums mean an insurer can adjust the premium on your policy at any time, without warning. It is a cheaper cost option at the start of a plan.

Age-banded premiums rise as a policyholder reaches certain age milestones, such as a 45 to 54-year-old age bracket. The initial option is cheap, but the premium increases significantly over the plan duration.

Guaranteed premiums mean the cost of income protection cover stays the same for the plan’s duration, and the insurer cannot change it. This is a good option if the policyholder is young at the start of the insurance.

What Areas are covered?

The benefit of income protection for the self-employed is the provision of a replacement salary if you cannot work for a time.

A wide range of accidents, illnesses and injuries are covered under a policy, but areas also exist that may not be a consideration for coverage:

- When the abuse of drugs or alcohol results in you being unable to work

- Participation in high-risk personal activities such as extreme sports

- Being unable to work due to an incident overseas, which is not covered

- If you are expecting a child or childbirth

Pre-existing adverse medical history

Any pre-existing medical conditions developed within the last five years must be declared when a plan starts.

An insurer will deal with any medical concerns in the following ways:

- The medical condition is covered, but it will result in a higher premium

- The medical condition can be covered under the standard terms of the policy

- The medical issue is considered too severe and is excluded from the policy

Own or any occupation

If you are self-employed, when taking out income insurance, it is vital to grasp how an insurer defines your profession, as this will affect the cost of cover.

If you are unable to work, it can be classified in three ways:

- Inability to undertake any paid work

- Failure to do your actual job

- Inability to undertake your actual job or one that you are qualified to undertake

The most expensive type of cover is not being able to return to work unless you can do your specific role.

A proportionate payment is an additional feature that allows you to return to the workplace in lower-paid employment, with the insurance topping up your salary.

Director income protection insurance

Self-employed individuals who operate as sole traders can make use of a standard plan.

For those working through a limited company, taking out director income protection insurance is a more relevant solution, as all dividends and salaries are paid to self-employed individuals through their limited company.

This is set up in the company’s name, and the business pays the monthly insurance premium.

If a claim occurs, the replacement salary is treated as income. This differs from a personal plan, where the replacement salary is received tax-free because premiums are paid from post-tax income.

Insurance Hero is an expert in life insurance products, including income protection. Contact our friendly sales team on 0203 129 88 66 to find out how we can provide the perfect plan to ensure financial peace of mind.

ASU

An income insurance policy differs from an Accident, sickness and unemployment plan. ASU plans are a lower-cost option, and similar alternatives are unemployment protection and self-employed sickness insurance

These cheaper alternatives are similar to short-term income protection, as the claims period is less than five years. The key difference with an ASU is its pared-back medical underwriting component.

It provides less certainty than income protection cover if you put in a claim.

FAQs:

Are life insurance and income protection the same?

Self-employed life insurance pays out only if you die, with a lump-sum payment made to designated beneficiaries.

Income protection pays out a regular salary rather than a lump sum and does not depend on the policyholder’s death for payment to be made.

Is it possible to have more than one income insurance policy?

Most insurers will permit more than one policy to be in place. A typical clause, however, will limit the accumulated replacement salary to no more than 75% of your pre-claim earnings.

Is there a difference between critical illness and income protection?

Critical illness and income protection provide financial protection that does not depend on the policyholder’s dying (like life insurance).

They differ as critical illness provides a lump-sum payment and assumes the policyholder may never return to the workplace.

Income insurance with a regular replacement salary encourages the policyholder’s return to the workforce.

Related To This Topic:

Income Protection Insurance For Doctors

Income protection insurance for doctors plans work by providing a replacement salary if you cannot do your work due to a…

Joint Income Protection Insurance For Dual Income Couples

If you’re in a similar situation to 25% of couples with a dual income, you’ll never have even contemplated Income Pr…

Can You Get Group Income Protection Insurance?

Are you worried about how you’ll cope financially if illness or injury stops you working? In 2024 alone, insurer…

Income Protection Insurance For Vets

Being a vet can be a challenging yet immensely satisfying profession. Accidents and injuries can occur in the workpl…

Income Protection Insurance For Contractors

Do you worry about how you will pay the bills if you cannot work? Do you have loved ones who would suffer from financial…

How Much Does Income Protection Insurance Cost?

While most people aim for the maximum amount of cover for the minimum cost, the actual cost of income protection insuran…

Income Protection Insurance For Teachers Guide

Receive a monthly income for as long as you need if you are off work sick or physically injured – it is that simple. …

Does UK Income Protection Insurance Cover Maternity Costs?

If you’ve just learned that your family is about to grow, there’s a good chance you’re filled with both tremendous…

Does Income Protection Cover Redundancy?

When times are tough, when the economy turns downward, or when corporate profits demand a reduction in expenses, employe…

What Is Accident Sickness And Unemployment Insurance (ASU)?

When it comes to safeguarding your family and your future, two major transition points matter. The first is any …

Income Protection Insurance For Dentists

Are you a self-employed or an NHS dentist? Do you worry about what would happen financially to you and your loved ones s…

Resources we consulted to create this guide:

- https://adviser.royallondon.com/articles-and-guides/protection/income-protection-for-the-self-employed

- https://www.citizensadvice.org.uk/consumer/insurance/types-of-insurance/income-protection-insurance/

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.