Income Protection Insurance For Vets

Being a vet can be a challenging yet immensely satisfying profession.

Accidents and injuries can occur in the workplace; however, if you are unable to work for a time, it can put financial pressure on you to continue paying rent and bills.

What Is Income Protection Insurance for Vets?

Income protection for vets is financial protection that provides a replacement salary if you cannot return to the workplace due to an accident or injury.

The size of a regular monthly premium paid to an insurer will correlate to the size of the income benefit.

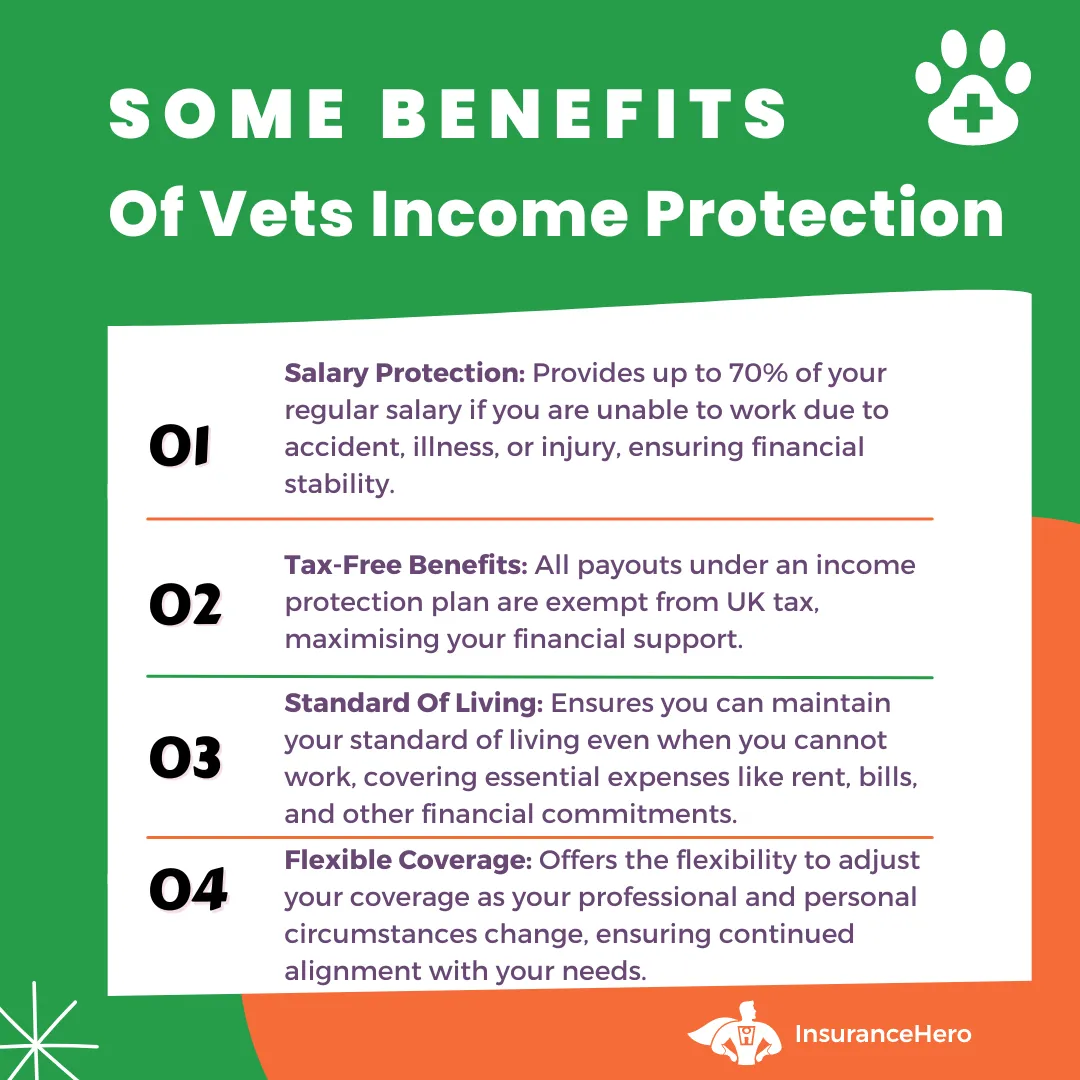

The Main Benefits Of Veterinary Income Protection:

- You can protect yourself with up to 70% of your regular salary by getting cover with a replacement wage should you be unable to work due to accident, illness, or injury.

- Income protection for vets is a flexible insurance that can be adjusted on an ongoing basis to meet the ever-changing needs of your professional and personal life.

- Receiving a replacement salary allows you to maintain your standard of living even when you are unable to work.

- All benefits paid out under an income plan are free of UK tax.

Income Protection Insurance From Top UK Companies. Quick Form. Start The Process Online

Why Do Vets Need Income Protection?

Being a vet is a complex and varied occupation, and, combined with specific workplace risks, it can result in a vet being off work for a sustained period if accidents occur.

There are four key risks involved in working as a veterinarian:

Injuries inflicted by animals

Small animals bite and scratch, which can lead to infections, and large animals, such as horses, have powerful kicks that can inflict serious injuries.

Before an animal undergoes anaesthesia, its reaction to a different environment, such as a vet’s surgery, can be unpredictable, potentially harming the vet.

Musculoskeletal injury

Working as a vet can be physically demanding, and wear and tear on the body can lead to absences from the workplace.

Animals can be cumbersome, and those under the influence of a general anaesthetic are like a dead weight. Improper lifting, bending, and prolonged standing during operations can take a toll on a veterinarian.

The US National Library of Medicine conducted a 2012 study that found 93% of vets reported some kind of injury in the preceding 5 years, including improper posture, which can lead to musculoskeletal problems such as muscle spasms, ruptured discs, and spinal alignment issues.

Dangerous hazards

Exposure to X-rays and chemical hazards is an occupational risk for veterinarians. Accidental exposure to X-rays can lead to an increase in cancer types and burns to the skin and eyes.

Chemical hazards are an ever-present danger that a vet must manage carefully. Dangerous drugs, anaesthetic gases, and disinfectants all pose risks to human health, and complications can arise if a vet has had extensive exposure.

Diseases

Exposure to disease-causing pathogens is a daily concern for veterinarians. An accidental prick from a needle contaminated with animal blood, rabies risk from an animal bite or other ailments are all risks that a vet faces in the workplace.

Protect Your Income Today. No Obligation To Purchase. Vets Income Protection

Is Income Cover Appropriate for Your Circumstances?

The importance of income protection as insurance and whether it is relevant for you relates closely to your circumstances.

If you cannot do your job for an extended period, important considerations include the following:

Savings

Without a regular salary, how long will savings sustain you or your family’s lifestyle should you be unable to work? Perhaps three months or six months?

What happens if you sustain serious injuries resulting from a workplace accident and cannot work for a year?

Financial commitments

Whether you are single or have dependents, there will be economic consequences if you are unable to work.

Mortgage or rent payments, personal loans, household bills and school fees all still need to be paid if you are not working.

Work considerations

Depending on how you work as a vet, your circumstances will dictate what you can do should you be unable to work. A self-employed vet may have different requirements than a vet working as an employee at a veterinary practice.

Self-employed vets

A self-employed vet or locum vet working at a practice will not have the comfort of receiving an ongoing salary from a method should they be unable to work.

Similarly, a vet who is the owner of the practice and operates the business as a limited company will have to consider income insurance in their capacity as a company director.

Veterinarians working as employees

If you work as an employee at a practice, it is essential to look at your work contract to see how long you will continue to be paid if you are unable to work due to an occupational illness, accident or injury.

For example, your employer may cover your salary for up to six months if you are unable to work.

However, what will happen after those six months are up, and you are still unable to return to the workplace?

The UK government only pays out a maximum of 28 weeks in sickness benefits, less than £100 a week. In comparison, a plan that covers up to 70% of your salary is a substantial financial safety net.

What Are the Different Elements of an Income Protection Policy?

Income protection is not complicated insurance. It is essential, though, that you use a broker that specialises in insurance for vets and understands the intricacies of the profession.

It is vital that coverage is set up correctly at the beginning and that the plan closely aligns with your day-to-day professional activities, so it pays out when you need it most.

There are several elements to a plan that you should be aware of:

Sum assured

At the start of the insurance, you decide how much of your monthly salary you want to receive if you cannot work. The higher the percentage, the higher the cost of coverage.

Most insurers will not cover you for more than 70% of your actual salary. The intention of a policy is to support you until you can return to the workplace and encourage you to do so, which may be less of an incentive if you are receiving your full salary.

Cease age

Cease age is the age you will be when the plan ceases to provide coverage. It is common practice to align a plan with your retirement date. The older you leave it to retire, the higher the cost of cover.

Deferred period

A vital element of income protection insurance for vets, the deferred period is the gap between when a claim is made and when a replacement salary begins.

The length of the deferred period will closely align with the terms of any employment contract. If you are self-employed, the deferred period might need to start from the next month’s salary, whereas an employer may cover an employee for three months before salary payments stop.

Fixed or variable benefits

You can choose whether your policy changes with your professional or personal circumstances or remains the same.

For example, if a mortgage is paid off and there is no rent to pay, a decreasing cover policy may be suitable for your situation.

Length of the claims period

Two types of policy lengths are available under an income insurance plan:

Short-term cover: This is the limit on how long a payout can last if you are unable to work, typically 1 to 5 years. It is a cheaper option than long-term cover.

Long-term cover: A more costly type of coverage that provides you with a monthly salary until you can return to the workplace or, if you are unable to go back to work, until your retirement date.

Optional Features Available With Vets Income Protection

We have highlighted the core features available with an income protection policy. Several additional cover options exist that you should be aware of, but their availability may depend on the plan:

Death benefit

If you have successfully claimed a payout and are receiving a replacement salary, a death benefit option will provide your dependents with a lump sum payout should you die during this time.

Childcare benefits

If you are unable to work, a childcare benefit will provide a fixed monthly amount per child until you can return to the workplace. For example, the benefit can cover additional childcare expenses.

Policy freezing or pausing

An insurance plan will not pay out if you are not employed, and should there be an accident, injury, or illness. If unemployed, it is advisable to pause your insurance until you find a new job.

Involuntary redundancy

Sometimes, it can be an option to include involuntary redundancy or dismissal as an extra feature on a plan. A layoff is not covered under a standard plan, and you would not receive a payout.

Specified injury or trauma

An additional payout may be due if specific injuries or trauma are listed individually in the policy definitions.

The extra payout can be either a lump sum or a top-up of the replacement salary received following a successful claim.

How Can Insurance Hero Help?

Insurance Hero is an independent broker that specialises in providing income cover for Vets and other medical professionals. We work with a network of underwriters who are experts in the intricacies of working as a vet.

With our thorough fact-finding questionnaire, rest assured, we will understand the full extent of your daily vet activities.

This will ensure a quote is competitive and closely aligns with your circumstances, meaning your policy will pay out when you need it most.

What is Covered and Not Covered Under Income Protection?

If you are a vet, income protection pays out if you successfully submit a claim confirming that you cannot work due to an illness or accident.

An income insurance plan is not absolute financial security, and not everything is covered, so it is essential to discuss with your broker what is in your insurance plan at the start.

Different underwriters will classify being unable to do your job differently and quote accordingly.

There are three factors:

- Inability to carry out your exact job role

- Inability to do your job role and a similar job you are qualified to undertake.

- Inability to do any type of paid role

The most expensive type of cover is if you are unable to work and perform your exact job role, compared to cover for not being able to do any job.

A job-specific policy will pay out a proportionate payment if you return to full-time employment, but in a less well-paid role.

Scenarios that are not covered

Income insurance will not pay out should you be unable to work due to any of the four following reasons:

- Pregnancy or childbirth

- Accident or illness from undertaking hazardous activities or dangerous sports that are not on an approved list within the plan definitions

- Drug or alcohol addiction is stopping you from doing your job

- If pre-existing medical conditions prevent you from doing your job

Insurance Hero is an independent insurance broker expert in providing income insurance for vets. Contact us on 0203 129 88 66 to find out how our professional team can provide the financial protection you deserve.

FAQs

My circumstances are changing. How flexible is a veterinary income protection policy?

Income protection insurance for vets is perhaps the most flexible type of insurance. Professional circumstances may include salary increases or the purchase of a practice.

A plan will allow for the continual adjustment of cover levels to ensure they remain aligned with your current situation.

Can any vet apply for income protection?

Any vet can apply for a plan, but the criteria must include the following:

- You must be no older than 63 years old when submitting a new application.

- You must be aged 16 or above.

- A holder of a current UK bank or building society account

- You are currently paying UK tax.

- Registered with a UK medical practice for at least three years

Can I claim for more than one policy?

It is possible to claim for more than one plan as long as the total of all the insurance plans does not make up more than 75% of your regular salary received preceding a claim.

What Does the Vet Community Say About Income Protection?

UK vets increasingly recognise income protection as a vital part of long-term financial planning, especially in a profession with high physical and mental demands.

Testimonials from Vets

“I never thought I’d be off work for more than a few weeks, but a back injury during a large animal call-out kept me out for six months. Income protection meant I didn’t have to worry about money while I focused on recovery.”

— Dr Lisa H., Equine Vet, West Midlands

“As a locum vet, I don’t get sick pay, so having income cover has given me real peace of mind. It’s one less thing to stress about in a high-pressure job.”

— Sam R., Small Animal Locum, London

Survey Insight

A recent survey by the British Veterinary Association (BVA)* found that 62% of self-employed vets had no formal income protection plan in place, despite over 70% being concerned about the financial impact of long-term illness or injury.

Alternatives to Income Protection

While income protection is a comprehensive safety net for vets, there are alternative insurance options worth considering:

Critical Illness Cover

This policy pays out a one-off lump sum if you’re diagnosed with a serious condition listed in the policy, such as cancer, stroke, or heart disease.

However, it does not provide ongoing monthly income, and you must meet strict medical definitions to qualify for a payout.

Accident-Only Cover

This is a lower-cost option that pays out if you are injured in an accident and are unable to work.

It typically excludes illness-related claims, which can be limiting for vets, as many absences are due to illness or wear-and-tear injuries rather than sudden accidents.

For most veterinarians, income protection offers the broadest and most reliable financial support when they are unable to work.

Other income protection products:

Joint Income Protection Insurance For Dual Income Couples

If you’re in a similar situation to 25% of couples with a dual income, you’ll never have even contemplated Income Pr…

Can You Get Group Income Protection Insurance?

Are you worried about how you’ll cope financially if illness or injury stops you working? In 2024 alone, insurer…

Income Protection Insurance For Contractors

Do you worry about how you will pay the bills if you cannot work? Do you have loved ones who would suffer from financial…

Does UK Income Protection Insurance Cover Maternity Costs?

If you’ve just learned that your family is about to grow, there’s a good chance you’re filled with both tremendous…

What Is Accident Sickness And Unemployment Insurance (ASU)?

When it comes to safeguarding your family and your future, two major transition points matter. The first is any …

Income Protection Insurance For Dentists

Are you a self-employed or an NHS dentist? Do you worry about what would happen financially to you and your loved ones s…

Income Protection Insurance For Teachers Guide

Receive a monthly income for as long as you need if you are off work sick or physically injured – it is that simple. …

Income Protection Insurance For Doctors

Income protection insurance for doctors plans work by providing a replacement salary if you cannot do your work due to a…

Income Protection Insurance For Social Workers

Social Workers’ Income protection insurance can cover 60-70% of a social worker’s monthly income. This provides a tax-fr…

External Resources:

- https://www.bsava.com/resources/resources-for-practice

- https://www.rcvs.org.uk/news-and-views/publications/the-2019-survey-of-the-veterinary-profession

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.