Job Security In The UK: What To Do If Your Job Isn’t Secure In 2025

In times of economic uncertainty, job security is a primary concern for millions worldwide. Here in the UK, things are no different.

Even that only tells half the story. In the modern pursuit of profits, companies feel beholden to shareholders and executives and happily reduce their staff rosters even when making record profits just to increase those numbers even further.

While this is most prominent in the United States, it happens worldwide.

The truth is that relatively few people have true job security in the UK. Most of us are beholden to the whims of the market, seasonal shifts, sudden competition, being let go at the whim of a manager, or any number of other potential issues.

Job security is distressingly scarce. A 2020 report even indicated that as much as 60% of Britain’s workforce feels insecure. The pandemic didn’t help, but it’s still a worrisome trend.

So, what can you do if your job isn’t secure, if you’re worried about your future, or if you want to plan to have some leeway in case the worst happens?

Job Security is Uncertain. Your Family’s Future Doesn’t Have to Be. Get A Life Insurance Quote Today

Why Job Insecurity is Rising

For various reasons, job insecurity is reaching a near-all-time high, locally and globally.

From the top down, companies have no qualms about firing or releasing their workers’ contracts to operate with the thinnest workforce they can.

Payroll is one of the largest expenses a typical firm has to pay, so cutting out workers – even if it means overworking those who remain – is beneficial for the short-term bottom line.

This isn’t limited to specific sectors, either. You can see it in banks, in tech firms, and everywhere else. Some areas tend to have more security, like the tenured positions in academia (specifically, non-tenure roles are among the least secure in the UK), engineering, healthcare, and primary school teaching.

You also have the pressure of advancing technology. The hottest buzzword on everyone’s lips right now is AI, with generative AI making all manner of positions redundant, cutting out creatives who work in technical and business writing, illustrators and graphic designers who work in marketing and production, and more.

AI also takes over in back-end roles, condensing what used to be several positions into one.

AI, of course, is undergoing a lot of evolution in a very short amount of time. It’s facing legal challenges, and there’s a lot to sort out about the ethics and legality of using it. That doesn’t stop companies from taking what short-term advantage they can from it, though.

There’s also the broad shift to more freelancing and gig work. Food service doesn’t need to maintain as many delivery drivers when Deliveroo will do it for them.

Taxis now work with Uber rather than face stiff competition from the subsidised app rideshare system. People who formerly worked salaried or hourly roles now have to find those same roles through contract work, with much less security and stability than before.

Of course, the elephant in the room is Brexit, which is still having far-reaching consequences on partnerships, logistics, shipping, and doing business throughout the rest of Europe.

Whether you were for or against it in the referendum, there’s no denying that it has had a detrimental effect across the UK. From the bottom up, job security is a different beast.

Overview of job security across various industries and regions in the UK

Best Industries For Job Security In The UK

| Industry | Redundancies in 2023 |

|---|---|

| Agriculture, Fishing, and Utilities | 5,051 |

| Public Administration and Law | 12,446 |

| Education | 18,759 |

| Miscellaneous Services | 22,556 |

| Transport and Storage | 23,391 |

| Human Health and Social Work | 15,335 |

Worst Industries For Job Security In The UK

| Industry | Redundancies in 2023 |

|---|---|

| Wholesale, Retail, and Motor Repair | 71,789 |

| Manufacturing | 57,376 |

| Hospitality | 32,623 |

| Financial, Insurance, and Real Estate | 31,088 |

| Administrative and Support Services | 30,021 |

Best Areas In the UK For Job Security

| Region | Redundancies in 2023 |

|---|---|

| Northern Ireland | 7,579 |

| North East | 14,663 |

| Wales | 15,218 |

| Scotland | 26,431 |

| East Midlands | 28,473 |

Worst Areas In The UK For Job Security

| Region | Redundancies in 2023 |

|---|---|

| South East | 72,324 |

| London | 66,844 |

| East of England | 43,636 |

| North West | 42,542 |

| South West | 42,201 |

Unfortunately, there’s not actually much you, as an employee, can do to increase your job security.

Layoffs affect the most and the least engaged employees, and so often, corporate leaders choose the numbers and don’t care who is let go so long as X number of people are removed from the payroll.

When the decision is more ground-level, or the company you work for is much smaller, you can do more. In these cases, job security can relate more to your performance, engagement, and ability to work with the team and foster a positive environment.

When you’re getting hired for a job, you can improve your security through contract negotiations. Having set terms for your minimum hours and other protections (like union backing) can make it harder or costlier to fire you.

This doesn’t always stop it from happening (sometimes with incredible results), but there are many ways a firm can make it such a hostile workplace that you either suffer – physically, mentally, emotionally – or quit with no recourse.

With job insecurity plaguing every industry, every role, top to bottom, what can you do?

Making Your Job More Secure

This is going to be a short section because – to put it honestly – there isn’t much you can do to make a current job more secure.

You can do extra work and hope that it’s recognised, but will it be? Often, it just means you’ll burn yourself out and be dropped the moment that productivity fades. There’s often not much you can do through sheer productivity that can save you.

Networking is another story. By shmoozing with the bosses, you may be able to keep your name from the list of those cut when the time comes. It’s far from guaranteed – and if you find it personally distasteful, it can be highly stressful – but it may help if you can pull it off.

One of the more reliable ways to improve your job security is to join – or even form – a union. Unions have power with collective bargaining, contracts with standard rules and terms, and more.

There’s plenty of pressure from the government and elsewhere to make unions worse, but you have to think why that may be. The power they wield for the common people should not be overlooked.

Short of contract terms that enforce your job security (and penalise a company for making your work environment so hostile you want to break the contract yourself), most of what you can do isn’t actually about making your current job more secure.

Instead, you should focus on two things: moving roles to a more secure job and insulating yourself from the negative effects of a layoff.

Finding a Career With Better Job Security

While Baby Boomers and Gen X are used to more secure jobs, younger generations are much more prone to job-hopping.

When companies aren’t loyal to employees when pensions and benefits are cut, when layoffs come at any time, and when upward mobility is much more limited, it’s no surprise that younger people find the best way to improve their position is to leave it.

The hope, then, is to rise to a position at less risk of being cut, with greater job security and a more fulfilling overall role. What should you look for in a job to make sure it’s as secure as possible?

First up, ask the right questions in an interview. Remember, interviews are about more than just the firm evaluating you; it’s about you evaluating your fit with the firm.

Some questions you might consider asking include:

- What’s the career path for people in this role? If most people in the role don’t advance or can’t tell you of a career path beyond growth in responsibility, it may not be secure.

- What opportunities are there for growth and development? Firms investing in their workforce are usually more secure than companies that don’t care and treat their employees interchangeably.

- How have you adapted to remote work and flexible hour demands? Companies that refuse to adapt to the times are less likely to be flexible and will generally be less secure.

You can also research a firm ahead of time. If you search for the firm’s name and see reports of layoffs, well, you have your answer. It’s also possible to seek out existing or former employees on sites like LinkedIn and simply ask.

If you get far enough in the interview process to be offered a contract, you can also evaluate that contract for signs of security.

Minimum-hour contracts, contracts with defined responsibilities and scopes, and contracts with self-limiting language can be good because they indicate the firm isn’t in the business of exploiting workers.

Finally, and obviously, a role with a union attached will give you a higher degree of security than one without.

Protecting Yourself from Job Insecurity

Whether you work in an insecure role, you’re worried about overall job security regardless of the reality of the role, or you simply can’t find a role with the signs of security, there are always going to be reasons to insulate yourself from a sudden job loss.

After all, even the most secure job can be cut out from under you during a recession or if something happens to the firm at a high enough level that it needs to fold.

The first and most important is to handle the mental issues that can arise from job insecurity. Most specifically, the anxiety. Anxiety is real, even if the reasons for it are irrational, and acknowledging that is the first step to fighting it.

Perhaps the biggest step you can take with anxiety is identifying what is and isn’t in your power to control and to learn to let go of (or plan for) the things you can’t control by taking more control of the things you do.

Of course, we’re only giving you the barest overview here; you can read more detailed information here and talk to specialists if you can’t manage it yourself.

Another piece of advice is the common aphorism: expect the best, but plan for the worst. Even if your job feels secure, it might not be; even if your job feels insecure, it might not be.

While you shouldn’t labour under constant anxiety for no reason, you should plan for the worst-case scenario where your firm implodes overnight and you’re left with nothing. It’s rare, but it can happen.

Another way to help protect yourself from job insecurity is by investing in yourself and your skills. Learn new things.

Build and grow your skills. Study for and obtain certifications that can prove your knowledge to future employers.

You might even study your current boss, see what they do, and learn how to do it. Even if you can’t take over their role, you can advance to the same position with another firm later.

Some of this can be expensive, and all of it will be time-consuming, but it’s extremely useful for finding a new, better job if your current one stagnates or disappears.

Networking is also, like it or not, one of the most important aspects of fighting job insecurity. Having friends throughout the industry you enjoy will allow you to put out feelers and rapidly find a new job if your current one evaporates.

The biggest source of anxiety and stress relating to job insecurity is the loss of income.

So, how do you protect yourself from a sudden loss of income?

- Work on building up savings. Far too many people grow their lifestyles to meet their income rather than maintaining a standard of living that allows them to plan for the future. Instead of treating extra money as expendable, put it in investments, long-term and high-yield savings, and other vehicles for the future.

- Proactively negotiate and pay off debts. You might be surprised at the leeway you can get from creditors simply by remaining in communication with them. Paying off your debts is a good first step towards financial independence and a more secure future.

- Control expenses and cut back on unnecessary lifestyle shine. Living within your means is important, and while appearances can feel bad if you aren’t “keeping up” with your neighbours, a good budget can help you be secure in spite of it. The cost of living keeps rising, so knowing where you stand is critical.

There’s also the fact that it’s often not just you who might have an issue if you lose your job. Your family and your loved ones may depend on your income. What happens if you lose your job?

You need to do what you can to secure their futures, not just your own.

We recommend life insurance here. While life insurance doesn’t pay out on a simple job loss, if you lose your life rather than your job, the loss of income is even more devastating for your family.

For a simple, fixed, shockingly low expense, you can secure years’ worth of financial security for your family.

All you need to do is fill out a quick form, and you’ll have a range of quotes from the best life insurance providers in the UK ready to go. So what are you waiting for?

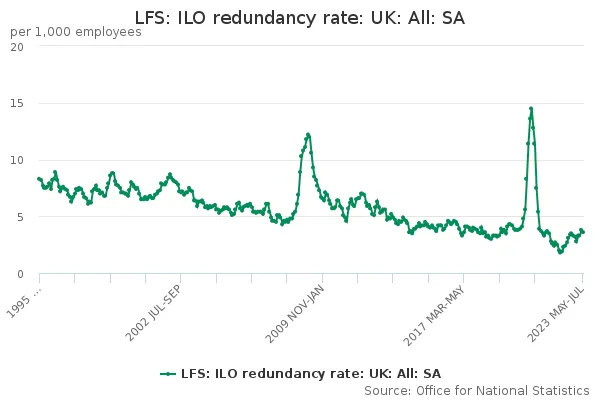

Is the rate of redundancy in the United Kingdom increasing?

The topic of redundancies in the UK is a significant aspect of the labour market, reflecting the dynamic nature of employment and economic conditions.

The latest data from May to July 2023, reported by the UK’s Office for National Statistics (ONS), showed a redundancy rate of 3.6 per 1,000 employees. This figure provides a contemporary snapshot of the redundancy landscape across the nation.

From September to November 2023, the UK observed a decrease in job vacancies, which fell by 45,000, bringing the total to 949,000. This decline in vacancies could be indicative of various economic factors, including market stability or shifts in industry demands.

Concurrently, the number of paid employees in November 2023 was relatively stable, showing a minor decrease of 13,000 from the previous month, totalling 30.2 million. However, this figure is provisional and subject to revision as more data becomes available.

The Labour Force Survey (LFS) estimates, which are a primary source of these statistics, have been marked by increased uncertainty.

Alternative estimates of UK employment, unemployment, and economic inactivity have been published to address this. These alternative estimates for August to October 2023 suggest that the UK’s employment, unemployment, and economic inactivity remained largely unchanged over the quarter.

The ONS provides a detailed breakdown of redundancies by industry, age, and region, although these are not seasonally adjusted.

These redundancy levels and rates are crucial for understanding the labour market’s health and the economic well-being of the workforce. The data is sourced from the Labour Force Survey, a comprehensive survey of households which offers insights into the employment landscape.

The redundancy rate of 3.6 per 1,000 employees from May to July 2023 is a critical indicator of the labour market’s status. It reflects the challenges and opportunities within the UK economy, providing a basis for policy decisions and workforce planning.

This rate and other labour market statistics are essential for understanding the broader economic picture in the UK, especially in the context of global economic trends and domestic policy impacts. If you are concerned about the stability of your job or career, it might be wise to consider taking out some form of redundancy income protection cover for that extra peace of mind.

Steve Case is a seasoned professional in the UK financial services and insurance industry, with over twenty years of experience. At Insurance Hero, Steve is known for his ability to simplify complex insurance topics, making them accessible to a broad audience. His focus on clear, practical advice and customer service excellence has established him as a respected leader in the field.