When Grandparents Should Review Their Life Insurance Policy

For grandparents, there are often a lot of people to spread what should be the wealth around

In the end, by the time you’ve calculated the amounts to go to your son, daughter, grandkids, husband/wife, funeral expenses, and potential inheritance tax bill, it makes complete sense that the policy is reviewed periodically.

In particular, when there are changes to your family’s circumstances, and especially for those who will be directly affected by higher living expenses, who are named as your beneficiaries.

When you have grandkids, there are a lot of expenses cropping up. The circumstances below are examples of when you’d want to discuss with your insurance provider to make amendments to your policy related to your grandkids.

Protect Your Loved Ones And Get Peace Of Mind With Family Life Insurance Today

When grandchildren will need a lot more money

1) When special health needs are required

This is unbearable to think about, and it’s not going to be on your mind until it’s happened: a serious diagnosis that will require long-term support, which in turn requires additional financial support.

2) Learning support

Health needs don’t necessarily mean physical health. It can be as slight as the learning difficulties a child is diagnosed with, requiring their parents to fund private tuition or hire a tutor for additional educational support.

The costs of private tuition vary greatly. It can cost £3,000, rising to a staggering £15,675 per term in affluent areas.

An alternative to private education is hiring an independent tutor. Again, these costs vary, typically ranging from £29 to £41 per hour.

3) The cost of childcare

Those who are retired or semi-retired will likely find that their time is taken up caring for their grandchildren while Mum and Dad are at work.

Many parents wouldn’t entertain the idea of paying their parents to watch their kids while they go out and work. So the childcare they currently receive is a courtesy from you, with no money changing hands.

When things change, and you aren’t around to provide the additional support, someone will need to do it.

Will there be someone available to take over your role as caregiver, or will your children need to hire a childminder for the grandchildren?

That’s a cost that hits family finances and ought to be factored into the total amount of coverage you have with your life insurance.

4) College and University Fees

Education is only free up to a certain point. After that, when kids go to college, it’s often a bursary they receive.

That’s based on their parents’ earnings. If that’s higher than the faculty’s threshold, Mum and Dad will be expected to partially fund their education.

Suppose household finances are decent but not considered a high-income household.

In that case, a top-up bursary may be available, but if the household income is in the high bracket, the bank of Mum and Dad may need to pay for advanced education.

Should they be unable to fund college and/or university, the alternative is student loans, and that’s when your grandkids start racking up debts before they qualify for a job.

Your life insurance cover can help prevent your grandchildren from inheriting large amounts of student debt, enabling them to start life debt-free.

The only way they won’t pay for university fees is if they’re super smart and able to secure a scholarship.

Other than that, chances are, if their parents are working, they’ll need to pay something towards the cost of their education, so they may need some top-up money to see them through their entire education without worrying about money or feeling forced into taking on a part-time job.

5) When the family grows

That day, when your son/daughter tells you to sit down as they have something important to say to you and then proceeds to inform you of a soon-to-be new addition to the family, is the time to have your life insurance coverage reviewed.

All the thoughts that went into financial protection for your first grandchild should be repeated for the next.

Naturally, the expenses will double and triple if a third comes along. Each time, revisions should be made with your life insurance provider to ensure you have enough cover to provide financial support to each family member who relies on your income or time.

In the case of your family outgrowing the level of cover you can afford, it may be best to adjust the amounts shared with the beneficiaries rather than increase your cover level.

You can change your life insurance policy anytime. It’s easier to increase your level of cover than it is to decrease it.

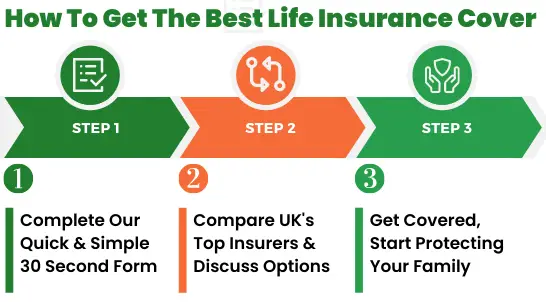

Whether you choose to remain with your existing provider or change to a new insurer is up to you, but should you decide to switch your provider, it would be wise to have an independent insurance advisor go over the terms and all clauses to ensure you are switching like-for-like but with the additional level of protection.

Nothing that was covered in your current policy should be taken away when you switch your policy with your existing provider or with a new insurer.

You can have more than one policy, so it may work out cheaper to leave your existing cover unchanged and take out an additional policy for the level of cover you require.

That could mean you get a more affordable deal for the same level of coverage.

Revise with Caution when Your Policy is written in Trust

Having your policy written in Trust is sensible, as it can avoid a hefty inheritance tax bill.

There are legal elements to establishing a trust. Still, surprisingly, the policyholder can invalidate an entire trust simply by switching to a different type of product, even with the same insurer.

It can dissolve an existing trust, setting up a new one automatically as happened here due to the execution-only option.

When Trusts are involved, never instruct an insurer to make changes before seeking professional financial advice.

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.