Life Insurance As An Income Replacement After Retirement

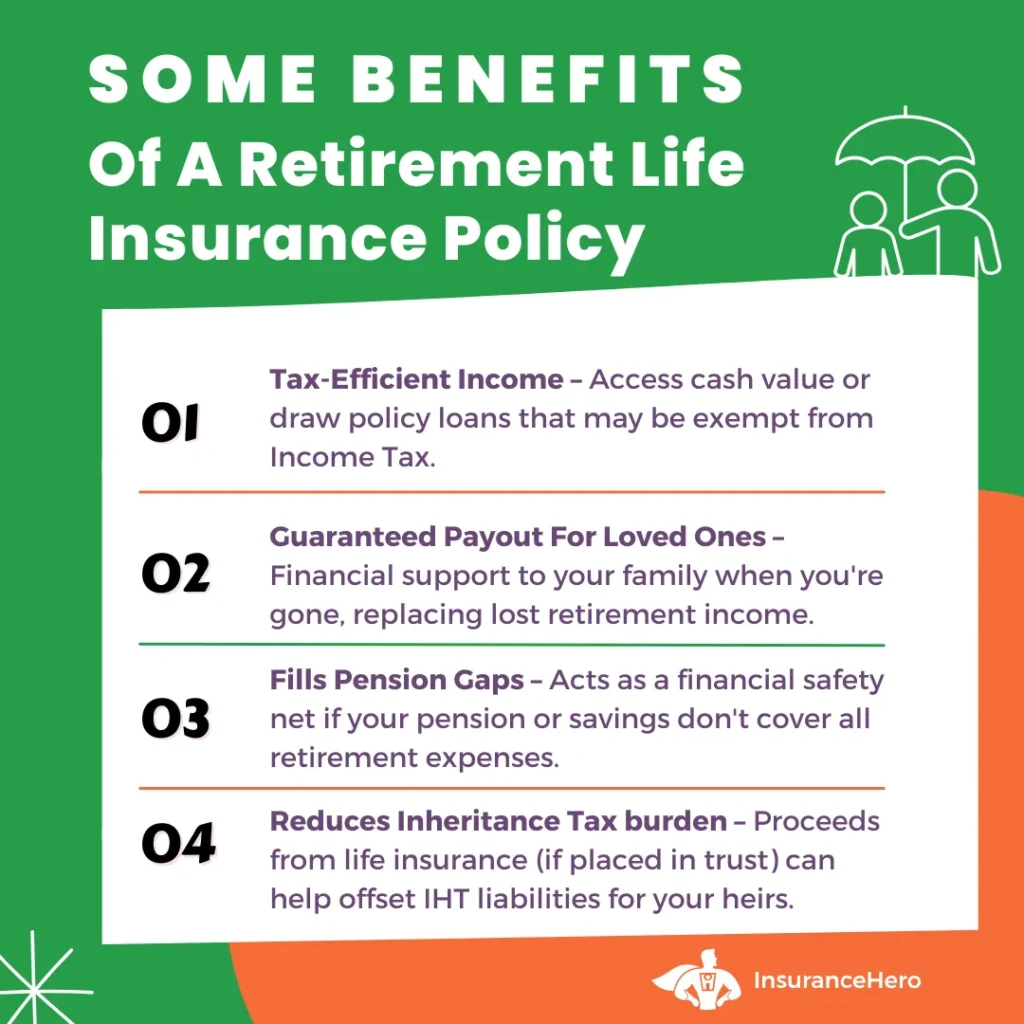

Life insurance for people over sixty is often seen as beneficial after death. However, many policies offer a cash value component you can use while alive.

This amount grows over time at a rate either tied to the stock market or pre-determined by your policy provider, and it becomes accessible once you have accrued a certain amount.

After retirement, you can often make a withdrawal, take out a loan, surrender, or sell your life insurance policy to use its value as an income replacement.

Retired And Need Life Insurance? Get A No-Obligation Quote Today

| Strategy | How It Works |

|---|---|

| Whole of Life Cover | Some life insurance policies accumulate cash value that can be accessed later for supplemental retirement income. |

| Using Cash-In Value | It can pay beneficiaries a regular income after the policyholder’s death, rather than a lump sum, replacing lost retirement income. |

| Family Income Benefit | It can pay beneficiaries a regular income after the policyholder’s death instead of a lump sum, replacing lost retirement income. |

| Pension Shortfall Support | Life insurance offers security and provides income if pension savings fall short or are depleted early. |

| Inheritance Planning | Life insurance payouts can help support loved ones financially and mitigate Inheritance Tax liabilities. |

| Tax-Efficient Withdrawals | Some policies allow partial withdrawals or loans that may not be subject to Income Tax, providing tax-efficient income in retirement. |

How to Use Life Insurance as Retirement Income

Here are the four main ways to use life insurance as an income replacement after retirement:

Make a Withdrawal

Most life insurance policies with a cash value component allow you to withdraw a portion of your earnings after some time.

The amount you withdraw is usually tax-free, as long as you don’t exceed how much you’ve paid in premiums since the beginning of your contract.

Take Out a Loan

Taking out a loan against your life insurance policy is like withdrawing, except you’re expected to repay what you borrowed.

Policy loans are great because the loan amount doesn’t come with any tax liability, and you don’t have to go through a lengthy loan approval process to receive the money.

You’re also not obligated to repay the loan if it doesn’t exceed the total cash value. Accrued interest may cause the policy to lapse, so you should still pay the annual interest.

It’s also good to note that if you don’t repay the loan before you pass away, your insurance provider will deduct the outstanding balance from your beneficiaries’ total death benefit.

So, if you’re thinking about how to determine if you need life insurance for inheritance tax planning after sixty, you might want to factor this in so that your family can pay the necessary costs.

Surrender Your Policy

‘Surrendering’ your life insurance simply means cancelling it, either because you no longer want the coverage or because you’d rather stop paying premiums on the product.

This allows you to obtain the total cash value accumulated by your policy over time, minus any applicable fees.

Sell Your Policy

If your life insurance provider allows it, you can sell your policy (also called a ‘life settlement’) to a third party.

In exchange, you can get a one-time cash payment that’s typically less than your total death benefit but more than your policy’s surrender value.

Hiring an independent expert and finding a reputable broker to facilitate this process is best.

Types of Life Insurance To Consider for Post Retirement

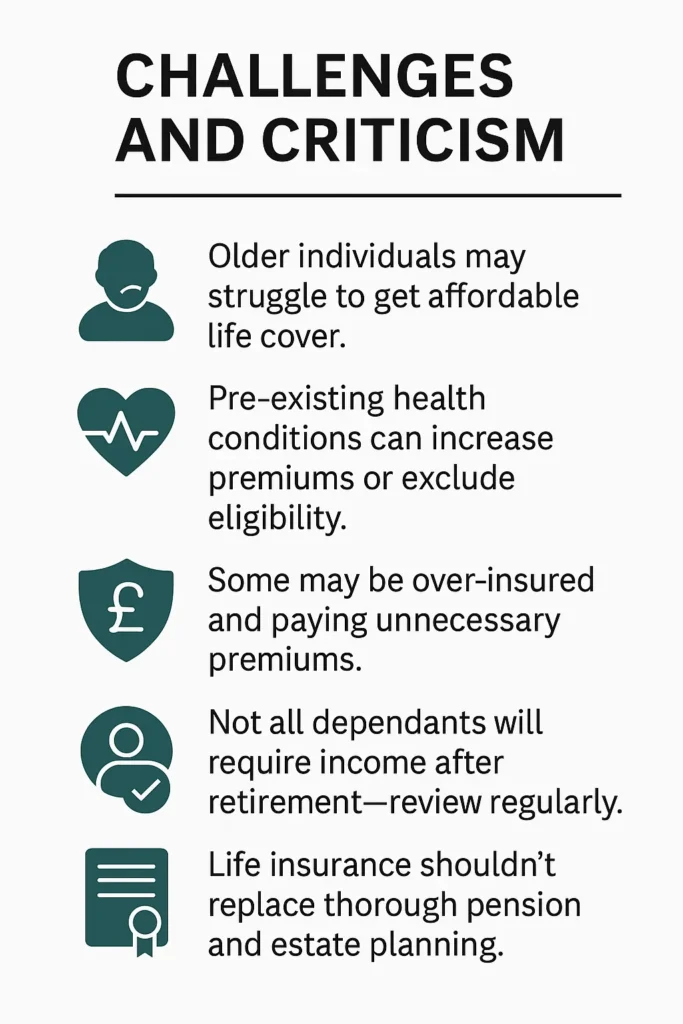

- Whole-of-life insurance is popular with older UK policyholders as it guarantees a payout.

- Term insurance is less adequate post-retirement due to age limits.

- Over-50s plans are a standard UK option but often offer lower payouts.

- Some retirees opt for joint life insurance, which pays out on the second death.

Calculating Life Insurance Coverage for Retirement Income

You must calculate a sufficient coverage amount to ensure that the amount you get from your life insurance policy is enough to replace your income.

Remember, age impacts life insurance premiums for seniors over sixty, so if you’re at retirement age, you might not get as attractive rates as younger policyholders.

Estimate Current and Future Income Needs

Look at your daily living expenses and determine how much you and your family need to sustain your day-to-day lifestyle and cover ongoing financial commitments.

Consider Inflation

Factor inflation into your calculations to ensure that your life insurance policy is sufficient to cover your expenses over time.

Appraise Existing Assets

Your life insurance policy alone may not be enough to replace the entire value of your income after retirement.

It is ideal to have other profit-generating financial products or assets that can supplement your finances. Evaluate your portfolio, considering land, cars, savings, and investments.

Alternatives & Complementary Products To Life Insurance

- Annuities may provide guaranteed income but end upon death.

- Savings and investments can serve the same goal, but are not guaranteed.

- Equity release may provide income,e but reduces inheritance.

- Funeral plans are sometimes confused with life insurance, which has a different function.

- Pension death benefits might be enough for some—insurance fills the gaps.

Life Insurance Policies Past Sixty

Life insurance remains a valuable financial product for individuals over 60. Not only does it provide financial protection to your beneficiaries after you pass, but it also provides you with ways to replace your income after retirement.

Find the best life insurance for over-sixty people with help from Insurance Hero today.

Further resources related to this subject:

- https://www.gov.uk/government/publications/planning-and-preparing-for-later-life/planning-and-preparing-for-later-life

- https://adviserservices.fidelity.co.uk/media/fnw/guides/retirement-income-advice-guide.pdf

- https://www.actuary.org/sites/default/files/files/The-Challenge-of-Longevity-Risk.pdf

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.