Aviva Life Insurance Review – Cover From £5 Per Month

Aviva is the largest UK insurance services provider and the fifth largest insurance group, with more than 45 million customers worldwide.

It is also a leading European life insurance provider. Consumers interested in mortgage life insurance, providing financially for loved ones, or adding coverage to their existing life insurance portfolio will find that Aviva Life Insurance offers a suitable product.

The best part is that they need not search for it themselves because we do all the work!

Is Aviva a good insurance company? During our market review of compatible products, we evaluate Aviva’s offerings and provide a comprehensive Aviva life insurance review.

We Compare The Top Insurers. Find The Best Cover For You & Help Provide Your Family With Financial Security

Household-name online review companies report positive customer experiences with Aviva.

| Review Platform | Review Quality And Number |

|---|---|

| Trustpilot | 41,131 Reviews With An Overall Rating Of “Great”. |

| Feefo | 20,017 Reviews With An Overall Rating Of Excellent And Service Rating Of 4.6/5. |

| SmartMoneyPeople | A Score Of 4.14 Out Of 5. Based on 103 Reviews. |

| Fairer Finance | A claims score of 93.40% and an overall rating of 84.45% |

| Defaqto | Rated 3 to 5 stars, reflecting a range from average to comprehensive coverage based on policy type. |

Aviva Life Insurance Key Features Table:

| Avivas Feature | Our Explanation |

|---|---|

| Purpose Of Cover | Financially protects your loved ones in the event of your death or terminal illness during the policy term. |

| Coverage Options | Offers level term (fixed payout and premium) or decreasing term cover (aligned with repayment loans, lower premiums). |

| Eligibility Criteria | Aged 18-77, UK resident, with truthful answers to health and lifestyle questions. |

| Aviva Policy Terms | Flexible options from short-term to 50 years or until the age of 90. |

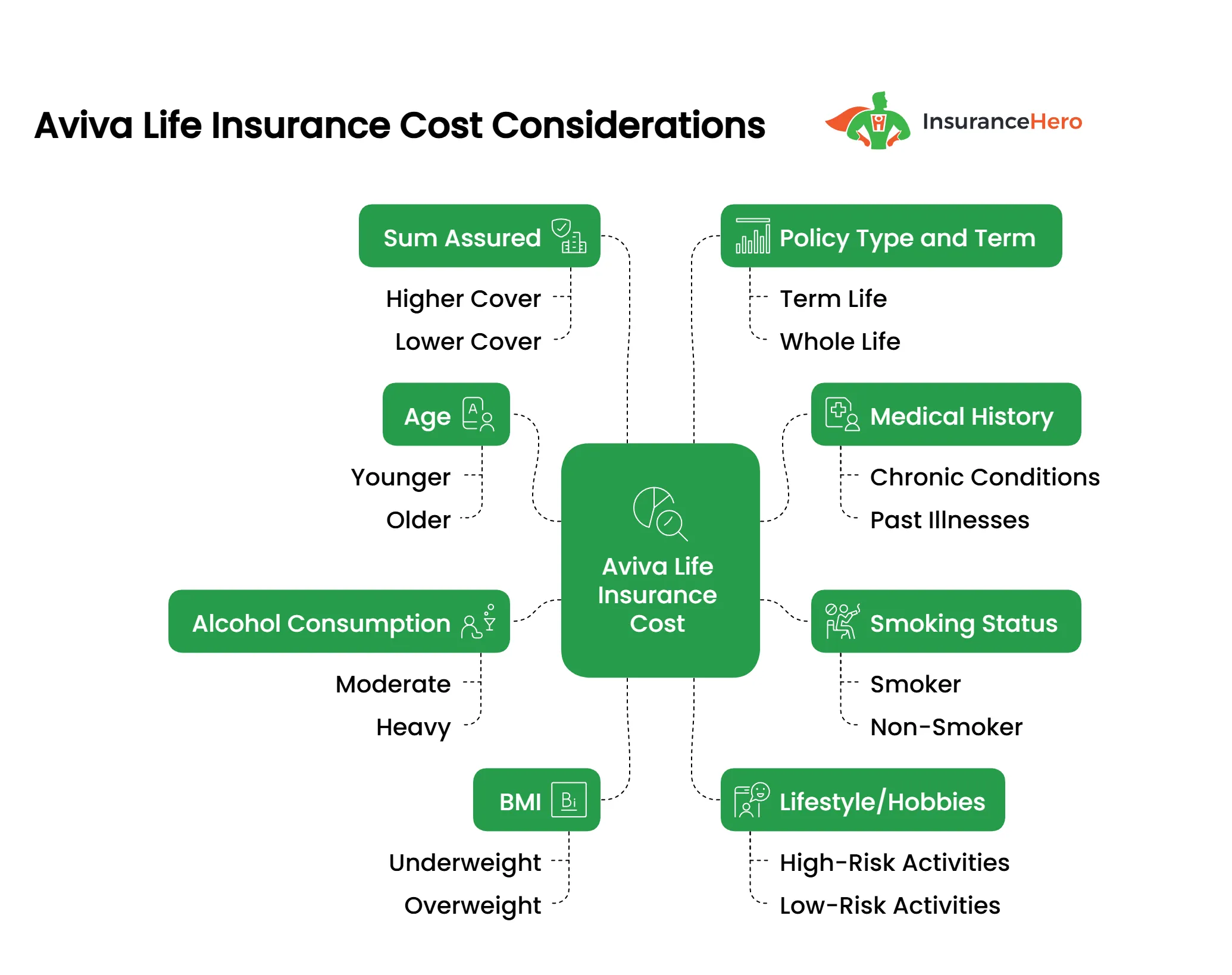

| Premiums | Starting at £5 per month, which is based on age, health, smoking status, and coverage length. |

| Payout | A lump sum of up to £5 million for a death or terminal illness diagnosis (expected to live less than 12 months). |

| What Are The Benefits? | – Lump sum payouts. – Option to place policy in trust to avoid inheritance tax. |

| Critical Illness Cover | An optional add-on pays a lump sum for a diagnosis of 52 covered critical illnesses within the policy term. |

| Exclusions | – Non-payment of premiums. – Death outside the policy term. – Suicide or self-inflicted injury in the first 12 months. |

| Gift Card Offer/Incentives | At the time of writing, a £120 gift card from either Amazon, Tesco or M&S. |

| Free House Purchase Cover | Up to 90 days of free cover during the home-buying process upon an accepted application. |

| Joint vs Single Policies | A joint policy covers two people but pays out once. Separate policies cost more but offer dual payouts if both pass away. |

| Inflation Protection | Option to adjust level cover for inflation (based on Consumer Price Index), increasing premiums and payout amount annually. |

| Additional Features | Access to bereavement support, mental health services, and nutritionists via Aviva DigiCare+ app. |

| Cancellation Policy | 30-day cooling-off period with a refund of premiums; no refunds after this period. |

| Tax Implications | Payouts are free from capital gains and income tax, but may be subject to inheritance tax unless placed in a trust. |

| Why Aviva? | – 325 years of experience. – Defaqto 5-star rated. – High claim approval rate (99.3% in 2024). |

Low Premiums From Only £5 Monthly

Aviva Life Insurance UK offers term insurance policies that make a lump-sum payment to beneficiaries. Monthly premiums start at just £5 and are guaranteed not to increase during the policy term.

Joint policies are available for partners, and an application takes only minutes to complete. Level and decreasing term policies are offered, and the industry highly rates both.

Aviva Life policies do not have a cash-in value, so failing to make premium payments will result in policy cancellation without a refund.

A simplified life policy provides life coverage only, and a level and decreasing option is available. The level option is similar to term insurance, providing a fixed lump sum payment if the insured dies during the specified term.

This is designed to provide financial security to surviving beneficiaries or help cover the amount due for an interest-only mortgage.

Consumers may choose a coverage limit of up to £500,000 based on age and policy term. Many select a term corresponding to when children will become financially independent or when the mortgage will be repaid.

The decreasing option resembles mortgage life insurance, providing coverage that decreases over the policy term and a lump-sum benefit upon the insured’s death during that term.

By decreasing the coverage level, this policy helps to lower premiums.

The policy is designed for consumers with an outstanding repayment mortgage loan balance because the coverage level decreases in line with the balance on this borrowing.

Up to £500,000 in coverage is available based on personal circumstances, and the premium is guaranteed not to increase.

If an insured is diagnosed with a terminal illness and the life expectancy is shorter than 12 months, either plan will pay a benefit as long as the diagnosis is not made during the last 18 months of the term.

The policy ends once a benefit is paid due to a terminal illness claim. The terminal illness benefit differs from critical illness coverage, which only provides a term or mortgage life insurance policy at an extra cost.

Life and critical illness coverage pays a lump sum benefit if the individual dies or is diagnosed with a covered critical illness and lives for 14 days or more.

The Aviva critical illness list includes more than 30 medical conditions. The benefit may be used for any purpose, such as repaying a mortgage, handling expenses and bills, or funding a holiday for treatment recovery.

There is no cash-in value for life and critical illness policy; if premium payments cease, the policy will end, and a refund will not be issued.

The table below illustrates sample monthly quotes from Aviva for both level and decreasing-term life insurance plans.

These estimates are based on a non-smoker in good health who needs £200,000 of coverage over a 20-years.

| Persons Age | Decreasing Term Cover | Level Term Cover |

|---|---|---|

| 25 | £3.87 | £4.41 |

| 30 | £4.53 | £5.46 |

| 35 | £5.27 | £7.49 |

| 40 | £6.96 | £10.34 |

| 45 | £9.86 | £15.19 |

| 50 | £14.73 | £21.12 |

| 55 | £16.71 | £23.16 |

What is Aviva’s Over 50s plan, and who would benefit from it?

Aviva’s Over 50s plan is for older people. It offers guaranteed acceptance without medical exams. It helps with funeral costs or other final expenses.

If you want support later in life, this plan is worth looking at during your Aviva life insurance policy analysis.

Trust Fund Ready

Either fixed- or decreasing-term life insurance can be placed into a trust. This allows the insured to leave money to specific individuals and avoid subjecting the lump sum benefit to inheritance tax.

If a joint policy is taken, a payout is made on the first approved terminal illness or death claim, and the plan ends.

Though this policy may be less expensive, the fact that it pays only one benefit may outweigh that.

Partners may be able to purchase individual life policies for only slightly more than a joint policy, which will provide a lump sum benefit upon the death of either person.

When determining how much coverage they need, consumers should consider their rent or mortgage payments, living expenses, credit card or loan payments, child daycare or education expenses, funeral costs, and other lifestyle-related expenses.

It is essential to consider all the ways the money could be used and to build in extra funds for holidays, unexpected expenses, and visits to friends and family.

Based on our research, consumers should multiply the annual amount needed by ten to 25 years to find a limit with an affordable premium.

While conducting our Aviva life insurance reviews, we found that Aviva paid out for 99.8 per cent of death claims during 2025 and into early 2026, totalling £150 million in payouts.

The company takes pride in its quick and sympathetic handling of claims. Aviva Insurance Ltd may have a suitable life insurance product, so complete our online quote request form.

We will include Aviva life policies in our life insurance providers’ UK market review and provide you with pricing and details on suitable plans.

Why is Aviva’s reputation for environmental initiatives relevant to policyholders?

Aviva’s focus on sustainability and its goal of achieving Net Zero by 2040 demonstrate its commitment. This appeals to customers who want to support a company with values. It also boosts Aviva’s insurance company reputation analysis.

In Summary

Aviva is a top pick for life insurance in the UK, earning 9s and 10s across the board for innovation. Policies can last up to 50 years, ending by age 77. This gives you flexibility for long-term protection.

The maximum sum insured is £3 million, meeting various financial needs. Aviva has helped over 19 million customers worldwide, showing its stability and reach.

You can customise your policy with riders, critical illness cover, or total permanent disability features. These options suit different life stages, from planning a family to retirement.

Aviva is known for clear documents and reliable claims handling.

Thinking about your finances and future needs can help you decide if Aviva’s life insurance is right for you. It’s a way to secure your loved ones’ future.

Aviva Life Insurance UK Further Information:

Aviva Life & Pensions UK Limited

https://www.aviva.co.uk/insurance/life-products/life-insurance/

Registered Office: Aviva, Wellington Row, York, YO90 1WR.

Freephone 0800 953 1777, Monday to Friday, 9:00 am to 5:00 pm. If you are outside the UK, please call +44 203 761 1200.

Member of the Association of British Insurers. Firm Reference Number 185896.

AA Life Insurance UK Cover Review

Various life insurance products are available, including level term, decreasing term, and 50-plus. AA life insu…

AEGON Life Insurance Reviews – Compare Quotes

If you want to provide financially for surviving loved ones upon death, AEGON life coverage may be the solution. …

AIG Life Insurance UK Reviews

AIG (American International Group) is synonymous with the insurance industry. AIG is a multinational insurer fo…

ASDA Life Insurance Cover Reviews

ASDA Financial Services offers travel, home, motorist, pet, life insurance, personal loans, trade, gift, and credit card…

Axa Life Insurance Cover Review

The AXA Group has been in the insurance business since the 18th century. Acquisitions, mergers, and name changes for lea…

Barclays Life Insurance Review

Barclays PLC is a major financial services company backed by more than 300 years of history. Welcome to our new…

British Seniors Over 50 Life Insurance Reviews

Find out about British Seniors Over 50 Life Insurance Reviews, Customer Experience, and Policies Available. Abou…

Direct Line Life Insurance For Over 50’s Review

Direct Line is a household name for insurance products. At the outset, their core offering was vehicle insurance with a …

Ageas Protect Life Insurance Review

Fortis Life is now Ageas Protect, the financial protection arm of Ageas within the UK. The company offers produ…

Friends Life Life Insurance Reviews

Since 1810, Friends Life has been providing financial services. Founded in Yorkshire as Friends Provident in 1832, the c…

LV Life Insurance Reviews

In 2007, Liverpool Victoria rebranded their company name to use LV=. The LV= brand is a visual play on the word…

Nationwide Life Insurance Reviews And Cover

Nationwide Building Society offers insurance, banking, investment, loan, credit card, and mortgage services to residents…

NatWest Life Insurance Review From £5.46 Per Month

Welcome to our newly updated 2026 Natwest life insurance reviews page National Provincial Bank was established i…

One Family Over 50s Life Insurance Reviews

One Family over 50s life insurance offers UK residents aged 50 to 80 a straightforward way to take out life insurance co…

Post Office Life Insurance Review

Welcome to our Post Office life insurance review. In the United States, the Post Office is where residents mail letters …

Prudential Life Insurance UK Reviews

The international financial services group Prudential plc serves over 25 million customers and manages approximately £3…

Royal London Life Insurance Reviews

Royal London is the largest mutual life and pensions company in the UK. It comprises several specialist businesses desig…

Scottish Provident Life Insurance Review

Scottish Mutual Assurance Limited provides healthcare and protection products under the brand name Scottish Provident. …

Scottish Widows Life Insurance Reviews

Scottish Widows is a nationally recognised financial services provider that has served families with financial protectio…

Shepherds Friendly Over 50s Life Insurance Review

The Shepherds Friendly Society is one of the longest-running insurers in the world. In 1826, they began by establishi…

Smart Life Insurance Reviews, What Buyers Should Know

Welcome to our newly updated Smart Life Insurance reviews guide. Smart Life Insurance offers people a range of flexible,…

The Exeter Life Insurance Reviews

Do you have pre-existing medical conditions? Do you want to put in place a robust life insurance policy that will provid…

Virgin Money Life Insurance Review

Virgin Life Insurance is one of the over 400 companies in Virgin Group Limited, the British-branded venture capital cong…

Vitality Life Insurance Review – Should You Buy?

Vitality Life takes a more active role than most insurance providers do by helping people to live active and healthy lif…

Zurich Life Insurance Reviews

Zurich Financial Services Group, commonly referred to as Zurich, was founded in 1872. Headquartered in Zurich, …

Saga Life Insurance Over 50 Reviews

Welcome to our Saga Life Insurance Over 50 Reviews. Many people over 50 are concerned about choosing the right life insu…

HSBC Life Insurance Review

Life insurance is an important financial product that can help provide financial security to your loved ones in the even…

Lloyds Bank Life Insurance Review

“Lloyds Bank is likely at the forefront of your search if you’re in the market for life insurance. But how does this maj…