Income Protection Insurance For Doctors

Income protection insurance for doctors plans work by providing a replacement salary if you cannot do your work due to an illness or injury in the workplace.

A monthly premium is paid to the insurer to provide this protection. This form of protection insurance is a consideration if you are a medical professional working for the NHS or in the private sector.

What Are The Main Benefits?

Insurance Hero can help you find the most comprehensive and cost-effective income protection policies.

Here are some reasons why you should consider taking out the cover:

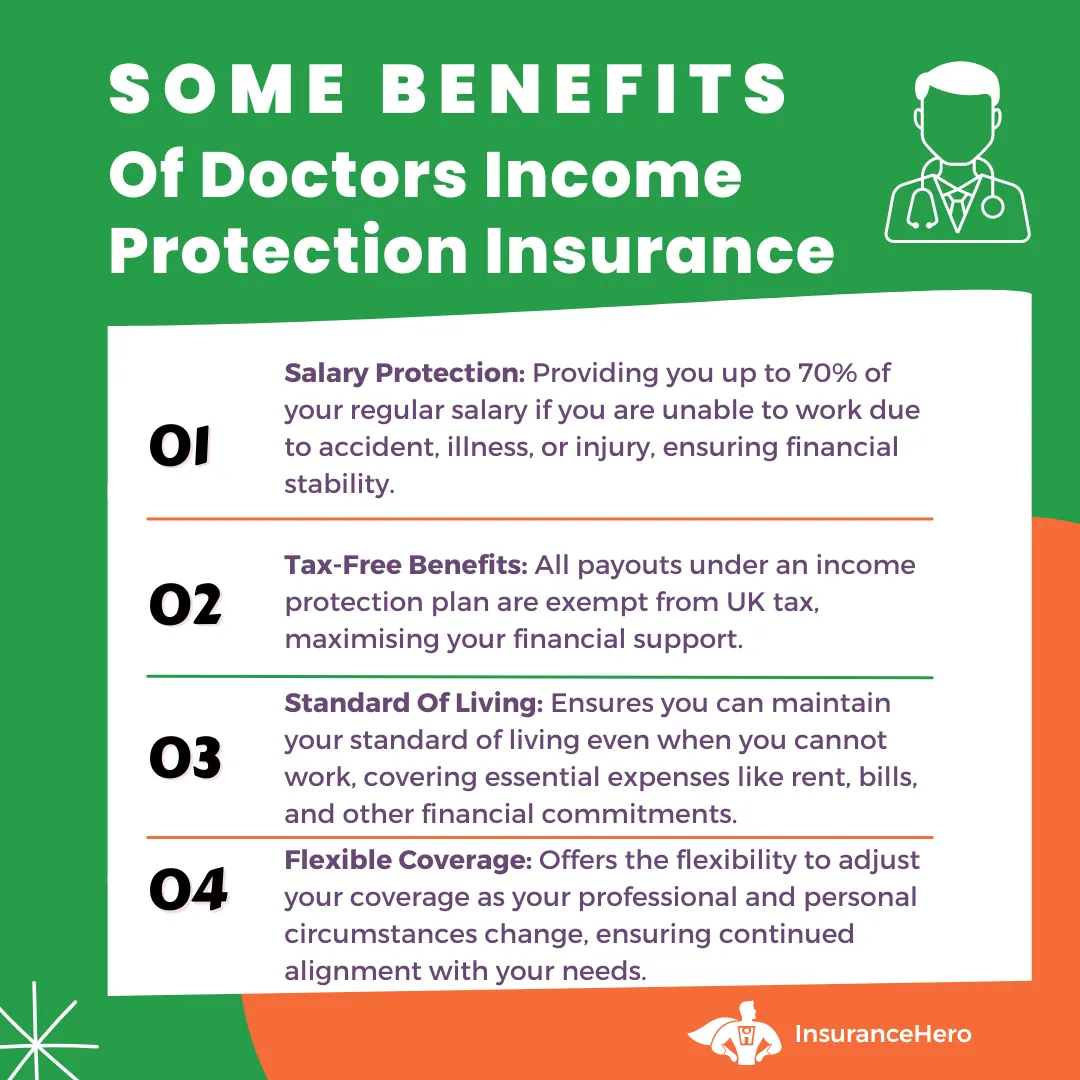

- Payouts from an income insurance plan are usually exempt from UK income tax.

- An income protection plan can be set up to protect you until you can return to the workplace or until your retirement, if it is no longer possible to work.

- Providing a replacement salary ensures you can maintain your lifestyle until you return to the workplace.

- Policies are flexible and can continually be amended to keep up with changes in your professional and personal life.

- Depending on the insurer, you may be able to maintain up to 70% of your regular salary if you cannot work.

Protect Your Income Today. No Obligation To Purchase. Quick Quote Form

Why Do Doctors Need Income Protection?

Clearly, the risks of working as a medical professional vary widely.

An NHS doctor or surgeon treating infectious diseases has a different risk profile than a GP who provides standard treatments and consultations.

A doctor may be unable to work due to exposure to hazardous chemicals, psychological issues related to the demands of the profession, or musculoskeletal problems caused by poor workplace posture.

The risks affecting doctors as a profession can result in them being unable to work for a time or working at reduced hours, all of which have a financial impact.

Is Income Protection Insurance Appropriate for You?

Only you, as a doctor, can answer this question, but to guide you on the right path, consider the following points that may be relevant to whether income protection insurance is appropriate for you.

Also, consider whether you are a self-employed doctor in a private practice or an NHS doctor.

Financial Commitments

As a medical professional, you may have a mortgage, a family, and children in private education.

Even for single doctors, financial commitments may mean that being unable to work for a period due to an on-the-job accident or illness can lead to financial discomfort.

Savings

Do you have substantial savings that will sustain you and your family if you cannot work for a year or even more?

Supportive Family Members

If you cannot work for a time, do you have another family member who can take the strain off the family finances, or are you the sole breadwinner?

Income Protection for the NHS Doctor

If you are a doctor working for the NHS, depending on your length of service, salary protection is part of an NHS contract if you cannot work for a time.

A doctor with more than five years of service in the National Health Service should expect to receive 12 months of NHS sick pay, with the first six months on full pay, followed by six months on half-pay.

For income protection, a policy can offset against the NHS sick pay period, with the deferred period commencing a year after an initial claim.

This means the income protection policy activates when your NHS sick pay stops. It helps reduce monthly premium costs.

Income Protection for the Self-Employed Doctor

If a self-employed doctor working in private practice were unable to work, they would only be entitled to the UK government sickness insurance, which provides a benefit of less than £100 per week for 28 weeks.

It is not a viable option for maintaining any reasonable living standard.

How Can Insurance Hero Help You?

Insurance Hero provides income protection policies and related coverage to doctors.

Here are four main ways in which we can help you:

- Our staff are experts in income protection policies for NHS doctors and other medical professionals. Through experience, our team intimately knows the policy requirements of both NHS doctors and those working in the private sector. With a direct email and telephone number, you will never have to wait in a call queuing system with Insurance Hero – our service is personalised.

- Here at Insurance Hero, we are an entirely independent insurance broker. As we do not tie to any insurer, we can offer impartial service and advice, and you can get a policy tailored to your needs at a competitive price.

- Insurance Hero is a caring team that will support and advise you throughout the claims process and provide an efficient service to assist with a rapid payout.

- As a broker handling large policy volumes, Insurance Hero will have more negotiating power than if you apply for income cover directly with an insurer.

Available Features in an Income Protection Insurance Plan

We aim to simplify doctors’ income protection for you. It is not complicated to grasp, but breaking down all the elements will help you understand both standard and additional features that may be appropriate to your circumstances.

Standard Features in an Income Protection Insurance Plan

Deferred Period

The deferred period is the time lapse between a claim and the start of a replacement salary. Getting it right at the beginning of a policy is key, and a specialist broker like Insurance Hero can help you with this.

If you are an NHS Doctor, consider the NHS sickness insurance policy, where full payment takes place for six months and half pay for the next six months.

It would make sense to extend the deferred period to a year from the moment you stop working. The longer the deferral period, the lower the premium level.

Cease Age

Cease age is your age at the end of a plan, typically aligned with either a retirement age date or the end of a significant financial commitment, such as the repayment of a mortgage.

The older you are at the policy maturity date, the more expensive the plan becomes.

The Insurance Hero team is looking forward to receiving your call on 0203 129 88 66, where we can guide you through the best options to put in place an income cover that closely matches your professional and personal needs.

Length of the Claims Period

Two lengths of protection policy are available: a short-term and a long-term plan.

A long-term policy is a more expensive option in terms of a monthly premium. Still, it will provide coverage in the form of a regular salary until you can return to work or, if never able to return to work, until the age at which you will retire.

A short-term policy has a time limit after which the replacement salary is paid out. It can be set from one year to five years, by which time you would have to return to work, or the income protection benefit will stop.

Sum Assured

The replacement salary that is received when a claim is approved is known as the sum assured. Under an income protection policy, the sum assured is rarely more than 70% of your full wage.

Income protection insurance for doctors’ plans aims to protect you until you can return to work. The intention is not for you to be better off than you would be if you were working.

Indexation

An income insurance policy will offer three types of indexation options, which result in either an increase, a decrease or a constant level of coverage:

- With an increase in cover, the sum assured will rise with the cost of living, typically measured by the retail price index (RPI) or the consumer price index (CPI).

- The decreasing cover reduces premiums and the sum assured over time. This type of protection is often aligned with a mortgage, which diminishes over time until it is paid off.

- The level cover ensures the sum remains the same throughout the policy term.

Premium Options

The premium is calculated by an underwriter using information from a client fact-finding questionnaire, which provides an understanding of the extent of your doctor’s activities, and is then combined with sophisticated algorithms.

Premiums typically pay out monthly, and there are three options:

- Guaranteed premium: With a guaranteed premium, the underwriter cannot change the premium during the policy term. Only the policyholders themselves can change the policy. This premium type can be cost-effective if it is taken out by a younger policyholder with a clean medical history.

- Age-banded premium: As doctors age, they are more likely to become increasingly susceptible to illness and, consequently, be unable to continue working due to ill health or an accident. Age-banded premiums increase incrementally over time, being cheaper at the outset of the policy.

- Reviewable premium: The underwriter can review the premium at any time, allowing an upward adjustment to the monthly premium payment. With periodic revisions, a reviewable premium, although an economical option at first, will become more expensive over the policy’s lifetime.

Optional Policy Features

Five main optional features are available as part of a doctor’s income protection policy that are useful to be aware of and may be relevant to your circumstances:

- Policy pausing: If you are unemployed, the plan will not pay out in the event of an incident. If you find yourself unemployed or in between jobs, an income insurance policy can be frozen until you can return to the workplace.

- Death benefit: If you die while receiving an income protection benefit, an optional feature available with a policy is a death benefit. Your dependents will receive a lump-sum payment upon your death.

- Involuntary redundancy: A standard income policy will not provide cover for redundancy. Some insurers, however, can, upon a specific request and at a higher cost, include protection should you be made redundant.

- Childcare benefit: If you are unable to work, a childcare feature will provide a fixed amount per child to be used for expenses such as increased child-minder or nursery hours

- Specified injury benefit: At policy inception, it is possible to include both injury and trauma. If you cannot work due to the inclusion, a further payment above the standard replacement salary is due.

What Is Covered Under Doctors Income Insurance Protection?

This type of policy does not serve as a blanket green light for an insurer to pay out, and a plan must be carefully thought out at the start to ensure it aligns with a doctor’s professional and personal circumstances.

Not being able to do your job has different implications, and these must be accurately reflected in the policy.

Do you need an insurance policy that, when you return to the workplace, will require you to:

- Undertake any type of paid employment?

- Only undertake your specific job?

- Only undertake a job that you are qualified to do?

All three variations will affect the cost of cover, with the most expensive premium reserved for returning to full-time employment in the specific job for which you are qualified.

Specific policies allow for a proportionate payment that will top up your salary if you return to the workplace in a lower-paid role.

Non-coverage Under Income Protection Insurance

A claim may be rejected if it does not meet the policy’s qualifying definitions.

Four areas where an insurer will not pay out are the following:

- Both childbirth and pregnancy

- Where drug or alcohol abuse is stopping you from doing your job

- Participation in dangerous activities such as extreme sports

- The non-declaration of pre-existing medical conditions at the start of a policy

Insurance Hero has a team of brokers who provide income protection for doctors and other medical professionals. For more information on how we can help you achieve financial security, call our direct line at 0203 129 88 66 for a free quote.

Summary

Income protection insurance is something doctors, whether working for the NHS or in private practice, should consider. With the arrival of Covid-19, the risks of being unable to work have increased.

Income protection insurance for doctors provides the financial security of a regular salary, allowing you to concentrate on caring for your patients with the knowledge that you and your loved ones are financially secure.

At Insurance Hero, our professional team can offer you several suitable policies to compare so you can choose the one that best suits your case.

Give us a call today at 0203 129 8866 or fill out our short no-obligation quote.

Other Income Protection Insurance Pages:

Joint Income Protection Insurance For Dual Income Couples

If you’re in a similar situation to 25% of couples with a dual income, you’ll never have even contemplated Income Pr…

Can You Get Group Income Protection Insurance?

Are you worried about how you’ll cope financially if illness or injury stops you working? In 2024 alone, insurer…

Income Protection Insurance For Vets

Being a vet can be a challenging yet immensely satisfying profession. Accidents and injuries can occur in the workpl…

Income Protection Insurance For Contractors

Do you worry about how you will pay the bills if you cannot work? Do you have loved ones who would suffer from financial…

How Much Does Income Protection Insurance Cost?

While most people aim for the maximum amount of cover for the minimum cost, the actual cost of income protection insuran…

Does UK Income Protection Insurance Cover Maternity Costs?

If you’ve just learned that your family is about to grow, there’s a good chance you’re filled with both tremendous…

Does Income Protection Cover Redundancy?

When times are tough, when the economy turns downward, or when corporate profits demand a reduction in expenses, employe…

What Is Accident Sickness And Unemployment Insurance (ASU)?

When it comes to safeguarding your family and your future, two major transition points matter. The first is any …

Income Protection Insurance For Dentists

Are you a self-employed or an NHS dentist? Do you worry about what would happen financially to you and your loved ones s…

Self-Employed Income Protection Insurance

Working as self-employed can be immensely rewarding if a business becomes successful and, with no employer or boss to re…

Income Protection Insurance For Teachers Guide

Receive a monthly income for as long as you need if you are off work sick or physically injured – it is that simple. …

Reference sites our team used for research:

- https://www.pgmutual.co.uk/doctors-income-protection-insurance

- https://protection.aviva.com/globalassets/life/documents/4129_occupational_sales_aid_doctors_dentist_surgeons.pdf

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.