Life Insurance For Police & UK MET Officers 2026

In many cases, being a police officer or working in law enforcement is considered to be a high-risk occupation.

Because of this, many people believe that their police life insurance coverage may be difficult to obtain or carry very high premium payments they cannot afford.

The good news is police life insurance policies can be secured with standard terms from most insurance providers.

Here is what you should know about police life insurance, income protection and critical illness cover:

- Special police life insurance policies are available for serving or retired Police Officers and their families.

- Save time by filling out a quick and easy form.

- Detailed Market Search. Insurance coverage: Life Insurance, Critical Illness Coverage and Income Protection.

- Get a policy that is tailored specifically to your needs. Be fully protected, whatever happens.

- Your monthly premiums are fixed for the duration of your policy; your monthly outgoings will remain the same if you don’t make any changes.

- Non-discriminatory quotes are provided for smokers.

Compare Police Life Insurance Coverage From The UK’s Leading Companies – 1 Minute Quote Form

Life Insurance Policy For Police Officers Overview

Life Insurance Policy For Police Officers Overview

| Topic | Description |

|---|---|

| Definition | Police life insurance is a term used to describe a standard life insurance policy that covers a police officer. It can also refer to the life cover benefit police officers receive with their pension or through the Police Federation Group Insurance Scheme. |

| Purpose | To provide financial protection for the families of police officers in the event of their death. |

| Additional Cover | If the life cover benefit from employment is insufficient, officers can opt for a personal life insurance policy for added protection. |

Key Features Of Police Life Insurance Policies

Key Features Of Police Life Insurance Policies

| Feature | Description |

|---|---|

| Starting Monthly Premium | From £7-£8 per month |

| Maximum Coverage | Up to £750,000, depending on age, at the start of the plan |

| Types of Cover | Level Term Cover and Decreasing Term Cover |

| Level Term Cover | Offers a fixed amount of money over a pre-selected period. It pays out a lump sum if you die within the term. |

| Decreasing Term Cover | The death benefit decreases over the term of the policy. |

| Family Income Benefit | It helps to replace lost income and provides loved ones with a regular, tax-free monthly payment. |

| Terminal Illness Cover | Included at no extra cost, it allows early access to the death benefit if diagnosed with a terminal illness. |

| Instant Decision | No waiting is required; answer some simple health questions. |

| Claims Paid (2023) | 95.3% of Term Life Insurance claims were paid. |

| Serious Illness Benefit | Optional extra protection for an additional monthly cost, covering six defined illnesses for you and your children over 30 days old. |

| Eligibility | UK residents aged between 18 and 70. The plan must end by age 80. |

| Important Notes | No cash value; it’s a protection policy only. Coverage ends if payments stop. |

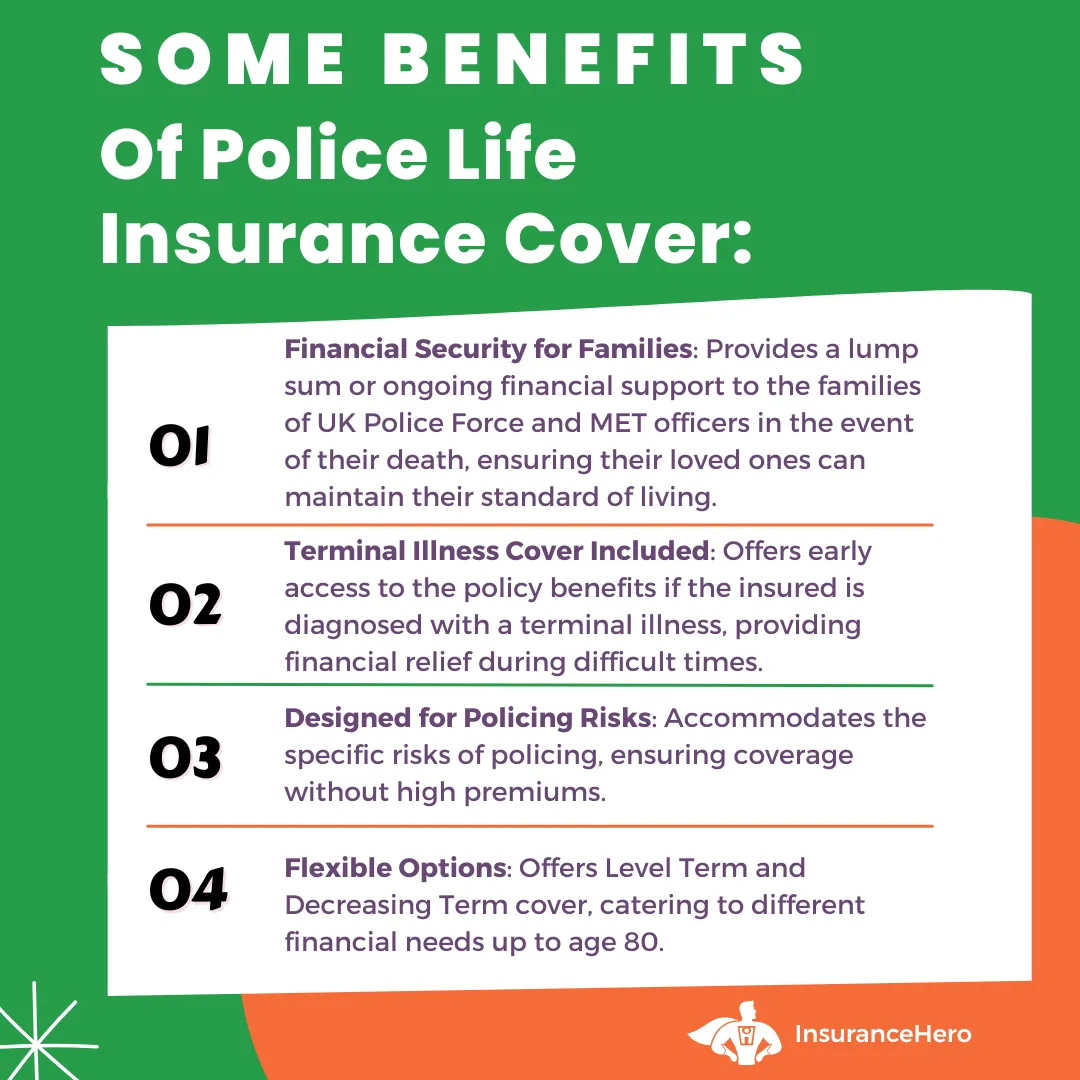

Benefits of Life Insurance for Police Officers

Benefits of Life Insurance for Police Officers

| Benefit | Description |

|---|---|

| Financial Security | Provides financial support to families in the event of the officer’s death. |

| Peace of Mind | Ensures that officers can perform their duties without worrying about the financial future of their families. |

| Flexible Coverage | Policies can be tailored to fit the unique needs of police officers and their families. |

| Support in Difficult Times | It can cover funeral expenses and medical bills or provide a financial cushion. |

| Educational and Mortgage Benefits | Some policies offer specific benefits to help pay for children’s education or mortgage in case of the policyholder’s death. |

Factors Affecting Cover

Factors Affecting Cover

| Factor | Impact on Insurance |

|---|---|

| Role in Police Force | Specific roles, especially high-risk ones like firearms specialists, may affect the cost of life insurance. |

| Health/Medical History | Personal health and medical history play a role in determining premiums. |

| Smoking Status | Smokers might have higher premiums. |

| Policy Type | The type of policy chosen (e.g., level term, decreasing term) will influence the cost. |

| Length of Cover | Duration of the insurance policy. |

| Level of Cover | The sum assured or the amount the policy will pay out. |

Life Insurance Policies for Police Officers

As mentioned earlier, many life insurance companies will accept an individual’s application whose occupation is law enforcement at standard terms with a standard monthly premium payment.

While applications for life insurance are easy to place, it is essential to let your insurer know of any travelling abroad you may be doing as part of your daily occupation as a police officer.

Not disclosing this information can null and void an insurance claim should the lack of information be uncovered.

Income Protection for Police Officers

Long-term income protection is unavailable for special constables, police officers, and community support officers.

Even though this is the case, some insurance companies will consider offering police officers short-term income protection policies, including unemployment, accident, and sickness.

A short-term police life insurance policy will provide protection for between 12 and 24 months if the individual cannot work due to an accident or injury.

This is a popular option, but ensuring that your income protection policy begins as soon as your sick pay ends is important.

Critical Illness Cover for Police Officers – Met Friendly Life Insurance Plans

Like a life insurance application, many police officers find that most met-friendly life insurance providers accept their critical illness cover applications at standard terms.

Although this is the case, it is essential to disclose any information about travelling abroad as part of your occupation and ensure the insurance provider is aware of this travel.

Life Insurance For Retired Police Officers

Retired police officers, having dedicated their lives to serving and protecting, deserve peace of mind in retirement. Life insurance is crucial to planning for the future, ensuring your loved ones are financially secure after you’re gone.

For retired officers, exploring life insurance options can seem like a chore. However, understanding the differences between plans for people over 50 and whole-of-life insurance can provide clarity and help people make informed decisions.

These policies offer a safety net, allowing you to leave behind a legacy and not liabilities.

Comparison Table: Over 50s Plans vs. Whole of Life Insurance

The table below highlights the main differences between Over 50s plans and Whole of Life insurance for retired police officers.

Over 50s plans offer a straightforward application process with no medical underwriting, making it an accessible option for those with pre-existing conditions.

However, the coverage limit is significantly lower than Whole of Life insurance, which considers health in its underwriting process but offers a higher coverage limit and immediate cover.

Both plans ensure that retired officers can provide for their loved ones, covering funeral costs, clearing debts, or leaving an inheritance. Still, the choice between them depends on individual health, coverage needs, and financial circumstances.

| Feature | Over 50s Plans | Whole of Life Insurance |

|---|---|---|

| Coverage Type | Whole of life cover | Whole of life coverage |

| Guaranteed Payout | Yes, as a cash lump sum | Yes, as a cash lump sum |

| Medical Underwriting | No medical questions asked | Medical questions asked, health considered |

| Coverage Limit | Up to £22,000 (varies by individual circumstances and budget) | Up to £1,000,000 (varies by individual circumstances and budget) |

| Premium Payment Period | Until the policyholder’s 90th birthday or for life, whichever comes first | For life, or until a specified age |

| Acceptance Age Range | 50 – 85 years | Up to 84 years. Immediate cover without a waiting period |

| Waiting Period for Claims | Applies to natural causes of death | No waiting period, immediate cover |

| Critical Illness Cover | Not available | Not available |

8 Reasons To Consider The Best Life Insurance For Police Officers

- Life insurance cover pays out a lump sum in the event of death or a permanent disability.

- Life insurance for police plans usually has a quick and easy application process.

- Can help you to protect your family from financial uncertainty. It is a small price to pay to protect your loved ones.

- It is designed to provide coverage for as long as necessary but with the flexibility to change the policy if required.

- A Police life insurance policy isn’t simply about paying for funeral expenses. It can also be utilised to cover medical costs you may encounter in your lifetime.

- It can be used to pay off a mortgage in the event of your death

- It can help to pay for your children’s college or school education fees

- It is a robust financial solution for every budget

Life Insurance from Insurance Hero helps to provide you with the coverage you need at a price you can afford. There are thousands of life assurance policies, but only a handful stand out.

Police officers are susceptible to the same things that can kill anyone. Cancer, heart attacks, strokes, and other things that can kill a person can kill a police officer.

The right life insurance policy can provide a family with the financial resources they need to live after a loved one is killed in the line of duty. Police life insurance is a type of insurance.

Let Insurance Hero find the best policies for you. If you need assistance applying for MET police life insurance or critical illness coverage, our knowledgeable team will answer your questions. Low rates and tailored plans are guaranteed.

Research Sources:

- https://www.statista.com/statistics/303963/uk-police-officer-numbers/

- https://www.gov.uk/government/collections/policing-statistics

- https://www.ons.gov.uk/peoplepopulationandcommunity/crimeandjustice

- https://www.polfed.org/

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.