Should I Keep My Life Insurance Policy After My Children Graduate?

Many parents secure a term life insurance policy solely to guarantee their children’s future is taken care of in case something happens to them before they graduate from college or university.

Once the child has gone through school, it would seem logical for them to then cancel the policy and save some money

But is this really a wise decision?

Whether you are considering keeping your life insurance policy after your children graduate or exploring other options, it’s important to consider the factors that can impact your decision.

For example, one factor to consider is the financial cost of keeping your policy versus cancelling it. In general, it may make sense to keep your policy if you will continue to incur expenses associated with raising young children and don’t have significant assets that can cover such costs in their absence.

However, if you have a well-funded emergency fund or other sources of income, there might be little point in continuing with a life insurance policy once the kids are out of the house.

Additionally, you’ll need to consider whether there is still a need for life insurance coverage beyond protecting your children financially.

If any other primary financial dependents remain, such as an elderly parent who requires caretaking, it might be worthwhile to maintain your coverage until they no longer need it.

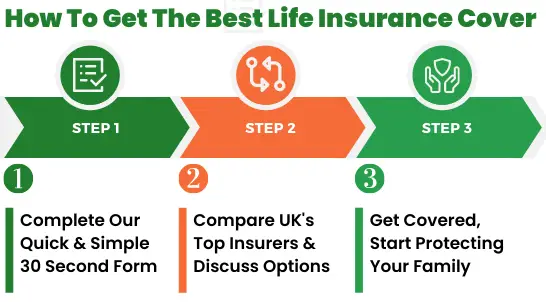

Find A Great Deal On Your Life Insurance – Get Quotes Now!

Benefits of a Term Life Insurance Policy

Term life insurance is often a policy secured because of its affordability. Instead of paying £100/month for whole life insurance, policyholders are often required to pay as little as ten percent of that for a term policy. If the holder dies unexpectedly, the family is taken care of for the full value of the policy.

This type of policy offers peace of mind in addition to significant savings. While the family will, of course, be mourning your passing, at least the family’s financial security remains in place.

Reasons to Continue Coverage

Once your children have graduated from school and are earning their own salary, there will surely be the temptation to cancel your coverage.

However, there are numerous reasons why you should not do this. That money earmarked to pay bills while they were still in school can still be put to good use as long as the policy is in effect.

At a younger age, term policies are easy to obtain and relatively cheap. While the premium may rise with age, you still have a policy. However, as you get older, it will become more challenging to find a provider that will offer a significant policy.

Since you already have the policy, you are better off keeping it than being forced to look for another policy later if you suddenly realise the need for life insurance again.

You should also consider the costs of burial

Today, these costs can significantly affect a family’s budget. Why would you want them to tap into existing savings or have to take out a loan when your term life insurance policy can cover all of these costs?

Even if the children are earning a wage, your policy may give them an opportunity to make their financial life easier after your passing.

If they are just starting out, they may have a large mortgage or business loan that can be paid off with the insurance money. While you may no longer be there to take care of them, the insurance policy can give them some financial freedom they would not otherwise enjoy.

Simply put, unless the premium is causing you financial difficulties, there are more benefits to continuing the coverage after your children graduate than detractions.

The last thing you want to do is have your family face additional financial problems after your passing. The small price of the premium is well worth the peace of mind of knowing they will be okay once you are gone.