Smart Life Insurance Reviews, What Buyers Should Know

Welcome to our newly updated Smart Life Insurance reviews guide. Smart Life Insurance offers people a range of flexible, straightforward life insurance policies designed to cover various eventualities.

What Type Of Life Cover Does Smart Insurance Provide in the United Kingdom?

Smart Insurance offers two different types of life insurance policies: Smart Guaranteed Life Insurance and standard life insurance.

Smart Insurance also provides people with personal accident insurance, designed for different circumstances, but gives the beneficiaries a lump sum payment should the policyholder pass away due to accidental death.

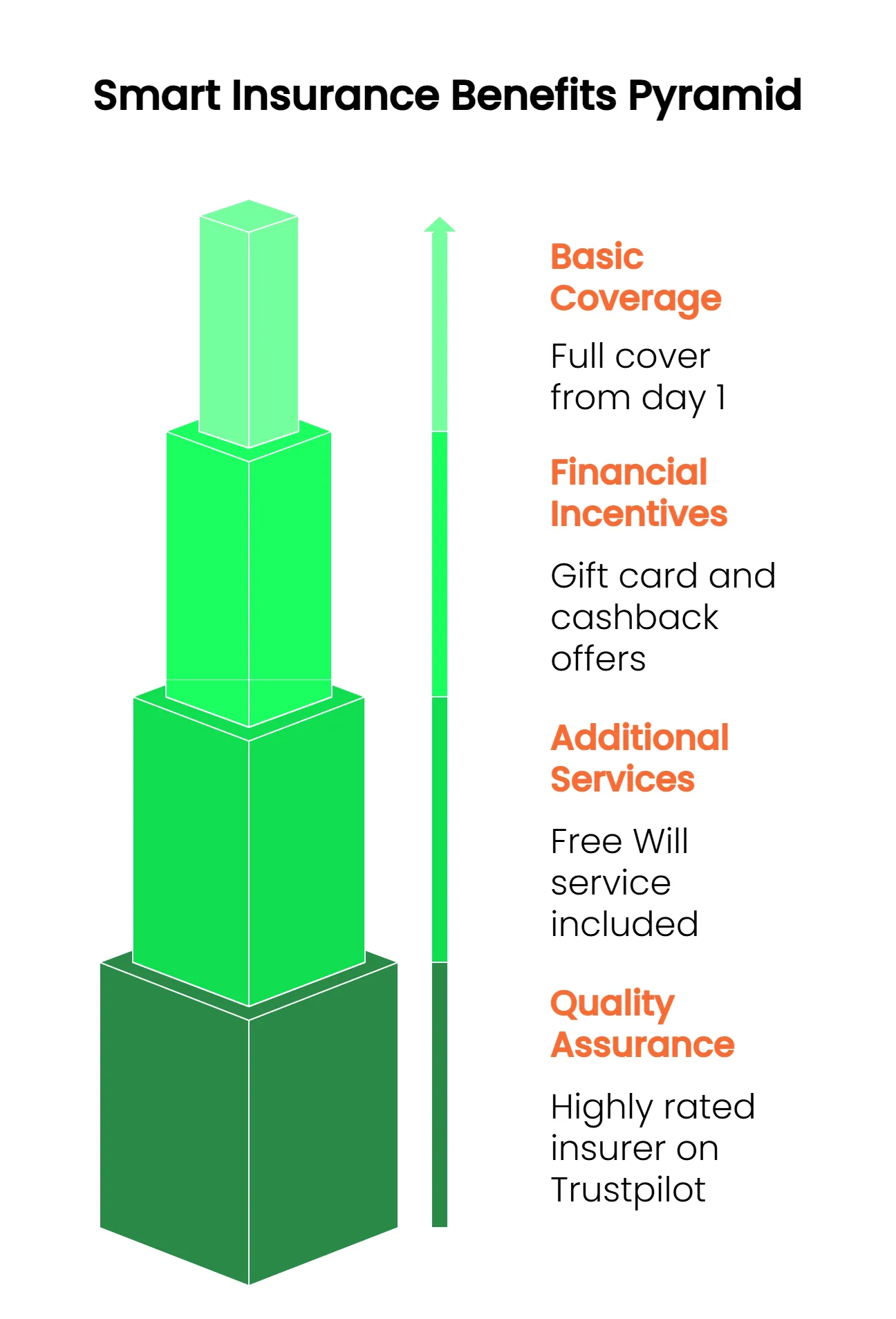

Smart Life Insurance Reviews: Key Benefits:

Here’s why you should consider them:

- Compared with the main rivals, they have fewer exclusions.

- Quick, hassle-free signup with no medical exams or complex forms; considered ideal for busy people or those with pre-existing conditions.

- Coverage is possible from day one, and includes full payouts for terminal illness to provide early financial support when you need it most.

- You can access 24/7 UK GP advice, mental health and nutrition services for you, your partner, and your children up to the age of 21.

See How Smart Insurance Plans Compare Against The Leading Life Insurance Companies – Quick Quote Form

Smartlife Insurance Review Data For Q1 2026

| Review Platform | Review Quality And Number |

|---|---|

| Trustpilot | 6,998 Reviews With An Overall Rating Of Excellent. |

| Feefo | 4,435 Reviews With An Overall Rating Of Exceptional And Service Rating Of 4.8/5. |

| SmartMoneyPeople | A Score Of 4.86 Out Of 5. Based on Only 27 Collected Reviews. |

| Fairer Finance | A claims score of 94.35% and an overall rating of 86.37% |

Overview Of The Smart Life Insurance Products

| Product | UK Life Insurance by Smart Insurance |

| Key Advantages of Smart Family Life Insurance | – Easy to understand – No medical tests or complex forms – Budget-friendly coverage starting at £14.77/month – Offers reassurance |

| – Provides up to £750,000 coverage based on age, along with 10% Smart Cashback | |

| – Assists in safeguarding your family’s economic stability | |

| How Does It Work? | – Offers monetary security in case of death or terminal illness |

| – Can be coupled with supplementary covers like Critical Illness cover or Children’s cover | |

| – Coverage amount is adjustable to suit individual needs and budget | |

| – Quick and easy policy acquisition over the phone | |

| Info on Coronavirus and Life Insurance | – Contact number: 0800 458 6901 |

| Policy Details | – New policyholders of Family Life Insurance are eligible for a £125 gift card after six successful monthly premiums |

| – Total paid premiums should surpass the gift card value | |

| Optional Coverage Types: | – Children’s Cover: Covers extra costs for medical expenses and school tuition in the case of defined serious injuries or illnesses |

| – Critical Illness Cover: Pays a benefit amount for specified serious illnesses such as cancer, heart attack, or stroke | |

| Premiums Criteria | – Payments vary based on personal conditions, age, and coverage amount |

| – Payments increase yearly based on age and coverage amount |

Without life insurance, how would you cover the following?

- Inheritance Tax when you pass away?

- Can cash gifts be provided to relatives or children?

- Mortgage payments and other critical financial commitments?

- Outstanding debts accrued in your name?

- Planning for funeral arrangements?

When compiling our Smart Life Insurance reviews, we discovered that the company was formed via a partnership between Scottish Friendly, a financial services group founded in the early 1860s, and Neilson Financial Services. This cooperation allowed Smart Life Insurance to offer the policies it offers today.

Policies such as life insurance are designed to help a family better cope with the loss of a loved one or primary earner.

You can get a quote here to see the options available through Smart Life Insurance.

Standard Life Insurance through Smart Insurance

Our smart life insurance review process revealed that a life insurance policy would pay a lump sum to help the policyholder’s family continue paying their living expenses, such as bills, mortgages, groceries, and other costs.

This life insurance coverage is available to individuals between 18 and 64. It can help grieving family members receive up to £750,000 (depending on the applicant’s age).

Smart Insurance does not require any medical tests and coverage for accidental death by any cause.

Smart Insurance offers two coverage options: clients can opt for a level policy, where premiums are fixed for the term chosen, up to 40 years, or an age-based policy, where premiums increase with the policyholder’s age.

The age-based policy will also include an automatic 5% increase in the benefit amount each year for 10 years, and the client can add critical illness and children’s coverage.

Guaranteed Life Insurance

Smart Insurance also offers guaranteed life insurance. This policy helps family members pay for funeral costs and final expenses.

The last payment from a general life insurance policy is lower than that for a guaranteed insurance policy.

These types of life insurance policies are available in the United Kingdom for individuals aged 30 to 79, providing coverage of £3,000 to £15,000 (depending on age).

It is important to note that a payout is possible for any cause of death after the first year of the policy, but accidental death is covered from day one of the policy.

This type of plan also includes an automatic five per cent increase in the number of benefits every year, which is applied on the policy’s anniversary for ten consecutive years or until the policyholder turns 74, whichever occurs first.

Policyholders with this policy can also add severe accidental injury coverage.

Personal Accident Insurance

Smart Insurance offers clients a personal accident insurance product in addition to the two types of life insurance.

This type of policy differs from the two outlined above because it covers a broader variety of events, not only accidental ones.

Some of the events covered under a personal accident insurance product include serious accidental injury and accidental death. Still, individuals will not be covered for death by any cause, only in the event of an accident.

This personal accident insurance product is available to residents of the United Kingdom between the ages of 18 and 69 and offers between £35,000 and £500,000 of coverage.

Additionally, this plan provides an automatic 5 per cent increase in the policyholder’s benefits each year for 10 consecutive years from the policy’s inception.

Policyholders can also add coverage for children to their accident insurance product if they wish.

What are the Acceptance Criteria?

Smart Insurance accepts a broad range of ages when applying for life insurance or personal accident insurance.

Additionally, for the life insurance products it offers, Smart Insurance does not require any medical exams or blood tests to determine eligibility or premium pricing.

Smart Insurance asks applicants some basic lifestyle questions, as well as easy health questions they can answer on their own.

For the guaranteed life insurance policy, acceptance is precisely how the name makes it sound – guaranteed for individuals between the ages of 30 and 79 years old.

Applicants within this age range will also not be asked any health-related questions.

For the personal accident insurance product, acceptance for coverage is guaranteed for applicants aged 18 to 69, and it will not include any health-related questions.

How Much Do Policies from Smart Insurance Cost?

The final cost of a Smart Insurance policy will depend on factors unique to each applicant. Some examples include the applicant’s age, health, and the amount of coverage they seek.

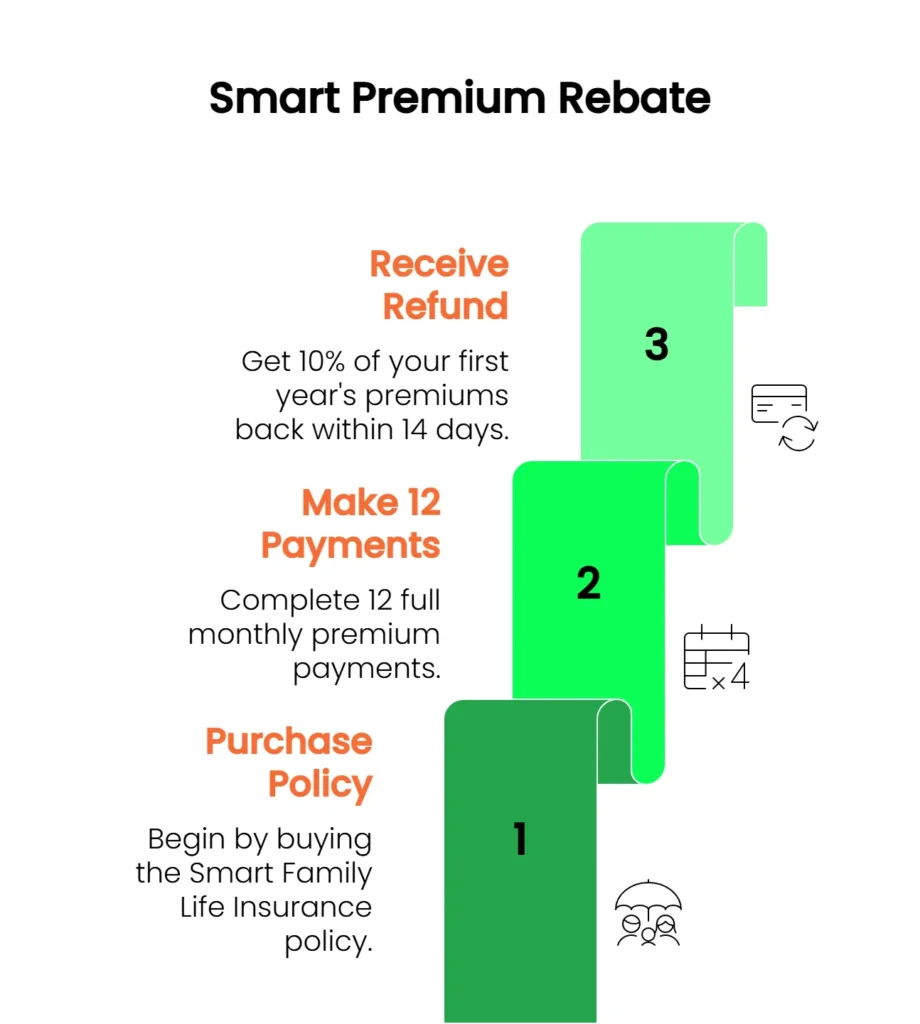

All policies include a “Smart Cashback” element, allowing applicants to earn 10 per cent of the premiums they have already paid back.

We hope you found our smart life insurance review helpful. Please remember we are always available to answer any questions regarding bespoke life insurance for you and your family.

Smart Life Insurance Over 50

Although Smart Insurance no longer provides a dedicated over-50s guaranteed life plan, people aged 50 and over can still apply for their standard life insurance options.

Smart’s family life insurance can be taken out up to the age of 64. If you decide on an age-based policy, you could maintain coverage for life, similar to a traditional over-50s plan, though your premiums would rise each year.

Typically, a standard over 50s life insurance policy ensures UK residents aged 50–85 are accepted without having to share medical details.

Once activated, coverage continues for the rest of your life, guaranteeing a payout to your loved ones.

At Insurance Hero, we offer guaranteed acceptance over-50s life insurance policies for people in the UK aged 50 to 85.

Smart Life Insurance Review Conclusion

So, do you need life insurance? The answer is it depends. But there’s no harm in completing one of our simple forms to receive a no-obligation quote and find out for sure.

After all, the peace of mind that comes with knowing you and your loved ones are financially secure is priceless.

Alternatively, you can read our examples of life insurance companies offering great deals on whole, term, over 50’s and critical illness cover.

Details For This Company:

Smart Insurance is a subsidiary of Neilson Financial Services Limited.

- All products are organised by Smart Insurance and issued, underwritten, and administered by Scottish Friendly Assurance Society Limited.

- Scottish Friendly Assurance Society Limited is authorised by the Prudential Regulation Authority (PRA) and regulated by the FCA and the PRA.

- Scottish Friendly Assurance Society Limited is listed under the PRA and FCA as 110002.

Smart Insurance

PO Box 4555,

Slough,

Berkshire,

SL1 1JL

https://www.smartinsurance.co.uk/

Financial Services Register reference 594926

Open Monday to Friday, 9:00 am to 8:00 pm

Telephone: 0800 977 6023

AA Life Insurance UK Cover Review

Various life insurance products are available, including level term, decreasing term, and 50-plus. AA life insu…

AEGON Life Insurance Reviews – Compare Quotes

If you want to provide financially for surviving loved ones upon death, AEGON life coverage may be the solution. …

AIG Life Insurance UK Reviews

AIG (American International Group) is synonymous with the insurance industry. AIG is a multinational insurer fo…

ASDA Life Insurance Cover Reviews

ASDA Financial Services offers travel, home, motorist, pet, life insurance, personal loans, trade, gift, and credit card…

Aviva Life Insurance Review – Cover From £5 Per Month

Aviva is the largest UK insurance services provider and the fifth largest insurance group, with more than 45 million cus…

Axa Life Insurance Cover Review

The AXA Group has been in the insurance business since the 18th century. Acquisitions, mergers, and name changes for lea…

Barclays Life Insurance Review

Barclays PLC is a major financial services company backed by more than 300 years of history. Welcome to our new…

British Seniors Over 50 Life Insurance Reviews

Find out about British Seniors Over 50 Life Insurance Reviews, Customer Experience, and Policies Available. Abou…

Direct Line Life Insurance For Over 50’s Review

Direct Line is a household name for insurance products. At the outset, their core offering was vehicle insurance with a …

Ageas Protect Life Insurance Review

Fortis Life is now Ageas Protect, the financial protection arm of Ageas within the UK. The company offers produ…

Friends Life Life Insurance Reviews

Since 1810, Friends Life has been providing financial services. Founded in Yorkshire as Friends Provident in 1832, the c…

LV Life Insurance Reviews

In 2007, Liverpool Victoria rebranded their company name to use LV=. The LV= brand is a visual play on the word…

Nationwide Life Insurance Reviews And Cover

Nationwide Building Society offers insurance, banking, investment, loan, credit card, and mortgage services to residents…

NatWest Life Insurance Review From £5.46 Per Month

Welcome to our newly updated 2026 Natwest life insurance reviews page National Provincial Bank was established i…

One Family Over 50s Life Insurance Reviews

One Family over 50s life insurance offers UK residents aged 50 to 80 a straightforward way to take out life insurance co…

Post Office Life Insurance Review

Welcome to our Post Office life insurance review. In the United States, the Post Office is where residents mail letters …

Prudential Life Insurance UK Reviews

The international financial services group Prudential plc serves over 25 million customers and manages approximately £3…

Royal London Life Insurance Reviews

Royal London is the largest mutual life and pensions company in the UK. It comprises several specialist businesses desig…

Scottish Provident Life Insurance Review

Scottish Mutual Assurance Limited provides healthcare and protection products under the brand name Scottish Provident. …

Scottish Widows Life Insurance Reviews

Scottish Widows is a nationally recognised financial services provider that has served families with financial protectio…

Shepherds Friendly Over 50s Life Insurance Review

The Shepherds Friendly Society is one of the longest-running insurers in the world. In 1826, they began by establishi…

The Exeter Life Insurance Reviews

Do you have pre-existing medical conditions? Do you want to put in place a robust life insurance policy that will provid…

Virgin Money Life Insurance Review

Virgin Life Insurance is one of the over 400 companies in Virgin Group Limited, the British-branded venture capital cong…

Vitality Life Insurance Review – Should You Buy?

Vitality Life takes a more active role than most insurance providers do by helping people to live active and healthy lif…

Zurich Life Insurance Reviews

Zurich Financial Services Group, commonly referred to as Zurich, was founded in 1872. Headquartered in Zurich, …

Saga Life Insurance Over 50 Reviews

Welcome to our Saga Life Insurance Over 50 Reviews. Many people over 50 are concerned about choosing the right life insu…

HSBC Life Insurance Review

Life insurance is an important financial product that can help provide financial security to your loved ones in the even…

Lloyds Bank Life Insurance Review

“Lloyds Bank is likely at the forefront of your search if you’re in the market for life insurance. But how does this maj…