HIV Life Insurance, Can I Get Cover In 2026?

Many people think life insurance is unavailable to those suffering from HIV. The good news is that getting life insurance cover is still possible.

Due to advancements in medical treatment and improvements in underwriting practices, people with HIV can now qualify for life insurance at standard rates.

The cover might be slightly higher than that of non-sufferers, but a competitive solution is within reach.

Life Insurance Cover With HIV In Summary:

This page, compiled by our specialists in medical life insurance, provides the latest insights on purchasing life insurance for men and women with HIV.

We regularly evaluate the available policies and pricing in the UK to ensure you receive accurate advice and reliable support.

Here’s why it’s worth considering:

- Peace of Mind: Securing coverage through mainstream providers or non-specialist brokers can be challenging. This is why consulting a medical life insurance expert like Insurance Hero is crucial.

- Application Process: Applying for life insurance with HIV should not cause any concern. You can consult with our team with complete confidentiality.

- Bespoke Insurers: We work with select insurers to ensure your HIV status remains confidential from your GP if needed. It’s crucial to match your application with the right insurer.

Compare Life Insurance Quotes For People Living With HIV

Example HIV Life Insurance Cost

| Details Of Applicant | Description Of Case |

|---|---|

| Applicant | Mr S, born in 1973, who is a non-smoker |

| Health Details | Diagnosed with HIV, CD4 of 610, undetectable viral load |

| Treatment | Regular HAART treatments |

| Other Health Info | Height: 5’9”, Weight: 98kg |

| Cover Requirements | £165,000 decreasing life coverage for 22 years |

| Premium | £20.423 per month with guaranteed premiums |

Factors Affecting Costs

- Health Details: Factors such as CD4 count, viral load, and overall health status determine premiums.

- Lifestyle Choices: Smoking, alcohol consumption, and occupation can impact rates.

- Provider Specialisation: Using a medical life insurance expert often leads to better terms and lower costs.

Tips to Reduce Costs

- Apply when your health metrics are stable.

- Work with providers such as Insurance Hero, specialising in HIV life insurance.

The Association of British Insurers (ABI) has worked with leading charities in their field to produce a new Guide to Life Insurance for Those Living with HIV.

While the number of new cases has stabilised somewhat, so has an awareness of more people being tested, leading to diagnoses.

The organisations consulted were:

- HIV Scotland

- NAM Aidsmap

- National Aids Trust

- Terrence Higgins Trust

- Unusual Risks Mortgage & Insurance Services

Support and advice can be sought from any of the organisations listed above.

Life Insurance Policy For HIV Positive: Clarity of Cover

In 2025, there were approximately 105,000 cases of people infected with HIV, of which 27% of those were unaware they had the condition.

The ABI created the guide to insurance for HIV due to a widespread belief that if you’re diagnosed with HIV, you can’t get life insurance cover.

Many people who already had life insurance cancelled their policy immediately following their diagnosis because they believed it would invalidate the policy. That couldn’t be further from the truth.

As it turns out…

If you already have HIV life insurance, you don’t need to tell your insurer that you’re diagnosed with HIV.

Your policy will protect you if you’re already insured before a diagnosis. Only when you have cause to believe you have a medical condition and don’t disclose that during the application process for your life insurance will it be invalidated.

Factors to consider

| Factor | Description |

|---|---|

| Diagnosis Date | When were you diagnosed with HIV? |

| CD4 Count and Viral Load | Current CD4 count and viral load status |

| HIV Detectability | Is your HIV undetectable? |

| Drug Use History | Any history of drug use |

| HIV Treatments | Details of HIV treatments being received |

| Related Medical Conditions | The Presence of conditions like hepatitis |

| Smoking Status | Whether you are a smoker or a non-smoker |

HIV and Life Insurance FAQs

| Question | Answer |

|---|---|

| Life Expectancy with HIV | Significantly improved with HAART, potentially up to 70 years |

| HIV Coverage by Insurance | Varies by the provider, with many offering fair terms and pricing |

| Requirement of HIV Test | It depends on individual cases and the insurer’s policy |

| Impact of HIV on Existing Policy | There is no need to inform the insurer if diagnosed after buying the policy |

| Critical Illness Coverage | Most policies pay out upon HIV diagnosis |

HIV is treated the same as any other medical condition by insurers

Assessing the level of risk for HIV

The Consumer Insurance Act 2013 was introduced to clarify the information insurers must disclose to consumers.

One of the main changes was the move away from consumer voluntary disclosure and, instead, placing the burden on insurers to ask the right questions to obtain relevant information about people’s medical situations.

Therefore, honesty is imperative when answering questions on the phone, on paper, or in an online application.

Insurers will use your responses alongside statistical data from other sources to determine a level of risk and offer HIV life insurance cover based on that, or decline the cover if they feel the risk is too high.

You will not be denied life insurance just because of an HIV diagnosis. If there is a denial, it’ll be due to a high level of risk. However, that could be six to twelve months after your application.

Statistical data is reports, polls, studies, and medical research that indicate the groups of people at risk of HIV. An example of this type of data is these findings reported by Avert.

3 Levels of HIV Risk Categories

- Men who have sex with men (MSM). This has been the highest risk category for decades and continues to be today, with an estimated 45,000 cases of infections being those in the MSM category.

- The highest prevalence of new cases (MSM) in 2014 was among those aged 25 -44. Six per cent were over 55, and 55% of new diagnoses were in the London area.

- 81% of new MSM diagnoses were white

- 2% Black African

- 2% Black Caribbean

- 14% described as other/mixed race.

- 60% were born in the UK.

The second-largest risk category is Black African heterosexual males and females. Of the newly diagnosed cases of HIV, 55% were Black African heterosexual men, and 62% were heterosexual women.

A third risk category is drug users or People Who Inject Drugs (PWID). This is the lowest risk category, with stats from 2024 indicating just 150 cases total of new diagnoses due to sharing needles.

While it is a low-risk category, it will still be a risk factor when assessing your life cover risk level.

This will include reformed drug users who have used drugs in the past. Insurers will usually ask if there’s any history of substance abuse; if there is, they are made aware of it due to it being a risk that could void your claim if it’s not declared.

HIV screening and HIV life insurance

Insurers can use a range of screening tests to adequately assess risk and quote appropriately. One of the ways they do this for HIV is to have you take an HIV test.

Your family doctor will do this, the results will be treated with the strictest confidence, and the insurer will cover the cost.

You will be asked to grant the insurance firm access to your medical records, which will also involve sharing the results of an HIV test with them.

There’s no obligation for an insurance company to notify you of a negative test. If you test positive, your doctor will work with you to discuss available treatment options.

Your HIV life insurance application may be put on hold for six to twelve months. The aim of this is to establish how you respond to treatment.

This won’t always happen, as an insurer could give a quote based on a pre-existing medical condition. However, some may want to wait to assess how you respond to the treatment to get a better indicator of your risk level.

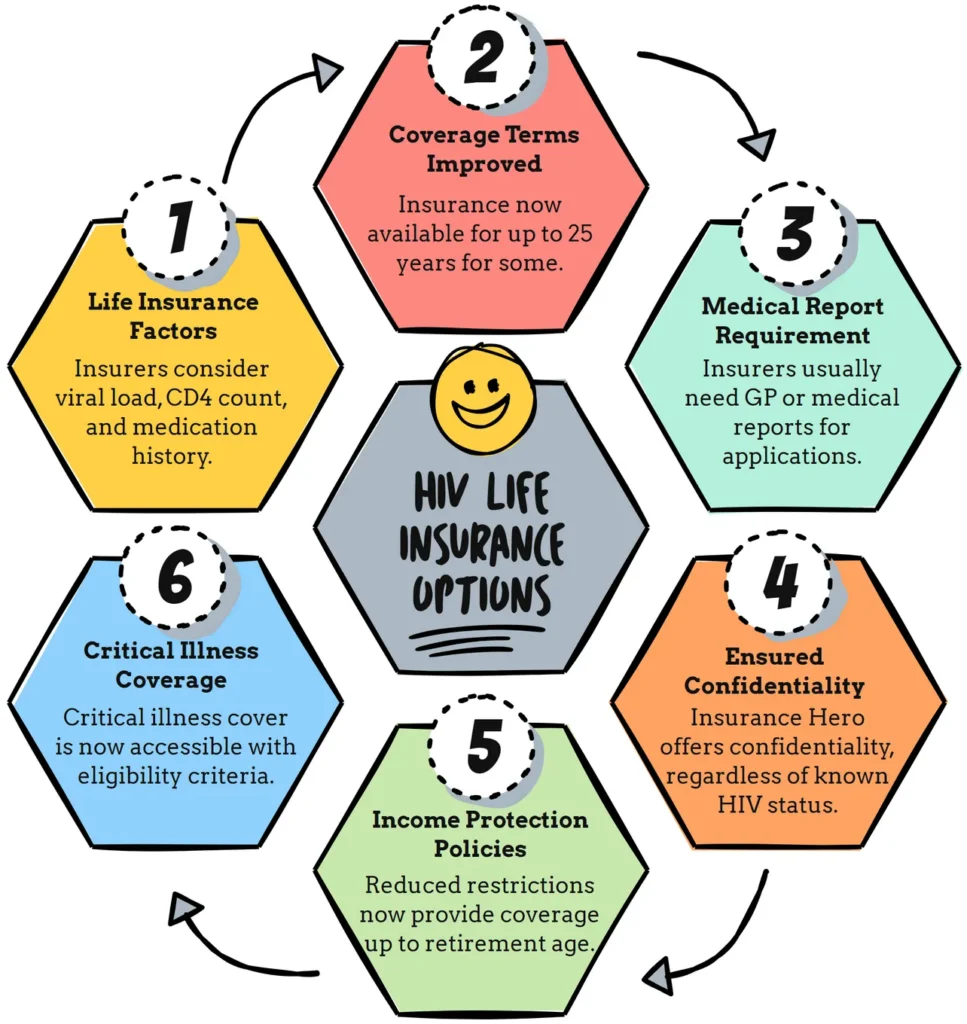

Life Insurance Options for HIV Positive People in the UK

A few different types of life insurance are available to people with HIV. These are:

Term Life Insurance

One of the most common types of life insurance is term life insurance. It provides financial protection for a set period, typically 10-20 years, though some insurance companies offer up to 40 years.

If you die during the policy term, the death benefit will be paid to your beneficiaries.

You can opt for level term insurance, where the death benefit and premiums stay the same for the duration of the policy, or decreasing term insurance, where the death benefit decreases over time. Still, the life insurance premiums stay the same.

In the past, HIV-positive people only had the option of a 10-year term life insurance policy.

Nowadays, medical advancements and changes in the underwriting process have meant that people with HIV can get the same coverage as those without the virus.

However, this will depend on factors such as the stage of your HIV, your CD4 count, and whether you have any other pre-existing medical conditions.

Whole Life Insurance

Whole life insurance offers lifelong coverage. Unlike term life insurance, which only covers you for a set period, whole life insurance remains in place as long as you continue to pay your premiums.

HIV-positive people can get whole life insurance, but it is more expensive than term life insurance. As with term life, the insurance company will determine the level of risk you pose to determine if they can offer you coverage.

Over Fifties Life Insurance

Over-50s life insurance is designed for UK residents aged 50 to 85. This type of policy has the significant benefit of not usually requiring a medical examination for approval.

This makes it a convenient option for HIV positive applicants to secure life insurance without disclosing their status.

The downside to over 50’s life insurance is a waiting period of up to two years before the death benefit is paid out. If you die within this period, your beneficiaries will not receive anything.

Group Life Insurance

You may be entitled to death-in-service benefits as part of your employment contract. These benefits are typically paid out as a lump sum to your beneficiaries in the event of your death while employed.

In most cases, your employer’s group life insurance policies provide death in service benefit. In short, you should still be covered for HIV if you work for a company that offers Group Life Insurance.

Business Life Insurance

Protects a business from the financial impact of losing a key member.

Application Process for Life Insurance

The life insurance application process can vary by company, but some general steps are typically followed.

You must complete an application form after selecting a life insurance policy. This form will ask about your medical history and current health status.

HIV-positive applicants will undergo a medical exam, which may include tests to determine the current CD4 count and viral load.

The insurer will also want to know when the applicant was first diagnosed with HIV, their history of Hepatitis B or Hepatitis C, and their drug use. The insurance company will use this information to assess the premium rates.

Symptoms and Treatment of HIV

HIV (Human Immunodeficiency Virus) is a virus that attacks the body’s immune system. The virus can be passed from person to person through blood, semen, or other bodily fluids.

HIV can, in time, lead to AIDS (Acquired Immune Deficiency Syndrome). AIDS is a serious, life-threatening condition caused by the destruction of the body’s immune system.

There are four main stages of HIV infection: seroconversion, asymptomatic, symptomatic HIV, and late-stage HIV.

During seroconversion, the virus replicates rapidly, and the body produces antibodies to fight the infection. This stage can take anywhere from a few weeks to months.

After seroconversion, most people enter an asymptomatic stage where they do not experience any symptoms. However, the virus is still active and can be transmitted to others.

Symptomatic HIV is the next stage of the infection, where an individual has started to experience symptoms related to the virus.

This can include fever, rash, fatigue, and swollen lymph nodes. At this stage, it is critical to use antiretroviral drugs to prevent the virus from progressing and damaging the immune system further.

If untreated, HIV will progress to late-stage HIV. The immune system is severely weakened, and opportunistic infections such as pneumonia and brain infections are common.

While there is currently no known cure for HIV, medical advances have dramatically improved treatment options and increased the average life expectancy for people living with the virus.

In the early days of the HIV and AIDS epidemic, very few treatments were available, and life expectancy was relatively short.

However, thanks to ongoing research, various effective treatments are now available. While there is still no known cure, HIV is now a chronic but not necessarily terminal illness.

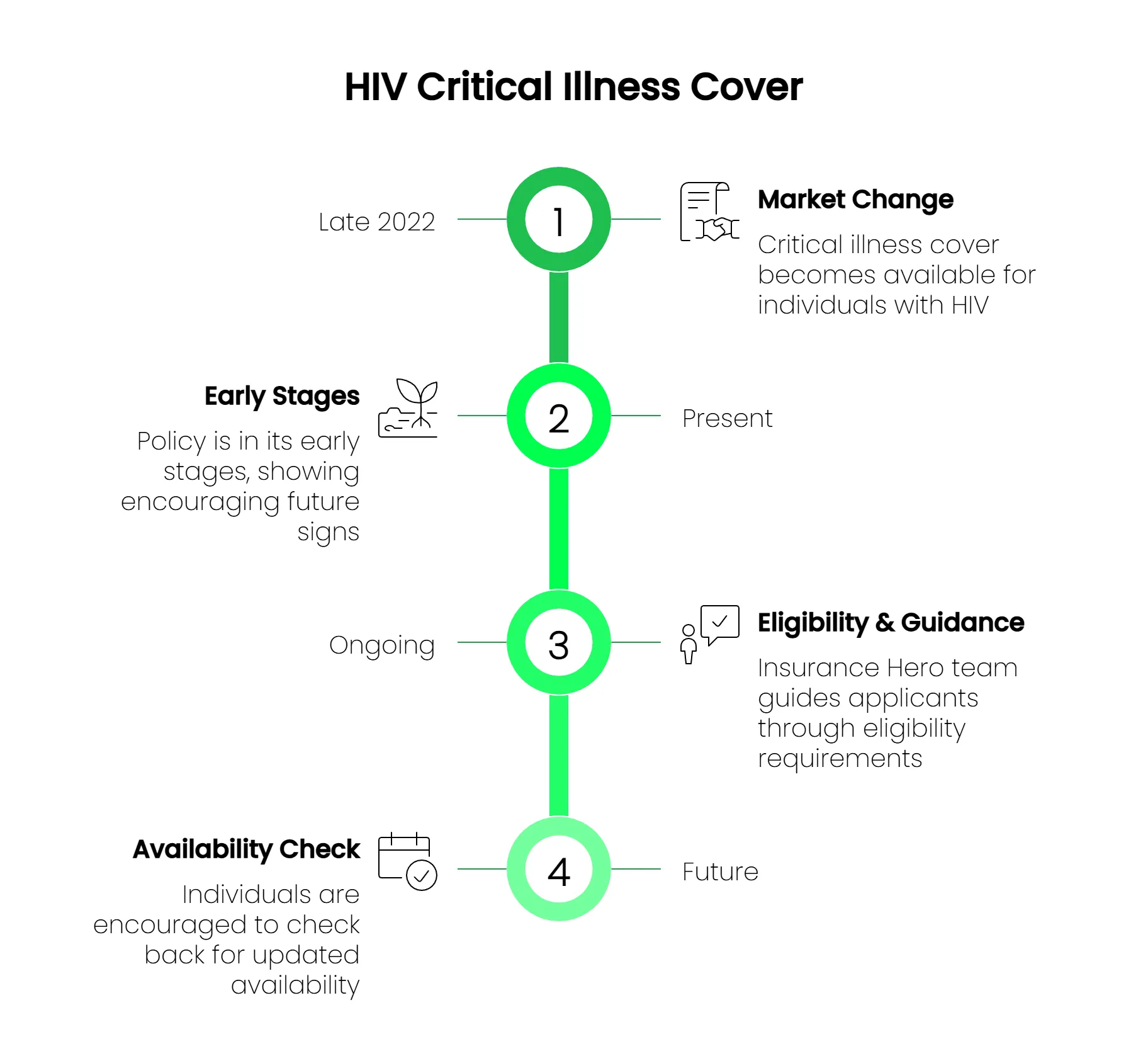

Can I take out HIV critical illness cover?

Critical illness cover is now a possibility for individuals living with HIV due to a significant change in the market in the late part of 2022.

While still in its early stages, this option is showing encouraging signs for the future.

The policy comes with defined eligibility requirements, and the Insurance Hero team is on hand to guide you through them step by step. Contact us to discuss your circumstances and explore your options.

Checking back occasionally is worthwhile to see if this cover is available to you.

HIV Life Insurance Companies

Many Mainstream UK Life Insurance Companies indirectly offer HIV cover through brokers or specialised intermediaries.

These well-known companies include:

- Legal & General

- Aviva

- Vitality

- Zurich

- Scottish Widows

- AIG Life

- LV=

- Royal London

- Barclays

- Nationwide Building Society

Working with a specialist HIV adviser or broker, such as Insurance Hero, can improve your chances of approval while protecting your medical privacy.

We know which insurers are best suited to your situation, and we can handle any specific rules or requirements.

Final Thoughts

HIV is considered and treated the same as any other medical condition by insurance companies. Not disclosing it when you know you have or are at risk can invalidate your policy.

Suppose you already have life insurance and are newly diagnosed. In that case, there’s no need to disclose your HIV status to your insurance company as long as you had no reason to suspect it could be an issue and didn’t declare it during your application.

If in doubt, ask your insurer because they cannot raise your premiums based on new medical conditions that come to light after you’ve taken out a policy.

The only exception is if you have a term life insurance policy, as some policies are periodically reviewed.

At the review stage of term policies, you need to disclose new conditions for your coverage to continue, and the premiums are likely to increase when new information is available about your medical condition.

Whole Life Cover policies will continue to provide the same level of protection with no additional premiums.

The key message from the ABI is that you should not cancel an HIV life insurance policy because you’ve been newly diagnosed with HIV. In many cases, the policies remain valid.

Always seek professional advice before cancelling because it’s harder to get life insurance with pre-existing medical conditions.

New policies can be taken out even when you have HIV, but they will have higher premiums due to the higher level of risk associated with the new policy.

FAQs

How does having HIV impact life insurance premiums?

When considering life insurance, it’s essential to understand that your health status will likely affect your policy and that you might pay higher premiums.

Remember that each insurer has its own underwriting criteria, which means one insurer may view you as a higher risk than another.

Where do I go to get HIV tested for my insurance policy?

This will depend on the insurance company; usually, the test is performed at a private clinic or your local GP surgery. The insurance company will inform you of the test date and time well in advance.

Who pays for an HIV test for life insurance?

When life insurance companies test for HIV, they will generally require a blood test. The life insurance company usually covers the cost of this blood test, so you won’t be out of pocket.

Does taking a test for HIV affect life insurance, even if it is negative?

Suppose an insurance company orders an HIV test for its underwriting process. In that case, the test result will be factored into the life insurance policy, regardless of its outcome.

If the test is positive, the policy will likely be rated, meaning the premiums will be higher than they would otherwise be. In some cases, a policy may even be declined.

However, if the test is negative, it will not impact the policy. In other words, taking an HIV test will not affect life insurance rates unless the result is positive.

If you have taken a previous test that returned negative, you are not required to inform the insurance company, as the result will not affect your policy.

What happens if I don’t tell my life insurance company about my HIV status?

If you don’t inform your life insurance company about your HIV status and they find out, your policy will likely be void.

This is one of the main reasons you must be completely honest with your insurer.

If found out later, not only will all the premiums you paid be wasted, but your family will also be left without a safety net in the event of your death. This applies to any pre-existing medical condition, not just HIV.

Do life insurance companies always test for HIV?

You will not necessarily be tested for HIV when applying for life insurance. Any medical examination required usually depends on the amount of coverage you need and any pre-existing conditions or high-risk hobbies you have disclosed.

If you have a history of drug use or STDs, travel, or work abroad in certain high-risk countries, you are more likely to be tested for HIV.

If the insurance company does require a medical examination, they will test for a wide range of conditions, not just HIV.

The examination results will be considered when determining your premium and the level of cover you can receive.

It is also worth noting that some life insurance companies will require a full medical examination if you list HIV as a pre-existing medical condition on your application.

Useful external resources on this subject:

- https://www.abi.org.uk/globalassets/sitecore/files/documents/publications/public/2016/hiv-and-insurance/hiv-and-insurance-guide.pdf

- https://nat.org.uk/wp-content/uploads/2024/07/HIV-and-Finance-2017.pdf

- https://www.gov.uk/government/publications/hiv-action-plan-for-england-2025-to-2030/hiv-action-plan-for-england-2025-to-2030

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.