Life Insurance Over 60 Guide To Cover

Welcome to our newly updated life insurance for over 60s guide. Discover the cheapest life insurance for seniors currently available in the UK.

Insurance Hero has access to specialist insurers, some of which are not available on comparison sites, that understand the needs of people over 60.

Discover the top brands currently competing for the over 60s marketplace, offering value and quality cover.

Whether you are retired, still working, or running a business, it doesn’t matter. Insurance Hero can help you get the cover that fits.

Over 60s Life Insurance In Summary:

Securing life insurance in your 60s is more crucial and attainable than ever. It empowers you to provide for your loved ones even when you’re no longer around.

Insurance Hero can help you find the most comprehensive and cost-effective products available.

Here’s why it’s worth considering:

- Peace of Mind: Life insurance offers financial security for your family, easing the burden of debts or ongoing living expenses upon your passing.

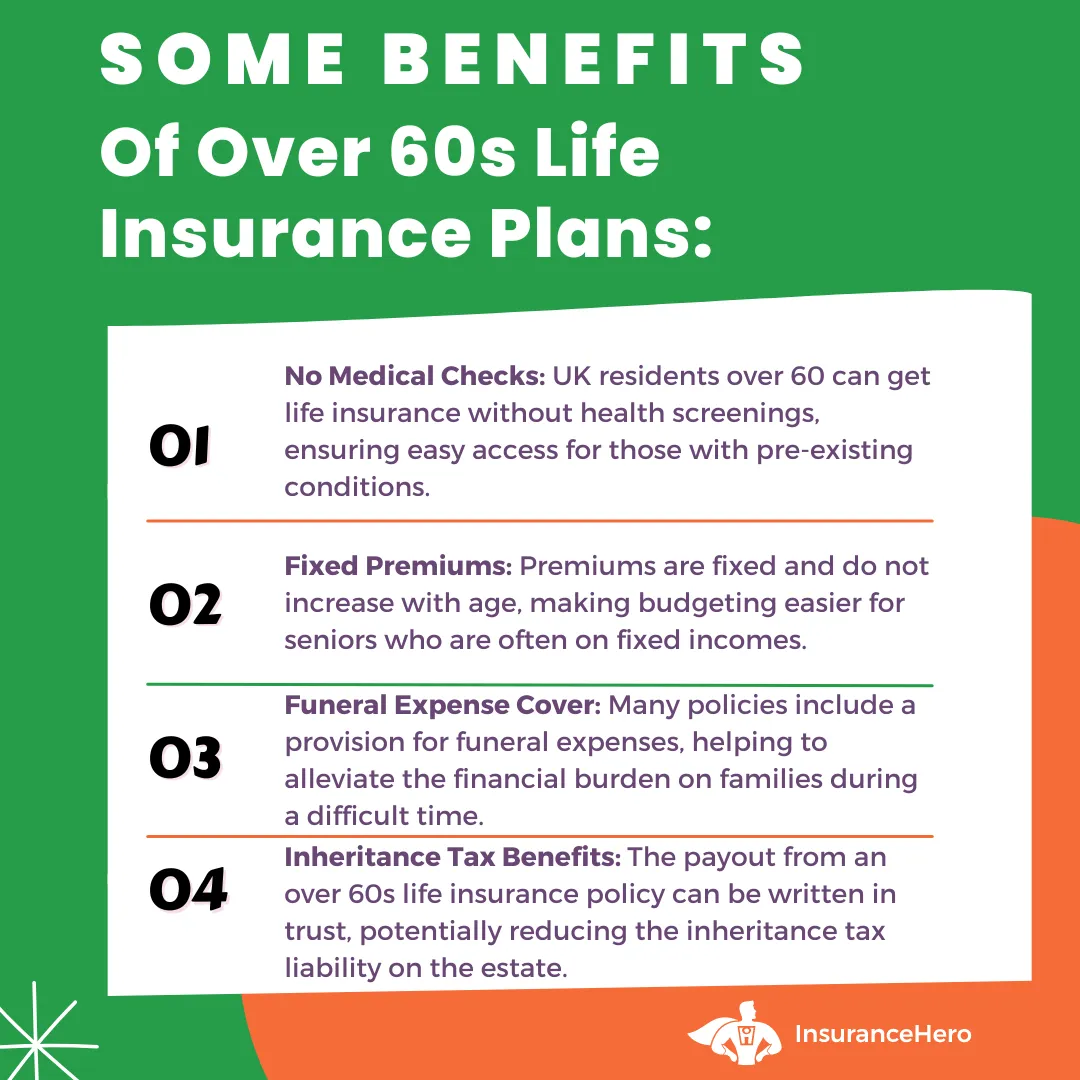

- No Medical Exam Required: Many policies now offer guaranteed acceptance without a medical exam, making coverage easier to obtain for those with pre-existing conditions.

- Affordability: Competitive premiums and the absence of medical exams lower the barriers to obtaining life insurance, making it a sensible choice even later in life.

Searching For Top Rated Over 60 Life Insurance? Easily Compare Cover Simple Quote Process

What Is Over 60s Life Insurance?

Advancements in medical care have improved life expectancy and made it much more likely that people will live past sixty.

Some people call this age the new 40 because many live until their 80s or 90s. This cover is for those who did not purchase life insurance earlier and want to save money by doing so now.

The over-sixties age group is no longer prominently placed in higher-risk categories and benefits from lower life insurance rates.

Several UK insurance companies now offer terms explicitly designed for this age group, with guaranteed acceptance for certain levels of coverage.

Guaranteed acceptance eliminates the need to undergo medicals to qualify for life insurance. People in their sixties who know or suspect they have underlying medical conditions need not worry about being denied coverage.

A premium considers coverage levels, age, gender, and smoking status. By quitting smoking at least a year before applying for an over sixties plan, people will significantly reduce their premiums.

Men of all ages usually pay more than women because they tend not to live as long.

These life insurance plans provide a payout upon the insured’s death, allowing a person over 60 to arrange for a lump-sum or one-off payment to be paid to one or more designated beneficiaries following a claim.

When considering how much life insurance coverage to purchase, factor in expenses resulting from your death, as well as ongoing expenses such as mortgage payments, loan payments, or debts from other lenders.

Many seniors over 60 are entering or nearing retirement, making it essential to leave enough money for a surviving spouse or partner to live comfortably in their golden years.

Should You Buy A Life Insurance Policy In Your 60s? Some Good Reasons

- Life insurance is a great way to protect your family from financial hardship.

- You can use the life insurance money for any number of things, such as paying off debts or a mortgage.

- Your children can go to college and pursue their dreams without worrying about how they’ll pay for it.

- You’ll want peace of mind that if anything happens, your spouse won’t have to worry about making ends meet on his/her own

- If you die before retirement age, your spouse could lose out on any pension benefits he/she might receive from your employer. With life insurance in place, these benefits are protected.

- You may need life insurance to pay for your funeral expenses

- In many cases, it’s possible to convert a traditional policy into a whole or term policy at no cost

- It’s never too late – even if you’re over 65, there are still ways to get coverage

- The cost of premiums increases with age, but the amount of coverage stays the same

Providing for Children or Grandchildren

Many people have children later in life, meaning they may not be financially self-sufficient if their parents die. Over-60-year-olds may also have young grandchildren whose parents are struggling due to the economy.

Providing for these younger generations through an over 60 insurance plan is one way to brighten their future.

Children can establish themselves comfortably, and grandchildren can attend university without taking out student loans. It is also a simple way to leave money as a gift for loved ones.

When parents pass away, family and loved ones are often left to handle the estate. Having extra money on hand to cover final bills, the funeral costs, and mortgage repayments until the home sells is helpful.

A funeral benefit option offered with most plans can help cover funeral costs. It means children will not need to dip into their savings to cover expenses related to a parent’s estate.

If each parent purchases a separate life insurance policy, beneficiaries will receive payouts upon each parent’s death.

Caveats with Over 60-Plus Life Cover

Reading the fine print is always a smart idea, especially when it comes to insurance planning.

A life insurance policy does not pay out within an initial coverage period of one or two years (determined by the insurance company) unless the insured’s death is an accident.

However, some companies will return premiums paid when death occurs during this period.

This policy lasts for the lifetime of the insured unless premium payments cease. If the individual stops making payments or decides to cancel the life insurance policy, premiums already paid will not be refunded.

People should consider all their options before purchasing because this product never has a cash-in value.

If a person elects a high coverage level and lives for 20 or 30 years, the total premiums paid could exceed the benefits provided at death.

Shopping Around Does Matter

Research shows that rates for over 60 life insurance vary by as much as 50 percent between insurance companies.

Finding appropriate cover can be difficult because most people do not know where to look for competitive products.

As experts, we know who offers this cover and can quickly find competitive premiums to get you the best deal. You complete our online quote request form, and we return policy quotes for your consideration.

Our service is impartial, and you are not obligated to purchase a life insurance policy. However, we recommend considering several things if you choose to purchase one.

A guaranteed acceptance plan is the easiest to qualify for, and an insurance company with an excellent financial strength rating is considered the best.

The Insurance Hero team will work hard to secure the cheapest quotes for your specific needs.

Technology and Affordable Life Insurance For Those Over Sixty

Though shopping online with us is the most convenient way to find inexpensive life insurance for over 60s here in the UK, we understand that some people in this age group are uncomfortable with computers.

Therefore, a customer service number provides the same quotes offered through an online search.

We examine the policies of the best life insurance companies and return with a selection of quotes we hope meet your expectations.

Customer service representatives are available for our customers during extended hours throughout the week and on Saturdays. If you cannot reach us, request a callback, and one of our experts will contact you.

Children and other family members can help older adults find the best available life insurance.

Our online quote request form will be secure for them to complete because it does not require complicated information.

For example, children can submit a decreasing life insurance quote request and view the provided quotes with the individual requesting the coverage.

No parent wants to think about death; we want a rose-petal path that lets us see our children through their happiest childhoods into adulthood with full education and a trauma-free upbringing.

Sadly, for 1 in 29 children across the UK, that doesn’t happen. Research by Parsons UK estimates that by the age of 16 years, one in twenty children has lost one or both parents.

That same research also shows that social class and geography affect the risk level. The more disadvantaged an area a person lives in, the higher the risk of parental bereavement becomes.

Of those who lose a parent, it’s more likely that the surviving parent will not be in work.

For those with the highest risk of parental grief, given that mortality is linked to social class and geography, the unfortunate part is that those most in need of life insurance are likely going without it.

This topic needs highlighting because an over 60 life policy is more affordable than most people think. Of those who are perhaps parents struggling with existing health problems, that may be a reason for going without life insurance because of the higher cost of premiums.

For that, the most straightforward approach is to buy a level-term insurance policy that you can easily afford.

The rule of thumb is to have a life insurance plan equal to 10 times the primary income earner’s income. For some parents, that’s not feasible, especially if pre-existing illnesses increase the cost of cover.

What types of life insurance are there for over 60s?

As people grow older, the types of life insurance policies they are offered change. What may have been suitable for them in their 20s, 30s, 40s, and so on may no longer be appropriate now that they are over 60.

Many term life insurance plans offer coverage until you reach the age of 65 or 70, which then converts to regular life insurance plans. What can be done is to continue paying the higher premiums for the term life insurance plan.

However, more and more people find that employer-provided group policies do not renew after age 65 or 70.

This means that if you have a group policy at work, it will only cover you while you are working. In this case, you need to look into a life insurance policy for the over 60s.

The following are some types of life insurance available to people aged 60 and above:

Term Life Insurance

One type of life insurance policy offered to those over the age of 65 but under 75 is known as a Term Life Insurance policy. Term life insurance provides an affordable way to protect a person’s family should they die before retirement.

Mortgage Life Insurance

Another type of life insurance for those over the age of 60 is Mortgage Life Insurance. This plan would pay off a person’s mortgage if they were to die before the mortgage was paid off.

This means you always have a home once you’ve retired, regardless of your health condition. This policy does not pay for a person’s medical expenses, food and other living costs.

It should be used as a secondary insurance policy to cover additional needs once the mortgage has been paid.

Increasing-term Insurance

Increasing-term life insurance policies are another type of life insurance available to those over the age of 60. These policies increase in value each year for as long as the premium is paid.

This means it will pay out a higher death benefit should you die during one of these periods where it has increased.

You must remember to keep paying the premium for as long as you want the policy to continue rising in value.

It can be concluded that as people age, they change, and their life insurance policies should reflect those changes.

This means that if you were suitable for a specific type of life insurance policy when you were younger, you might not be ideal for it now that you are older.

Changing your life insurance policy over time, rather than cancelling it altogether, is possible.

What is the best life insurance for over 60s?

The level-term cover is the cheapest.

The longer the term of a 60 plus life insurance policy, the higher the cost. The harsh reality is that you’re more likely to die, resulting in the insurer needing to pay out, pushing the premiums higher.

Consider the term you need to cover based on the age of your youngest child. For example, for a family with two children, the youngest of whom is 8 years old, you may want to invest in a level-term policy to protect until your youngest reaches 16, 18, or 21 years of age.

The shorter the term is, the cheaper the premiums will be because of the lower risk level of your passing away within that time frame.

Using the example above, for life coverage until your eight-year-old child reaches 16, it would be an 8-year term policy. That will cost a lot less than a whole-of-life policy.

Another good thing about level-term coverage is that it’s based solely on death, not on additional coverage such as critical illness or terminal illness, which are optional extras.

There will be the usual exclusion of suicide within the first year of the policy, which is worth mentioning as parental suicide affects around 6,000 children annually.

The Association of British Insurers estimates that 98% of life insurance claims are successfully payout.

They can invalidate, though, by non-disclosure of any mental health problems or other conditions. Life insurance for over 60s is for protection and not an answer to financial difficulties.

Some advice to get the best price on level term life insurance

- Don’t go directly to a life insurance company for quotes. You must be lucky to get the best price and coverage available. The UK life insurance market is competitive, with many more providers than most people know.

- Comparison websites can help with life insurance by providing numerous quotes to suit your needs. It is based on your age, existing health, family background, and many other health and lifestyle factors, including whether you are a smoker.

- Once you have chosen one or more providers from No. 2 above, obtain a tailored quotation from them because arranging over-60 life insurance can be tricky, given how personalised the quotes need to be.

The specialists at Insurance Hero work with you to help you understand your real requirements.

We provide tips, guide you through the jargon, and match you with a suitable provider and a life insurance policy that fits your needs and budget. Being a senior does not mean that your life is not worth insuring.

Individual policies are available for life insurance for over 60 age groups and also life insurance for retired persons. The Insurance Hero site makes such cover easier to find.

The application process is as easy as requesting a quote. Buy that perfect cover today, and take care of loved ones after you have left them.

Related Reading:

Summary

“Over 60s Life Insurance” is a specific type of life insurance plan designed for individuals aged 60 and above. It often falls under the category of over 50s life insurance plans.

These products do not require a medical check and offer a fixed lump sum payout upon death. The policy requires monthly payments; if these are stopped, no benefits are paid.

The cost of the insurance and the payout can vary based on several factors, including age, health, and the policy’s terms.

Key Features

| Feature | Description |

|---|---|

| Age Eligibility | 60+ years |

| Medical Check Requirement | Not required |

| Payout Type | Fixed lump sum |

| Payment Terms | Monthly: ceasing payments can lead to loss of benefits |

| Policy Type | Often falls under over 50s life insurance plans |

Cost Considerations

| Factor | Description |

|---|---|

| Age | Higher age can increase the cost |

| Cover Amount | Depends on the desired payout |

| Policy Duration | Affects the monthly premium |

| Smoking Status | Smokers might pay higher premiums |

Average Cost Example

| Age Group | Average Monthly Cost | Cover Amount |

|---|---|---|

| 60s | £20.41 | £4,000 – £5,000 |

Comparison with Standard Life Insurance

| Insurance Type | Description |

|---|---|

| Standard Life Insurance | Term-based; can be more expensive for over 60s |

| Over 50s Plan | There is no term limit; it is more affordable for the over 60s |

Types of Term Life Insurance

| Type | Description |

|---|---|

| Decreasing | Payout reduces over time, often aligned with debts |

| Level | Fixed payout amount throughout the policy term |

| Increasing | Payout increases annually with inflation |

Life Insurance Over 60 FAQs

Can I get life insurance over 60?

Yes, you can purchase life insurance over the age of 60. This can be done by buying group insurance or a private insurance policy.

You can get life insurance over 60 years of age. There are no upper limits on life insurance policies. You can get a policy for any amount you need.

How much does life insurance over 60 cost?

Life insurance costs depend on several factors, including health, age, and tobacco use. An insurance comparison tool can help you find life insurance rates and quotes.

How much does term life insurance cost for a 60 year old?

The cost of term life insurance for a 60-year-old in the UK varies based on health, lifestyle, and coverage amount.

On average, premiums can range from £20 to £80+ per month. Smoking status, medical history, and policy length significantly influence the cost.

How much is whole life insurance for a 60 year old?

As with term coverage, the price of whole life insurance for someone aged 60 in the UK depends on several factors, including health status, lifestyle, and the level of coverage desired.

Monthly premiums can range from £40 to more than £200. To obtain precise cost estimates, it is important to obtain tailored quotes from insurance companies, as individual situations significantly affect the overall price.

Can I get life insurance over 60 with no medical?

Many life insurance companies require a medical exam when you apply for life insurance. However, if you are 60 years old or older, you can apply for and get term life insurance with no medical exam.

How long does it take for a life insurance claim to be paid?

The length of time it takes for a life insurance claim (for example decreasing life insurance) to be paid varies depending on the company and the policy.

The company typically requires a death certificate and other paperwork to process the claim. Once all necessary documentation is received, the payout usually happens within a few weeks or months.

Will my life insurance premiums ever go up?

The answer to this question depends on a lot of different things.

For example, if you have a family and are older, the premiums will most likely go up because, statistically, people with families tend to be older.

If you don’t smoke or drink excessively, your life insurance premium is more likely to stay level or go down over time than go up.

Finally, suppose someone in your household has life insurance through their employer. In that case, they may be able to trade in their old policy for something new once eligibility requirements are met – but again, these changes would depend on many factors.

Hence, I recommend researching before making any decisions about this possibility.

How long does life insurance last?

The length of life insurance varies depending on the type of policy purchased. Generally, however, life insurance policies have a term of 10-30 years.

At the end of the term, the policyholder must either renew the policy or let it lapse. If the policyholder dies during the policy’s term, the insurance company will pay his or her beneficiaries.

Over Sixty Life Insurance In 2026

Many people aged 60 or over think that life insurance is only for young families, but leaving some money for your loved ones after you die can be affordable.

An over-60s life insurance policy will pay out a cash sum if you die during the policy’s term. You can choose how much cover you need at 60 and how long. So why not get a no-obligation free life insurance quote today?

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.