The Exeter Life Insurance Reviews

Do you have pre-existing medical conditions? Do you want to put in place a robust life insurance policy that will provide financial peace of mind for your dependents should you die suddenly?

If you have been turned down for life insurance due to your medical history or have been put off by costly quotes to purchase a policy, this review of Exeter is essential reading.

In this Exeter life insurance review, we will look at the Exeter’s Key life insurance products to help you decide if their insurance policies may be appropriate for you.

The Exeter Life Insurance: Core Benefits:

Did you know that the Exeter is a life insurance company that actively specialises in helping people with multiple medical conditions?

- Flexible cover is available from £20,000 to £3 million, helping meet the financial needs of different people.

- Automatic terminal illness cover is included at no extra cost, allowing for an early payout if your life expectancy is 12 months or less.

- You can adjust the cover (increase or decrease the sum assured) to reflect your changing circumstances.

- They offer joint and single-life policy options to suit family or individual protection needs.

- You can choose from a broad range of terms, with policy lengths of 5 to 50 years and an end date up to age 90.

Help Protect Your Family’s Future · Compare Top Insurers · Find Your Cheapest Quote >> 60-Second Form

The Exeter Review Data For 2026 So Far

| Review Platform | Review Quality And Number |

|---|---|

| Trustpilot | 1,051 Reviews With An Overall Rating Of “Great”. |

| SmartMoneyPeople | A Score Of 4.72 Out Of 5. |

| Fairer Finance | Overall score of 75.21% and a transparency rating of 68.97% |

About the Exeter?

The Exeter was founded in 1927 and is now one of the UK’s most prominent friendly societies, serving over 95,000 members and employing over 100 staff at the Devon office.

The Exeter specialises in insurance products, including income protection, cash plans, private medical insurance, and life insurance.

Life insurance has become one of Exeter’s most important products. It has developed a reputation for offering policies in one of the most challenging segments for those seeking life coverage with multiple health conditions.

The Exeter Life Insurance Products

The Exeter provides specialist life insurance for individuals with pre-existing medical conditions. Having an adverse medical history has been shown to affect up to 25% of all adults living in England.

Life insurance can be a low-cost form of financial protection for a healthy adult. However, as the cost is based on the likelihood that you will die, medical conditions can rapidly increase monthly premiums.

The Exeter has recognised a need to provide affordable life insurance for British adults with multiple medical conditions and has created two products, Real Life and Managed Life.

We will now individually analyse how these policies work and their key features.

Compare The Leading Life Insurance Companies & Get The Best Deal. Highly Rated For Financial Strength.

The Exeter Real Life Policy

Real Life pays a monetary lump sum should you die during the policy term or be diagnosed with a terminal illness that will lead to your death within a year.

The plan is designed for individuals who may struggle to obtain life insurance due to a pre-existing medical condition.

The policyholder’s age at the outset

Real Life is available to anyone aged 18 to 80 who has been a UK resident continuously for at least 3 years before applying for cover.

The policy duration at the start of the plan

The policy’s term can be 5 to 50 years, and the maximum policyholder age is 90 years when the plan must end.

Minimum and maximum payouts

In a real-life policy, the minimum lump-sum payout, also known as the sum assured, is £20,000, and the maximum payout is £3,000,000.

How much does the plan cost?

The cost of a real-life plan depends on several factors. These include the lump-sum payout amount required and the policyholder’s age, weight, and medical history. The minimum monthly premium permissible is £15.

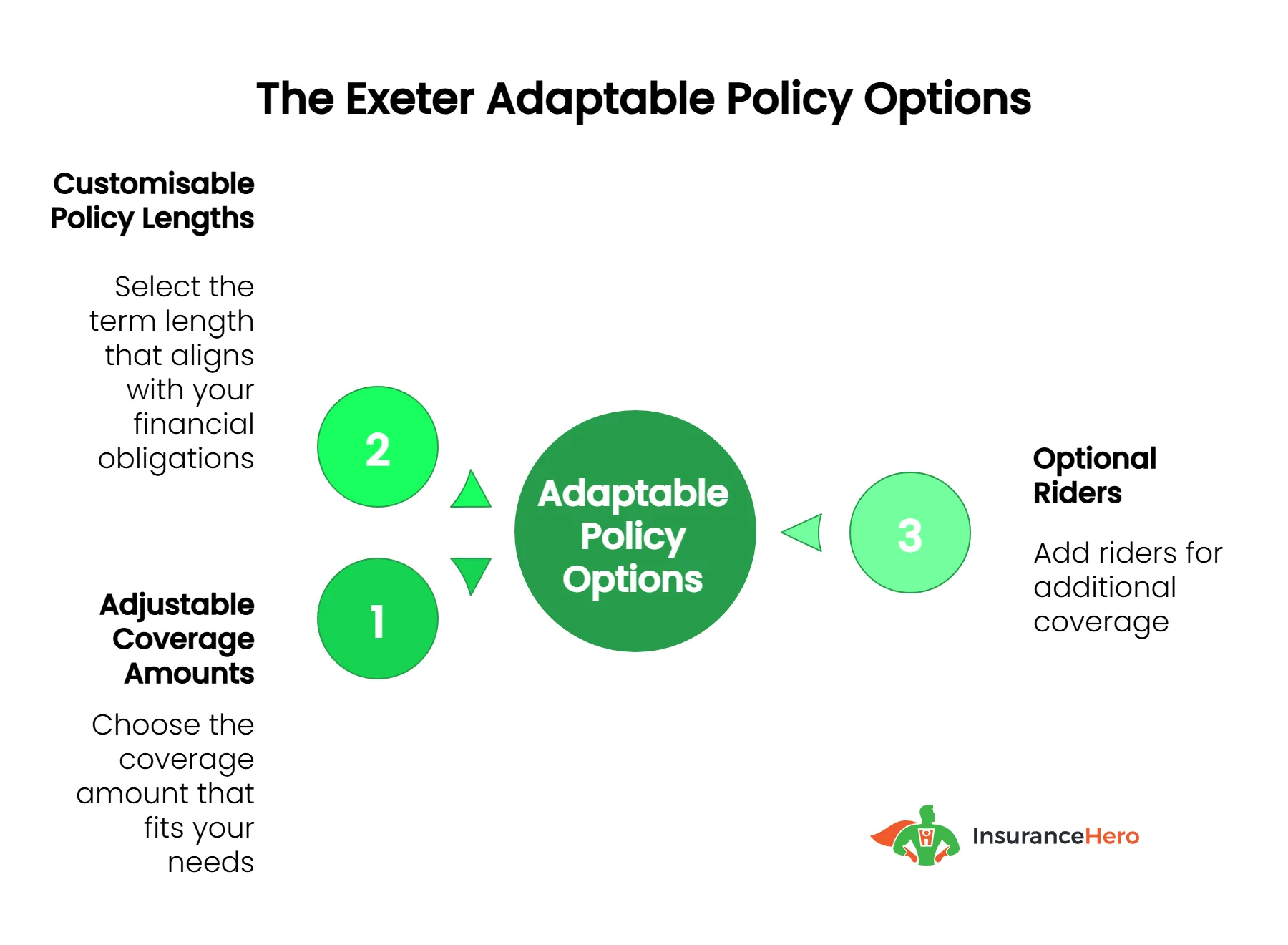

Flexibility of Life Insurance

Real-Life is a very flexible life insurance plan. The Exeter understands that a policyholder’s needs will change as their life circumstances evolve.

A new house, an addition to the family, or changing medical circumstances may require adapting coverage levels to reflect a unique situation that may increase, decrease, or keep premiums unchanged.

The Exeter Managed Life Policy

Managed Life tailors to those who have type 2 diabetes or weight issues, who may struggle to put in place life insurance at an acceptable cost.

As part of Managed Life, policyholders can reduce future premiums by managing their existing condition through lifestyle changes.

For people with type 2 diabetes, this is through a glycated haemoglobin reading before a policy’s anniversary.

For those with weight issues, a BMI reading must be provided before an anniversary. An improved reading may lead to a fall in the premium level, while a declining reading may lead to a rise in premiums.

Policyholder age at the outset

The Managed Life plan is available to all customers aged 18 to 69 who have resided continuously in the UK for at least 3 years before their life insurance application.

Policy length at the start of the plan

Under Managed Life, the duration can range from 5 to 50 years, but the cover must end before a policyholder reaches their 90th birthday.

Minimum and maximum payout levels

As with Real Life, Managed Life has a minimum sum assured of £20,000 and a maximum of £3,000,000. The payout size is agreed at the start of the plan, but due to The Exeter policies’ flexible nature, this can be adjusted throughout a fixed-term plan.

How much does a managed plan cost?

With Managed Life, the minimum premium is £15 per month. However, the cover cost will depend on the required level of coverage, age, personal circumstances, and, importantly, the severity of your diabetes and level of BMI.

Exeter will establish a target level for your controlled condition that must be adhered to. A schedule will outline the percentage reduction in premium that will apply if you meet the target.

Conversely, the schedule will also outline the percentage increase in premium if the target is not met.

If you are not given a managed condition target as part of the cover, the premium level will not be subject to a target-related change.

What Will The Exeter Need to Provide A Quote?

Exeter life insurance is not a one-size-fits-all policy. If you have underlying health conditions, you must disclose the full extent of your medical history.

Questions that need asking may include the following:

- Do you have any pre-existing health conditions? If so, what are they?

- How long have you had health issues?

- Are you a smoker or a non-smoker?

- What is your weight, and what is your body mass index (BMI)?

- What is your height?

- How old are you, and how long do you need life insurance cover?

- Do you take drugs or drink alcohol?

- Do you work? If so, what is your weekly, monthly, or annual gross salary?

- What level of life insurance coverage do you require?

- Over what period do you require life insurance cover?

- Which premium type best suits your circumstances —increasing, decreasing, or level cover?

Without you truthfully answering questions, premiums may not accurately reflect your circumstances, meaning that should you die, there is a risk that a plan may not payout as premiums are not an accurate record of your true health.

The insurer can offer instant online quotes if underlying medical issues are not severe, and include:

- Diabetes (type 1 and 2)

- Heart attack and heart-related conditions

- Stroke

- Obesity and other weight-related issues

The Exeter will need to assess your personal and medical history for any potential complex medical conditions. An underwriter assessment will be necessary for:

- Alcohol or drug dependency

- Different types of cancer cover

- Multiple sclerosis life cover

- HIV positive coverage

- Mental illness

- Cardiomyopathy

Real and Managed Life Policies – Further Options and Limitations

Like other providers’ policies, The Exeter also includes policy options and limitations in its plans. For Real and Managed policies, several are listed below.

Different cover types are available with your insurance plan

The flexible nature of Exeter life insurance extends to the cover type, which is either increasing, decreasing, or level.

Increasing life insurance cover

As cover increases, the premium and corresponding payout level rise throughout the plan in line with the UK government’s Consumer Price Index (CPI) benchmark.

As the insurance cover level increases, it ensures that any payout is worth the same, in relative terms, as the sum assured stipulated at the start of the fixed-term cover.

Decreasing life insurance cover

Decreasing cover means the premium amount and subsequent payouts will decline over the fixed term of a policy.

Decreasing cover is typically associated with a fixed-term financial obligation, such as a mortgage, where payments decrease over the life of the mortgage until the final payments are negligible.

A decreasing life insurance cover can align with a decreasing level of mortgage exposure.

Level life insurance cover

Level cover life insurance maintains the premium and sum assured at the same level throughout the plan. It can be an excellent option for keeping premiums low in the initial stages.

Still, over time, the payout will be significantly smaller relative to the policy’s start, as inflation begins to take effect.

Terminal Illness Cover

Like other leading life insurance providers, Exeter includes terminal illness coverage in its Real and Managed Life policies.

Terminal illness is an essential component that allows you to claim an early payout of your Exeter life insurance policy.

If you are diagnosed with a terminal condition and expect to die within a year of the diagnosis, you can apply for a financial payout.

The idea behind terminal illness cover is that the one-off payment helps cover medical costs, allowing you to organise your affairs and spend time with your loved ones without the stress of financial concerns.

Accidental Death Benefit

The accidental death benefit is significant at no extra cost on the Exeter’s Real and Managed policies.

Accidental death coverage applies when a policy application is submitted and approved.

With the Exeter, accidental death pays out a lump sum, which is the lower of the sum assured on your application or £250,000.

As with the insurance policy itself, there are conditions attached to accidental death where payment is not due, including:

- Death by suicide

- Death caused by hazardous activities, including extreme sports and pursuits

- Death caused by alcohol or drug abuse.

- If the applicant is 55 years of age or over at the time of application

Mortgage Free Cover Benefit

Mortgage Free Cover Benefit is an option available if you have specifically taken out a policy to repay a mortgage should you pass away unexpectedly.

As with all elements of an insurance policy, conditions are set out at the start of the policy, and for this option, these include:

- The policyholder must be under 55 years of age at the time of application.

- The mortgage cover is the lower of either £500,000 or the approved mortgage amount.

Exclusions and Payout Limitations

As with other life insurance policies, Real Life does have limitations and exclusions when a payout cannot be made, which include the following:

- A special condition excludes cover at the start of the policy.

- The true extent of all underlying medical conditions is not declared at the start of the policy.

- A policy is invalidated due to failure to maintain premiums.

- Your death is caused by suicide or another intentional injury within the first year of the policy.

The Healthwise App

Healthwise is an app that is provided free of charge when someone signs up for a policy. The app provides direct access to medical experts from your smartphone or tablet.

For life insurance policyholders, Healthwise includes:

- General Practitioner (GP) on-demand and prescription services

- Nutritional and dietary advice

- Lifestyle coaching and guidance

- A second medical opinion service

Can I Write A Policy Into A Trust?

As with other major UK life insurers, The Exeter offers the option to have its policies written into trust.

Writing into a trust means a trustee will manage your policy should you die, and they will distribute the proceeds of the plan according to your wishes.

Further benefits of writing a policy into trust include the following:

- Minimising or removing the 40% tax due as part of Inheritance Tax, known as IHT

- Having more control over a policy by appointing a trusted person (trustee) to carry out policy instructions.

- Eliminates the need to undertake the process of probate.

Other Insurance Cover Available from The Exeter

The company offers a wide range of insurance policies, including life insurance products, as well as income protection and private health insurance plans.

We will now give an overview of these additional types of protection.

Income Protection Insurance

Income protection provides a replacement salary if you are unable to work for a period due to injury or illness.

A replacement salary can begin within one month following a claim and continue for up to a year after the claim is submitted.

It is generally decided at the outset of the policy and coincides with your employer’s statutory employment policy regarding payment for sickness absence.

Regarding income protection, The Exeter offers two protection plans, Income One Plus and Pure Protection Plus.

Pure Protection Plus is designed for manual workers and skilled tradespeople. These jobs can also be considered higher-risk occupations, as workers may be exposed to hazardous equipment or work in environments with elevated risks.

Income One Plus is an income protection policy for clerical and professional workers. Because they are office and desk-based, they are not associated with the same occupational risks as manual workers or those in skilled trades.

The Exeter Health Insurance Scheme

The Exeter provides private medical insurance cover, which gives access to personal health cover treatment in the UK.

Known as Health Plus, the private health insurance is designed for conditions that will respond to treatment, and a summary of its key features is as follows:

- Complete cancer cover for a variety of different cancers

- Unlimited day-patient and in-patient treatment

- Home nursing, if required

- Outpatient surgery

- Post-operative physiotherapy

- Parental accommodation, if needed

- National Health Service (NHS) cash benefit

What Is the Insurance Claim Process with The Exeter?

As with other life insurers, a death certificate or a medical certificate confirming a terminal illness diagnosis is required to make a life insurance claim.

The claim process is as follows:

- Contact the Exeter by telephone, email, letter, or online form.

- Provide a death certificate or terminal illness diagnosis certificate, policy number, date of death or diagnosis, and the policyholder’s details.

- Wait for the Exeter to respond to your insurance claim and confirm the next steps to move towards a financial payout to provide peace of mind for you and your dependents.

The Exeter Life Insurance Summary

The Exeter is one of the UK’s leading providers of life insurance quotes, specialising in the industry’s more complex segment involving pre-existing medical conditions.

Suppose you have medical issues and are considering getting life insurance, but find the cost is too high. This company could be a perfect match for you.

Hopefully, this review will provide you with the information you need to decide whether The Exeter can help you secure insurance coverage to eliminate any financial worries.

Further Information:

The Exeter

Lakeside House

Emperor Way

Exeter

EX1 3FD

Main switchboard:

0300 123 3201

General inquiries:

enquiries@the-exeter.com

Website: https://www.the-exeter.com/

AA Life Insurance UK Cover Review

Various life insurance products are available, including level term, decreasing term, and 50-plus. AA life insu…

AEGON Life Insurance Reviews – Compare Quotes

If you want to provide financially for surviving loved ones upon death, AEGON life coverage may be the solution. …

AIG Life Insurance UK Reviews

AIG (American International Group) is synonymous with the insurance industry. AIG is a multinational insurer fo…

ASDA Life Insurance Cover Reviews

ASDA Financial Services offers travel, home, motorist, pet, life insurance, personal loans, trade, gift, and credit card…

Aviva Life Insurance Review – Cover From £5 Per Month

Aviva is the largest UK insurance services provider and the fifth largest insurance group, with more than 45 million cus…

Axa Life Insurance Cover Review

The AXA Group has been in the insurance business since the 18th century. Acquisitions, mergers, and name changes for lea…

Barclays Life Insurance Review

Barclays PLC is a major financial services company backed by more than 300 years of history. Welcome to our new…

British Seniors Over 50 Life Insurance Reviews

Find out about British Seniors Over 50 Life Insurance Reviews, Customer Experience, and Policies Available. Abou…

Direct Line Life Insurance For Over 50’s Review

Direct Line is a household name for insurance products. At the outset, their core offering was vehicle insurance with a …

Ageas Protect Life Insurance Review

Fortis Life is now Ageas Protect, the financial protection arm of Ageas within the UK. The company offers produ…

Friends Life Life Insurance Reviews

Since 1810, Friends Life has been providing financial services. Founded in Yorkshire as Friends Provident in 1832, the c…

LV Life Insurance Reviews

In 2007, Liverpool Victoria rebranded their company name to use LV=. The LV= brand is a visual play on the word…

Nationwide Life Insurance Reviews And Cover

Nationwide Building Society offers insurance, banking, investment, loan, credit card, and mortgage services to residents…

NatWest Life Insurance Review From £5.46 Per Month

Welcome to our newly updated 2026 Natwest life insurance reviews page National Provincial Bank was established i…

One Family Over 50s Life Insurance Reviews

One Family over 50s life insurance offers UK residents aged 50 to 80 a straightforward way to take out life insurance co…

Post Office Life Insurance Review

Welcome to our Post Office life insurance review. In the United States, the Post Office is where residents mail letters …

Prudential Life Insurance UK Reviews

The international financial services group Prudential plc serves over 25 million customers and manages approximately £3…

Royal London Life Insurance Reviews

Royal London is the largest mutual life and pensions company in the UK. It comprises several specialist businesses desig…

Scottish Provident Life Insurance Review

Scottish Mutual Assurance Limited provides healthcare and protection products under the brand name Scottish Provident. …

Scottish Widows Life Insurance Reviews

Scottish Widows is a nationally recognised financial services provider that has served families with financial protectio…

Shepherds Friendly Over 50s Life Insurance Review

The Shepherds Friendly Society is one of the longest-running insurers in the world. In 1826, they began by establishi…

Smart Life Insurance Reviews, What Buyers Should Know

Welcome to our newly updated Smart Life Insurance reviews guide. Smart Life Insurance offers people a range of flexible,…

Virgin Money Life Insurance Review

Virgin Life Insurance is one of the over 400 companies in Virgin Group Limited, the British-branded venture capital cong…

Vitality Life Insurance Review – Should You Buy?

Vitality Life takes a more active role than most insurance providers do by helping people to live active and healthy lif…

Zurich Life Insurance Reviews

Zurich Financial Services Group, commonly referred to as Zurich, was founded in 1872. Headquartered in Zurich, …

Saga Life Insurance Over 50 Reviews

Welcome to our Saga Life Insurance Over 50 Reviews. Many people over 50 are concerned about choosing the right life insu…

HSBC Life Insurance Review

Life insurance is an important financial product that can help provide financial security to your loved ones in the even…

Lloyds Bank Life Insurance Review

“Lloyds Bank is likely at the forefront of your search if you’re in the market for life insurance. But how does this maj…